- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Central Banks

- The Federal Bank and how it affects us

News & Analysis

All major countries’ economies have one thing in common; they are all subject to a central bank. Here in Australia is no different, we have the RBA Reserve Bank of Australia.

Their roles are largely the same everywhere: a key role of central banks is to conduct monetary policy to achieve price stability (low and stable inflation) and to help manage economic fluctuations. Central banks conduct monetary policy by adjusting the supply of money, generally through open market operations. For instance, a central bank may reduce the amount of money by selling government bonds under a “sale and repurchase” agreement, thereby taking in money from commercial banks. The purpose of such open market operations is to steer short-term interest rates, which in turn influence longer-term rates and overall economic activity. Another key factor is that they have a hand in influencing Interest Rates. This is used to stimulate economies and keep inflation under control (or at least try to do so).

For traders, keeping in touch with what our central banks say is hugely important as this can ultimately help you make a profit, or it can turn trades into losses.

This brings me nicely on to perhaps the biggest, or at least one of the most influential roles of the Central Banks: they directly or indirectly have one of the biggest effects on commerce, business and currency fluctuations all over the word. The FED.

Keeping an eye on your Economic Calendar, can be beneficial if you are a trader who likes to keep up with the latest reports on the finance of a country, or in this case The FED. The 26th January 2022 Federal Reserve meeting might be the single most critical event in determining the future of the economy (directly in the US and indirectly to the rest of the world), here’s a breakdown into why is so important (and maybe why you should care).

2021 was a year of crazy growth, if you bought Stocks, Crypto or Real Estate in 2020, early 2021, you would have personally seen considerable gains compared to recent years. Economic boom? Sounds great! Unless it goes too far, and the economy overheats. An economy which overheats, is expanding at a rate that is unsustainable in the long term, a red flag that accompanies that is high inflation.

It is no secret that the US (and other major economies) has experience high inflation in last few months.

The FED is now faced with a critical decision: increase interest rates or keep them largely the same. Fed Chair Powell is expected to signal to the markets which way the FED is leaning.

Two possible outcomes:

Do not raise interest rates – Likely the engine keeps running and keeps overheating. More record highs for the S&P, Stocks, Crypto, Real Estate. Asset prices keep rising… And inflation keeps rising, food becomes more expensive, fuel becomes more expensive, etc. etc.

Raise interest rates – Effective way to slow the economy down. The “eeek” is, it can deepen the current dip being seen in the markets and potential cause a recession.

Economists often talk about a soft landing. It means a slow down of the economy without a crash.

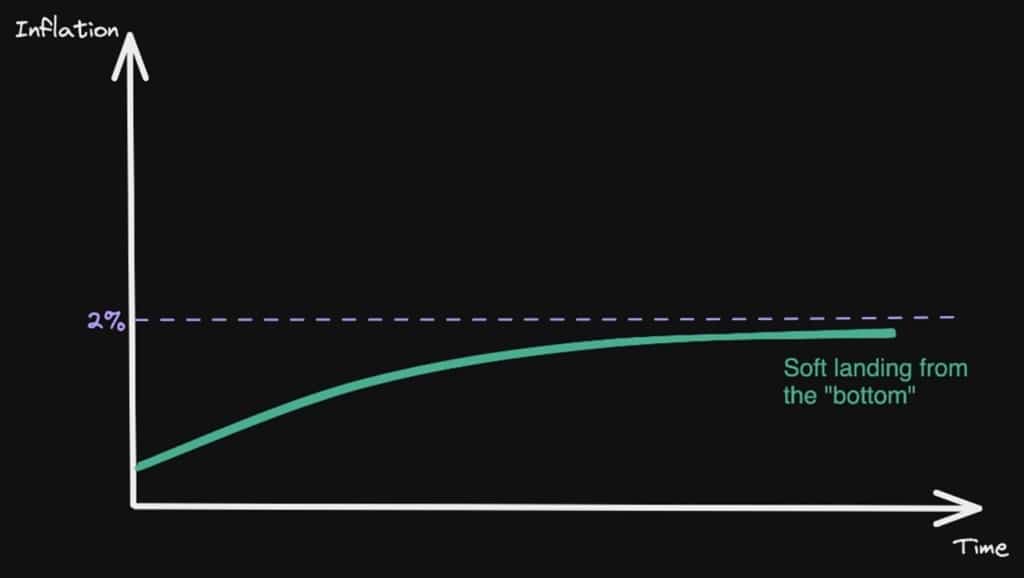

A soft landing is easier when inflation is controlled (see below).

