- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Fed Interest Rate Decision – How might this move the markets?

- Home

- News & Analysis

- Central Banks

- Fed Interest Rate Decision – How might this move the markets?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisIt’s that time again, the looming US FOMC meeting is upon us. Once again, investors and analysts are confident that they know the result.

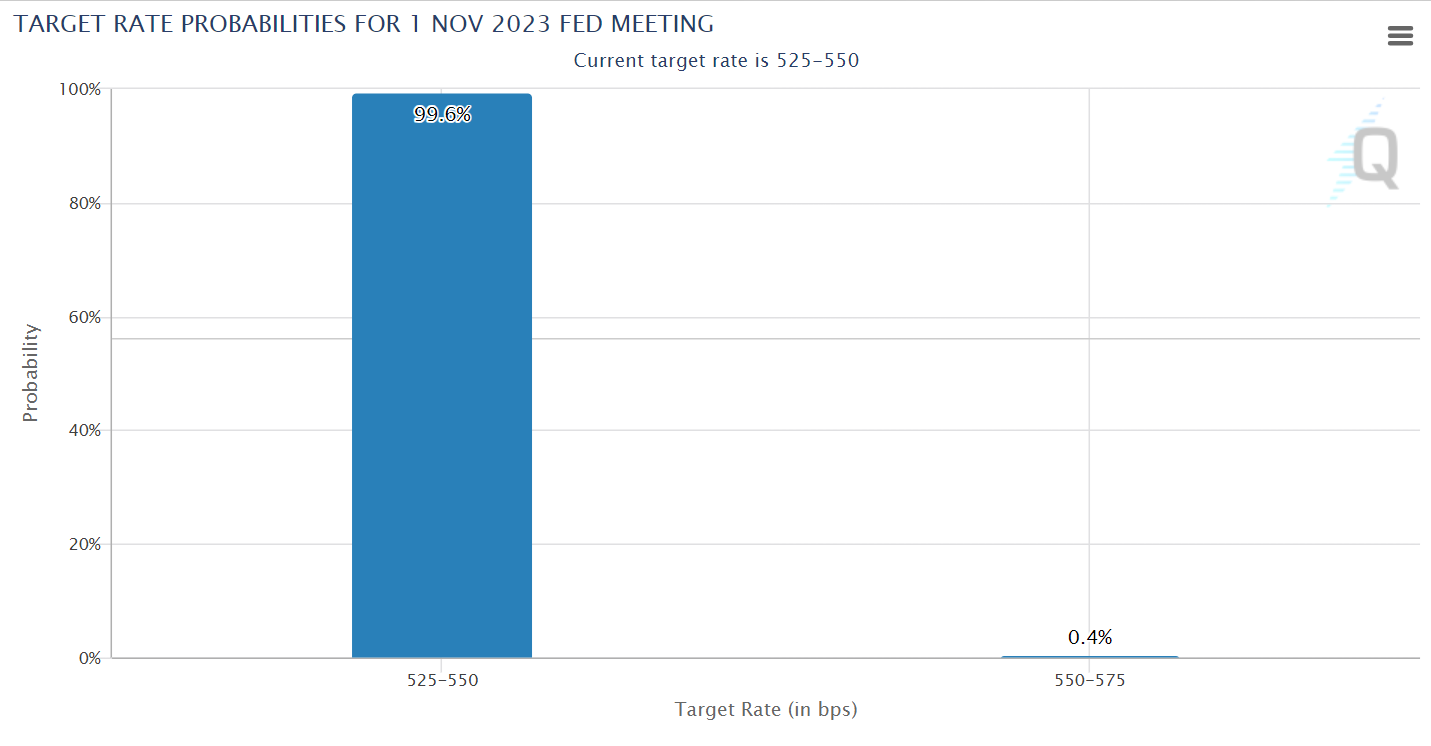

With the rate currently at 5.50%, markets have priced in a hold, with the CME FedWatch Tool giving it a 99.6% probability of the second consecutive hold for the Fed.

Let’s explore that 0.4% chance that a hold might not happen.

