- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Central Banks

- Hold tight: trading the RBA

News & Analysis

With core CPI missing expectations and some slight deceleration in other areas such as retail sales an overall service economic activity. The RBA is likely to hold tight and not raise rates on Tuesday.

With core CPI missing expectations and some slight deceleration in other areas such as retail sales an overall service economic activity. The RBA is likely to hold tight and not raise rates on Tuesday.We say this with some confidence, based on the communication coming from RBA governor Bullock. She had emphasised the importance of the second quarter CPI print at the June meeting, despite providing hawkish rhetoric around the risk of rate rises and a stalling inflation story.

This had led the market and many economists to suggest the possibility of a rate rise has now reduced to sub 10% coming into Tuesday’s meeting. That clearly means that it’s not still a possibility but all things being equal the likelihood now is negligible. You can see that here in the charts of the Aussie dollar particularly against the JPY and the USD

AUDUSD

AUDJPY

Given the preference for rate stability by the board, what’s also interesting about the Q2 CPI figures is that it gives them a clear path to keep rate stability (their words) for the stable future. It suggests not only will August be a hold but suggests that the September meeting as well would likely be the same.

However it can’t be ignored that CPI was slightly ahead of forecast and thus the Statement of Monetary Policy (SoMP) coming up in a few weeks will be very interesting. Because we expect forecast changes and are likely to show a slower progress towards target.

So first and foremost, forecasts have to narrow to include the higher than expected year on year figure.

The forecast for inflation at the May SoMP update didn’t include the new Federal government’s $300 energy rebate or the Western Australian and Queensland governments respective energy rebate. This will significantly lower the financial year 24 inflation rate but will simultaneously raise the financial year 25 forecast by a similar amount. Providing a bit of a catch 22 from the board.

There’s been upward revisions in consumer spending and are likely to challenge the forecast assumptions used in the May statement of monetary policy that was justifying a lower part of inflation.

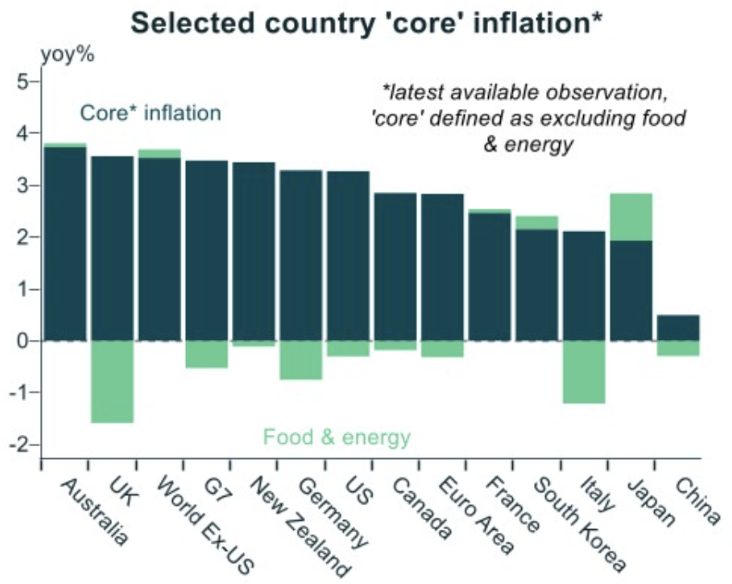

All things therefore being considered the hawkish message coming from governor Bullock is likely to persist. Because as this chart shows core inflation and headline inflation in Australia is the highest against all major peers and despite the RBA having a 2 to 3% target band higher than its peers around 2% it is a long long way away from reaching its goal.

It should therefore be pointed out that come the Tuesday decision making call “all options” as the RBA like to call it, realistically means a tight hold or a possible rate hike With the right hike being dismissed.

This means that there is a divergence going on between the RBA and the rest of the dovish global environment. You only have to look at what the Bank of England said last week to understand that something like AUDGBP has a neutral central bank with the hawkish bias dovish central bank with dovish action to see the pair likely moving slightly higher in the interim.

The same argument could actually be made for the AUDUSD because post the CPI number as we explained last week The US Federal Reserve was due to meet. And although the board didn’t move the Federal Funds rate At the July meeting it is all but confirmed September is the likely start point for the Fed’s right cutting cycle.

The US has seen some pretty mixed data over the last six days. Unemployment has ticked up; retail sales ticked down; inflation has moderated and forward looking indicators in consumer confidence and industrial manufacturing have both declined.

Couple this with the US election geopolitical risks and other factors explains the rally that has happened in the pair post the CPI data as seen here:

AUDUSD

Returning to the outlook for the US and the federal funds rate post the FOMC July meeting. 7 major economists are forecasting not just the September meeting with a rate cut but the remaining three meetings of the year will see cuts from Constitutional Ave.

And if we take into consideration the FOMC’s dot plots the cuts will continue early into 2025 most likely at the February, March and May meetings.

If this doesn’t indeed come to fruition the impact on US indices will clearly be to the upside. FX is likely to have to ask some serious questions around pricing in pairs such as the EUR, GBP and CAD. Which brings us back to the Aussie dollar

The current sell off that we’ve seen in the currency is based solely on the idea the RBA is on a tight hold, and that selling is probably justified. However with the data that is currently before us it is hard to make a case that isn’t bullish for the AUD as it gets left behind in the rate cut environment and dovish outlook the global economy is about to undertake.

Thus post Tuesdays meeting Michele Bullock’s press conference will be key to this trade idea because it’s likely to show you like she did in June that is going to have to continue on with the hawkish view and jawbone inflation lower.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Jackson Hole Symposium – When doves try

Jackson Hole Symposium – When doves try Market pricing of the Federal Funds rate currently sits at 93 basis point of easing by year-end. Let us put that into perspective it was 110 basis points of easing at the peak of excitement, yet despite the increase in yields DXY has sold off and now trades sub-102.00 and is still falling like a stone. W...

August 21, 2024Read More >Previous Article

One of two ways: Trading Australia’s CPI data

Australia's second quarter CPI due out on the 31st of July could go one of two ways so let's dive into how it will move and how to trade it. First ...

July 30, 2024Read More >Please share your location to continue.

Check our help guide for more info.