- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- Reserve Bank of Australia releases its minutes from the July meeting

- Home

- News & Analysis

- Central Banks

- Reserve Bank of Australia releases its minutes from the July meeting

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisReserve Bank of Australia releases its minutes from the July meeting

19 July 2022 By GO MarketsThe Australian dollar has begun the week relatively strongly after gaining some momentum from RBA’s most recent meeting. The board pushed across quite a hawkish sentiment sparking the rise in the AUD. They found that the current slowing growth across the market and global sphere created that was “becoming skewed to the downside.”

The board expressed their concern about the economic activity in China, particularly with the threat of Covid 19. With lockdowns and a strict covid policy, the threat remains a key factor in the speed of growth on the mainland. Whilst overall business activity improved through May and likely June as well, recent lockdowns have the potential to pull back these gains.

The low unemployment signalled Australia’s robustness and strength with record high participation rates in the economy. Violent weather events like the floods in NSW and the Russian and Ukraine crisis also further added strain on the supply driving up prices and increasing the price of goods. Non-labour inputs also rose in price contributing further to inflation. The members did note the prices for base metals had begun to ease as recession fears had grown. In addition, declining house prices and clearance rates as a sign that the speed of inflation is potentially slowing, however, they still expect inflation to continue rising for the remainder of 2022.

Ultimately the members of the board agreed to increase the cash rate by 50 basis points instead of the alternative of 25 points. With particular emphasis on the strong labour market, the need to bring inflation under control trumped the need for stronger growth.

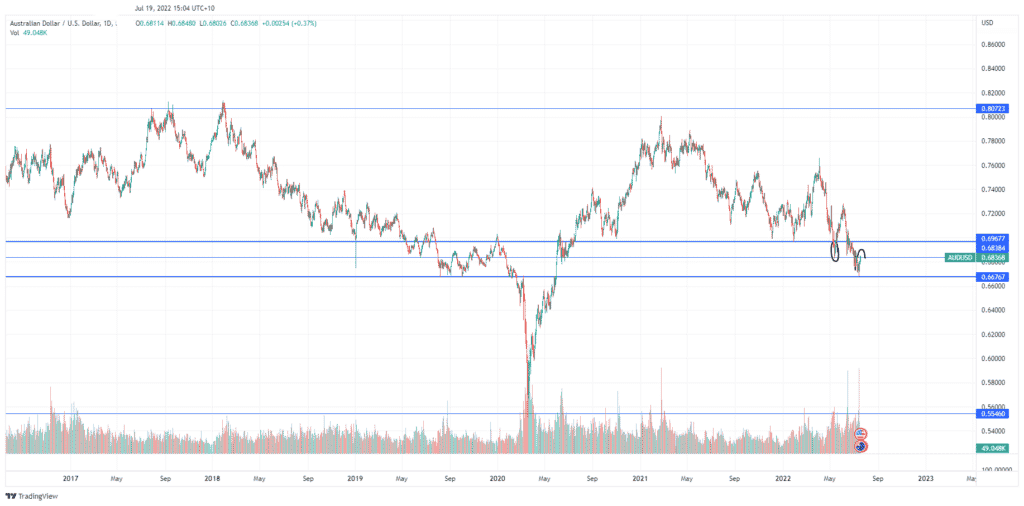

In response to the release of the minutes, the AUDUSD saw a little rise higher. After sitting near its 52-week lows at $0.6681 in recent weeks, the minutes provided a much-needed push. The price of the AUDUSD currently sits at $0.6845 which is its prior support level and has now become a level of resistance. If the AUDUSD can push through this level the next resistance point is at $0.6967.

As the market is still dealing with unprecedented global inflationary figures, it remains risky to go against the USD, however with effective risk management this risk can be mitigated.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Market jumps on the back of weak USD and better then expected earnings

The US stock market saw one of its best days in months, as speculation swirled that the 'bottom' may be in. The indices gained their momentum from better-than-expected earnings and a weakening of the USD, with the USDX dropping to $106.58. With more earnings still to come better than expected results may see the S&P500 and markets break out of ...

July 20, 2022Read More >Previous Article

ANZ set to acquire Suncorp in mega acquisition

Big 4 bank ANZ is set to takeover Suncorp in a massive buyout. The agreement stipulates that the buyout is only for the banking side of the business w...

July 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.