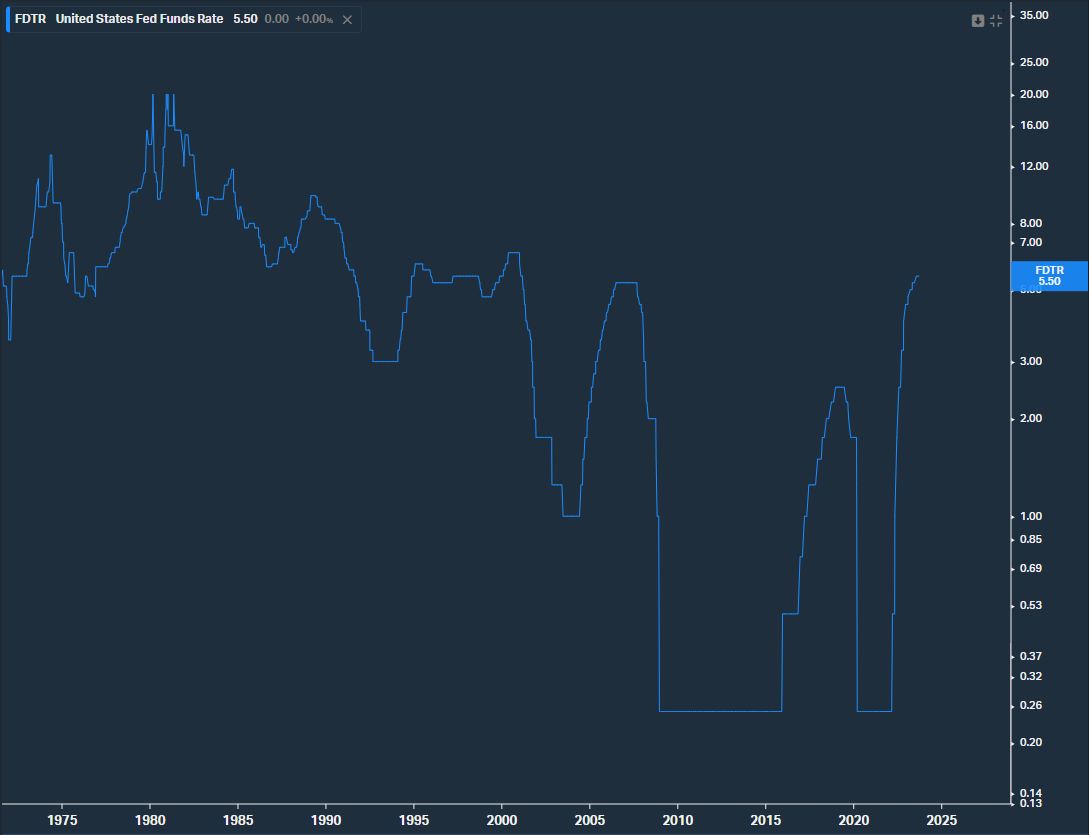

As you can see from the above chart, there has been a spectacular rise in the Fed Funds Rate since early 2022 when US inflation started to soar.

Each Federal Open Market Committee (FOMC) meeting that occurs, the members assess economic conditions, monetary policy and make the big decision on what to do regards interest rates. The rapid ascent of the Fed Funds Rate has been an attempt to tame the post Covid-19 inflation, with a fair bit more to go.

While inflation is easing, recent GDP data in the US signaled a growing economy, which would be a key talking point in the upcoming FOMC meeting.

Let’s look at a few scenarios on the markets for this month’s FOMC meeting.

Hold –

With inflation easing, and no major data released in the past month to indicate a reversal, markets have priced in a hold at November’s meeting. As this has been widely accepted, this

has been priced into the markets, and I’d expect minimal movements in both US equities and the USD if rates are on hold.Cut –

With inflation still above the Fed’s target range, a cut is very unlikely. However, in the slim chance they decide they’ve done enough and are ready to take their foot off the accelerator,

we could see plenty of volatility across both the US equity markets and the US Dollar.Signalling that the Fed thinks the worst is over, US equities could rally on the newfound confidence that they’ve made it through the uncertain times, and cost of living may begin to ease.

A cut could see USD lose strength, as investors may look to rotate into other higher yield currencies. I’ll be watching the major USD pairs for plenty of volatility if a cut is seen.

Hike –

While inflation is easing, there are still signs the economy isn’t ‘breaking’ as much as it should be with such high rates. Recent US GDP data came in above forecasts, which I’m sure is being

heavily looked at in the November FOMC meeting.In the chance the Fed believes further work is needed and hike, I’d expect a short-term sell-off in the US equity markets and a rally in the USD.

With the US Dollar Currency Index (DXY) bouncing between a range of around 105-107 for the past month, November’s FOMC meeting might be enough to kick it one direction if we see either a Hike or a Cut.

As analysts generally price in the expected decision prior to the announcement, eyes generally shift to the FOMC statement and press conference after the data is released.

The statement and press conference sees Fed Chair Powell discuss the decision and gives an indication on their plans. Analysts will be analysing every word to try and get hints on the Fed’s future movements and will be looking for either more aggressive ‘Hawkish’ language or more cautious ‘Dovish’ language.

I’m bracing for volatility across the USD pairs during this speech, and the language used will determine the direction. Hawkish language can see strength in the dollar, while dovish can see

weakness.Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Markets Watch the Fed Decision Tonight – But Will We Stray from the Current Path?

After the BOJ's action yesterday, the ramp-up of earnings season, treasury auctions, and a flurry of data over the next few days—including U.S. jobs data—market attention will briefly focus on the U.S. interest rate decision this evening. Chairman Jerome Powell and the Fed members will conclude their two-day meeting today and release the la...

November 1, 2023Read More >Previous Article

Will any BOJ intervention really have an impact on continued JPY weakness?

With the USD/JPY sitting at historic highs and touching the psychologically important level of 150 at the end of last week, markets are waiting to see...

October 31, 2023Read More >Please share your location to continue.

Check our help guide for more info.