- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Cryptocurrency

- Rising yields have markets seesawing, US dollar rising

- Home

- News & Analysis

- Cryptocurrency

- Rising yields have markets seesawing, US dollar rising

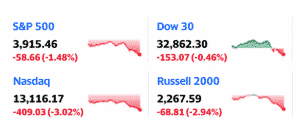

- Dow Jones down 153 (0.46%)

- NASDAQ down 409 (3.02%)

- S&P 500 down 58 (1.48%)

- Russell 2000 down 69 (2.94%)

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisEquity markets

US markets dropped sharply overnight as inflation fears returned on the back of Treasury yields hitting their highest levels in more than a year.

Investors are concerned the Federal Reserve will allow inflation to accelerate, after Wednesday’s policy meeting where they reaffirmed their commitment to easy money policies.

As seen previously the hardest hit stocks were the growth small caps and Tech companies on the Russell and NASDAQ, as traders rotated out of these sectors into traditional value stocks tracked by the Dow Jones index. The Dow did touch all time highs during the session before fading in the afternoon.

Source: Yahoo Finance

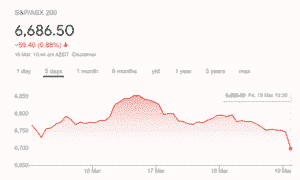

The Australian equity market had a choppy week, mirroring its US counterparts as economic enthusiasm battled with fears of rising interest rates. The ASX 200 dropped yesterday with the sell-off continuing today as much better than forecast employment figures saw market expectations of rising interest rates coming sooner than previously expected.

Source: Yahoo Finance

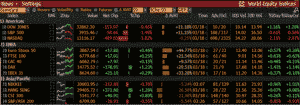

World equity indices are mostly flat for the week as markets see sawed between all time highs and steep declines. Evidence of rotation from Growth and momentum stocks into traditional value stocks in the US is evident from Dow’s outperformance of the NASDAQ and S&P 500.

The ASX 200 also dropped over the week as rising Aussie and US bond yields plus a strong employment report had investors reassessing predictions of when the RBA would start a tightening cycle on rates.

Source: Bloomberg

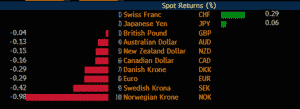

Forex markets

FX markets saw a mostly stronger US dollar against most major currencies. Rising bond yields in the US have mostly driven this move higher – higher interest rates make the US dollar a more attractive investment than its counterparts. Traditional safe haven currencies the Swiss Franc and Japanese Yen were the only major currencies to outperform the US dollar this week, on a choppy performance in equity markets.

Source: Bloomberg

Commodities

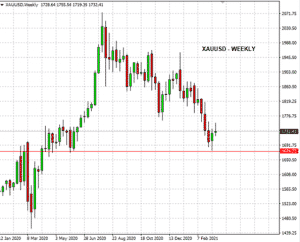

Gold

Spot gold (XAUUSD) was the other safe haven that rallied against the US dollar, being modestly up for the week at the time of writing.

Despite a mostly rising US Dollar, gold ground higher on inflation fears spurred by rising rates in bond yields.

Source: GO MT4

Oil

US crude prices dropped sharply this week as US crude found stiff resistance around the $67 a barrel price level after a recent strong run up.

US Crude plunged more than 9% in yesterday’s session at one point, on concerns new COVID lockdowns in Europe will sap demand, and whether the recent run up is justified with the current progress of world economic recovery.

Source: GO MT4

Bitcoin

Bitcoin gapped on the Monday open to set a record price above $60k US per token. This after an extremely volatile week which saw the cryptocurrency ranging from 53k – 60k

Whether the cryptocurrency has run out of steam at these levels or is preparing for another push higher remains to be seen.

Source: GO MT4

Monday, 22 March 2021

Indicative Index Dividends

Dividends are in PointsASX200 WS30 US500 US2000 NDX100 CAC40 STOXX50 0.081 0 0.01 0.024 0 0.098 0 ESP35 ITA40 FTSE100 DAX30 HK50 JP225 INDIA50 0 1.454 0 0 0 0 1.072 Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Tesla delivers in Q1

The electric vehicle industry has had a tough few weeks with the global chip and battery shortages affecting electric vehicle manufacturers around the world. Despite that, Tesla delivered 184,800 vehicles in Q1 of 2021, exceeding the number of vehicles produced (180,338). The deliveries consisted of 182,780 Model 3 and Model Y. The rest (2,020) wer...

April 6, 2021Read More >Previous Article

Dow Jones rally Q1 2021

2021 has been a profitable year for stocks in the Dow Jones Index. Since the turn of the year, the Dow has seen what appears to be a roaring rally wit...

March 17, 2021Read More >Please share your location to continue.

Check our help guide for more info.