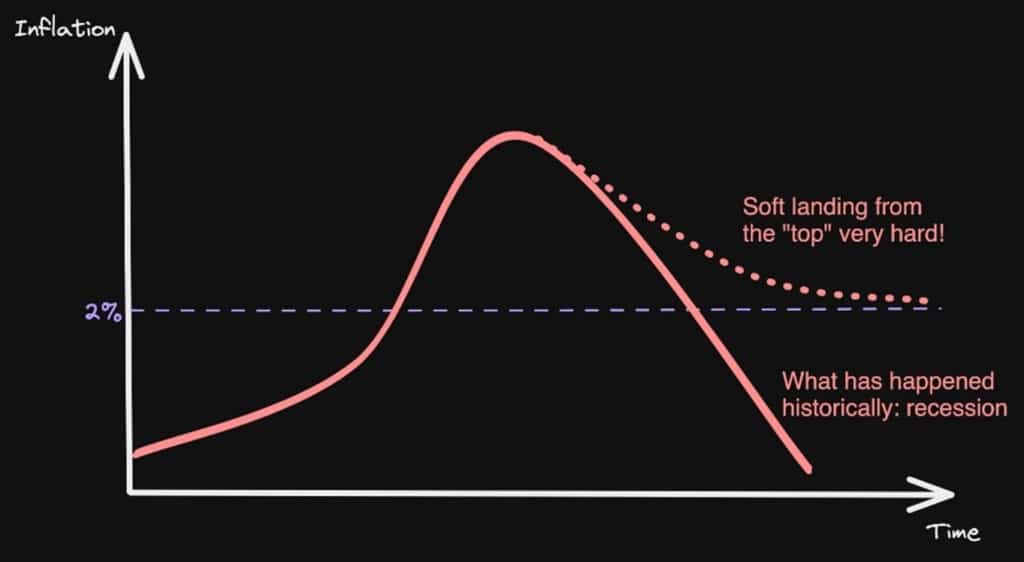

However, this has usually successfully been done when inflation is under control and is impossible once inflation hits crazy highs – or once the economy has overheated. (See below)

In short, if Powell advises that a series of aggressive hikes is coming, a recession becomes likely and expect movements in the markets whether you are trading a USD pair of the S&P. The FED and its policies drive our economies and understanding their roles, its history and their future plans, can help shape your economic future.

Update: The Federal Reserve concluded Wednesday its January monetary policy meeting, indicating that a potential rate hike could come in March. The major stock market averages initially jumped around 2 p.m. ET, when the Fed released its policy statement. However, stocks gave up those gains and turned lower as Chairman Jerome Powell answered questions from reporters.

Christian Ramos

Sources: Wikipedia, Kalshi, CNBC, RBA

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Tesla earnings have arrived

Tesla Inc. (TSLA) reported its Q4 2021 results after the market close on Wednesday. The world’s largest automaker exceeded analyst expectations on both revenue and earnings per share. The company reported total revenue of $17.719 billion in the fourth quarter vs. $17.132 billion expected. Earnings per share reported at $2.54 vs. $2.36 per s...

January 27, 2022Read More >Previous Article

Johnson & Johnson Q4 results are in

Johnson & Johnson (JNJ) reported its Q4 earnings before the opening bell on Wall Street on Tuesday. Let’s take a closer look at how the pharmace...

January 26, 2022Read More >Please share your location to continue.

Check our help guide for more info.