- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- 2024 and 2025 what happend and what will

News & Analysis2024 – Where did that go?

As we sit here and review the last weeks of 2024, it has dawned on us that 2024 was the year of wanting everything and getting nothing.

Now that might sound like a ridiculous statement considering equities across the MSCI world are averaging double digit returns for 2024. In fact in the US they are on track for two consecutive years of 20% gains or more. So we certainly gained something, but what we have come to the realisation is that 2024 was a year of anticipation and more anticipation and more anticipation but nothing being delivered particularly here in Australia.

So let us put forward our reasoning.

1. RBA Rates – Pricing v the reality

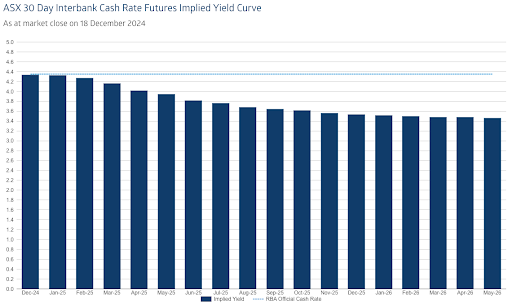

The start of 2024 it’s hard to believe that three rate cuts were fully priced in to the cash right by December this year. The pricing versus the reality facing the RBA in 2024 was one reason that we have probably seen muted movements in currencies and bond markets. We do need to commend the Reserve Bank of Australia (RBA) for navigating what has been a perplexing year in 2024. As mentioned, we start the year influenced by global central banks for multiple rates, driven in particular by the U.S. Federal Reserve. However, by mid-year, pricing shifted so dramatically it moved through 189 basis points to be factoring in not one but up to four rate increases as inflation remained in a state of suspension as sticky components slow the rate of change and has seen underlying inflation holding at 3.5% and above.

Despite this the RBA held rates steady throughout the year and has now adopting a dovish tone at its December meeting.

This is key – its 2024 cautious approach is seeing 2025 pivotal shift and the board is now making it clear that its focus of managing inflation risks is starting to switch to addressing growth concerns. Market forecasting has easing beginning at the April meeting, the range from economists is February through to May 2025. Whenever it starts, the consensus between the market and the theorical world is the same – one cut will bring several and come December 2025 the belief is the cash rate will be as low as 3.6%.

2. Labour Market

The other factor that has keep the RBA on the sidelines has been employment. IF we were to look at employment in isolation it should be championed. Underemployment, underutilisation and unemployment as a whole is – strong. It has completely defied expectations in 2024, with employment levels reaching record highs and participation levels for the population and women in particular also at records.

It should be noted that part of the reasoning for this is robust immigration, cautious corporate behaviour toward redundancies and then the big one public sector hiring. Surges in hires for education, healthcare, and hospitality, drove public sector resilience, offsetting weakness in private sectors like manufacturing, mining, and financial services.

What could force a change here is the 2025 Federal election – a minority government or even a change of government could lead to fiscal restraint and dampen employment growth, while a surprising downturn in job data could prompt the RBA to expedite rate cuts and increase the amount of cuts as well. Something traders will need to have their fingers on.

3. Record level Wage Growth

Wage growth, a key concern earlier in the tightening cycle, moderated in 2024, easing pressure on policymakers both on the fiscal and monetary side. At one point their wages were growing at levels not seen since record began. However, it did coincide with an inflation level of a similar rate meaning real wages were flat.

Looking into 2025, wages remain a concern for rate watches for the following reasons: Minimum wage has consistently follow the inflation rate with a premium suggesting the will increase exceeding 3.5%. Industrial relations reforms over the past 2 years have embedding wage rigidity. Finally accelerating wage increases in Enterprise Bargaining Agreements are now averaging 4%. Without corresponding productivity gains, these dynamics could challenge the RBA’s assumptions, complicating the path to rate cuts.

4. Gravity defying markets

Earnings multiples of the ASX 200 and its sector have soar in 2024. It’s a reflect of the optimism bordering on exuberance about peak interest rates and an imminent easing cycle. The forward P/E ratio of 17.9x is well above the 10-year average of 16.0x and significantly above its historical average of 14.2x.

Looking into 2025 – yes, these multiples are stretched, but when put into a global context it is understandable and even defendable. For example – Australian equities trade at a 21% discount to the S&P 500’s multiples and expectation for the US market in 2025 is one of further expansion. Thus to sustain these levels robust earnings growth are needed to close the P/E gap. A 17.0x multiple down from 17.9, would meet expectations.

5. Banks being banks?

One area that we note has not just defy expectations but also logic is Australian banks. The banking sector was the standout performers in 2024. The sector outpaced the broader market by 25%, not hard when you look at CBA which has surge 40% in the past 12 month. It’s even more remarkable when you compare it to the material sector, it has outperformed its cycle peer by 50.2%.

The surge in passive investment flows (exchange traded funds and the like) which is growing at record levels, alongside superannuation sector contributions, fuelled this robust performance considering the Big 4 and Macquarie sit inside the top 20 and make up 45% of the ASX 20.

However, this dominance is likely to face challenges in 2025. Key factors to watch include China’s commodity and economic outlook, shifts in risk asset performance, and potential regulatory scrutiny of superannuation’s ties to bank equity. Couple this with stretched bordering in snapping valuations – the risks underscore the sector’s sensitivity to macroeconomic and policy developments going forward and overdone investment.

6. Iron Ore – heavy lifting

Iron ore defied the forecasts in 2024. The expected collapse never truly eventuated buoyed by cost-curve dynamics and stronger-than-expected demand in the latter half of the year.

Prices exceeded consensus estimates by upward of US$20 a tonne and, provide a tailwind for materials. But and it is a major but China remains a pivotal factor.

Broad-based policy stimulus announcements in late 2024 lifted sentiment, but execution and clarity remain uncertain. China is looking to stimulate itself in 2025 and that will determine whether materials can close the performance gap with commodity prices in 2025. The other big unknown for Iron Ore – Trump 2.0 and his future tariffs on Australia’s largest trading partner.

Signing off

2024 was a year defined by shifting dynamics across monetary policy, sector performance, and macroeconomic trends.

As we move into 2025, investors and traders will face a complex landscape shaped by earnings growth challenges, election-related uncertainties, and potential shifts in global economic momentum and policy.

Successfully navigating these factors will come from understanding the macroeconomic signals and sector-specific opportunities they will present.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Developing your trading skills: An action-based approach to improved trading outcomes

Trading is a skill that requires continuous development, self-assessment, and refinement. For traders aiming to achieve consistent profitability and long-term success, following a structured process can make the difference between stagnation and mastery. In this article, we’ll explore a systemized five-step process for trading development, d...

December 23, 2024Read More >Previous Article

What to watch in 2025: Equities trends and insights

This article provides an in-depth analysis of potential market drivers, sector-specific performance expectations, global trends shaping the investment...

December 20, 2024Read More >Please share your location to continue.

Check our help guide for more info.