- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Reserve Bank of New Zealand – First 2019 Policy Statement!

- Home

- News & Analysis

- Central Banks

- Reserve Bank of New Zealand – First 2019 Policy Statement!

- The Reserve Bank of Australia

- The Federal Reserve Bank

- The European Central Bank

- The Bank of England.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Reserve Bank of New Zealand (RBNZ) will make its first interest rate decision for the year 2019. We will see the Press Conference, Rate and Monetary Policy Statement on Wednesday.

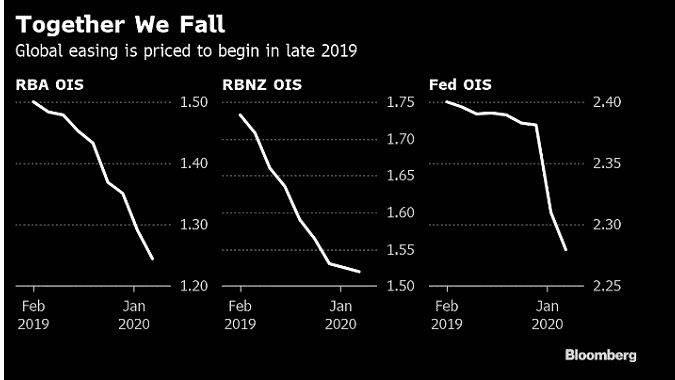

Market participants are expecting the RBNZ to adopt the same dovishness seen lately by major central banks

The global downside risks have increased, and major central banks are downgrading their growth forecasts. It is widely expected that the RBNZ will follow suit in the shift towards easing and echoed the RBA’s concerns.

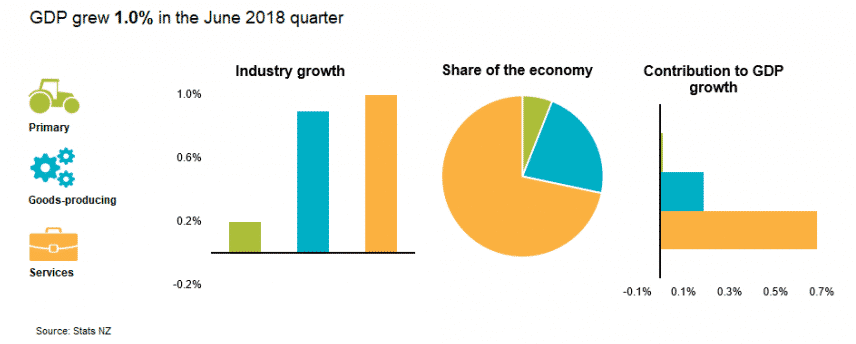

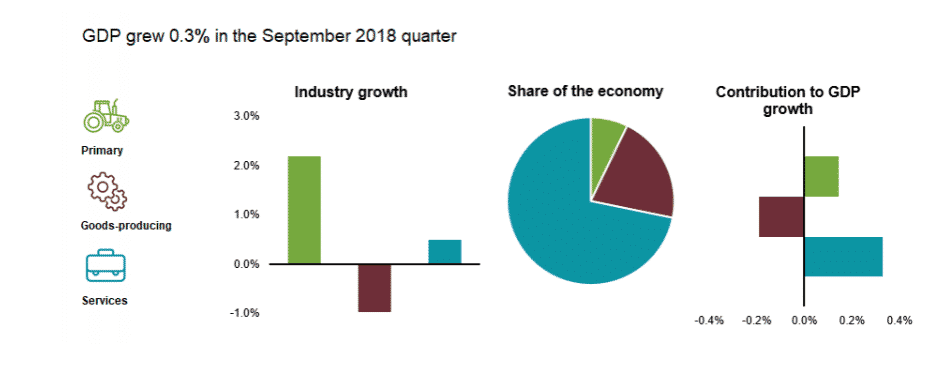

New Zealand’s economy has slowed in the second half of 2018. Gross Domestic Product (GDP) grew by 1.0% in the June 2018 quarter compared to the September quarter whereby the economy increased by only 0.3%.

June 2018 Quarter: GDP, Industry growth and contribution to growth.

Source: Stats NZ

September 2018 Quarter: GDP, Industry growth and contribution to growth.

Source: Stats NZ

The Labour market reports received last week might add to a more cautious tone from the RBNZ. The Unemployment rate rose back to 4.3% in the December 2018 quarter, up from 4.0% (revised) in the previous quarter.

The Housing sector is also experiencing volatility dragged by bank prudence, investor wariness, and affordability constraints, along with the foreign buyer ban, which prevents foreigners from buying homes.

Keeping these in mind, and in anticipation of the same dovish comments from the RBNZ, the markets are aggressively pricing in the chance of a rate cut later this year which is weighing heavily on the local currency.

The price action of New Zealand dollar pairs will, therefore, depend on how dovish the RBNZ will be compared to the current expectations. It should be noted that odds of a rate cut were also on the table last year. However, back in January, the released inflation data cast some doubts about a cut, and it will be interesting to see how the RBNZ plays out the growing global risks.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Margin Call Podcast – S1 E5: Andrea Marani | CEO of OpenMarkets

Andrea Marani (Linkedin) is the CEO of OpenMarkets and longtime operator in the financial services space. A South African at heart, the now Aussie financial operator has many runs on the board with organisations like Investec, Rabobank, Shaw & Partners, plus Global Trader. OpenMarkets is a Digital Trading Platform that provides clients with...

February 13, 2019Read More >Previous Article

Bank of England Synopsis

Thursday the 7th of February saw Bank of England Governor, Mark Carney, stepped back up to the mark to take on a barrage of Brexit related economic ...

February 8, 2019Read More >Please share your location to continue.

Check our help guide for more info.