- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Preview: The Bank of Canada Rate Decision

News & Analysis

One of the must-watch economic events this week will be the Bank of Canada interest rate decision. The decision is scheduled to be announced on Wednesday 29th May at 15:00 PM London time.

Why Is The Announcement Important?

A bank interest rate is a rate at which a countries central bank lends money to local banks. The interest rate is charged by nations central or federal bank on loans advances to control the money supply in the economy and the banking sector. The Bank of Canada has an inflation target of 1% to 2% (currently 2%), and the interest rates are changed accordingly to meet the target. Therefore, the Bank of Canada’s and other central bank rate decisions can have a significant impact on the financial markets.

Expectations

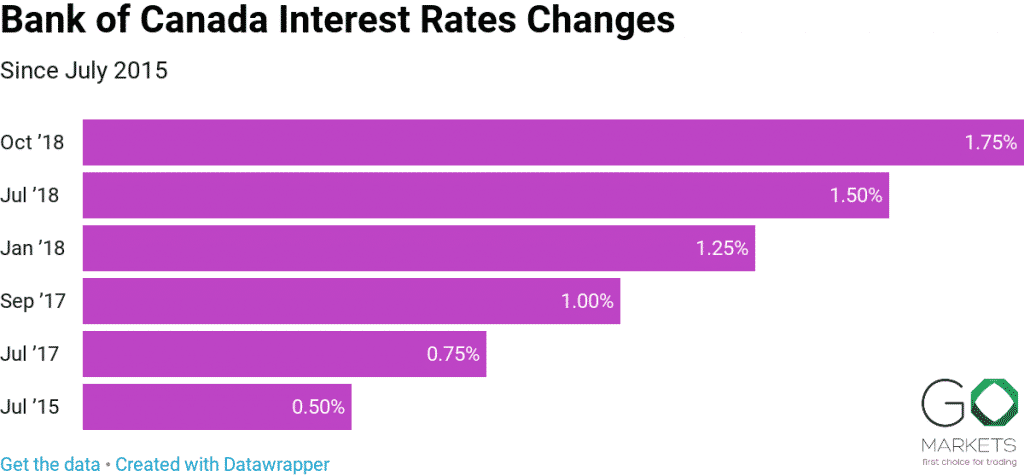

The last time the Bank of Canada raised its key interest rates was back in October of last year and it is expected that the rates will remain unchanged at 1.75%, according to the analysts.

”Recent economic data suggest that growth will be stronger than the Bank was expecting in the first quarter, providing a reason to not cut rates.”

”At the same time, growth will remain below potential, providing no reason to lift rates. The Bank of Canada will, therefore, remain in a holding pattern for now and make any necessary adjustments to that stance based on incoming economic data”, Principal economist Alicia MacDonald said at the Conference Board of Canada last week.

Even though a rate decision is not expected, traders will be keeping a close eye to the upcoming meeting and the comments after the rate decision has been announced.

To keep up to date with other upcoming economic events click here for our Economic Calendar.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: DataWrapper, Bank of Canada

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Share CFDs: Know the costs.

Many traders have the prudent approach that treats trading as you would a business. A critical component of this is to have a thorough knowledge of your expenditure related to your trading activity. With Share CFDs these are potentially fourfold namely: a. Your cost of trading (e.g. brokerage) b. Your cost of holding a position c. T...

June 13, 2019Read More >Previous Article

Option traders – Time to Hedge your Currency Risk?

Many traders utilise options amongst their investment strategies either for income or capital growth. As with Forex and CFD trading, options offer ...

May 17, 2019Read More >Please share your location to continue.

Check our help guide for more info.