- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Cryptocurrency

- Stimulus euphoria leads to all time highs, a new US administration and Bitcoin bust

- Home

- News & Analysis

- Cryptocurrency

- Stimulus euphoria leads to all time highs, a new US administration and Bitcoin bust

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisStimulus euphoria leads to all time highs, a new US administration and Bitcoin bust

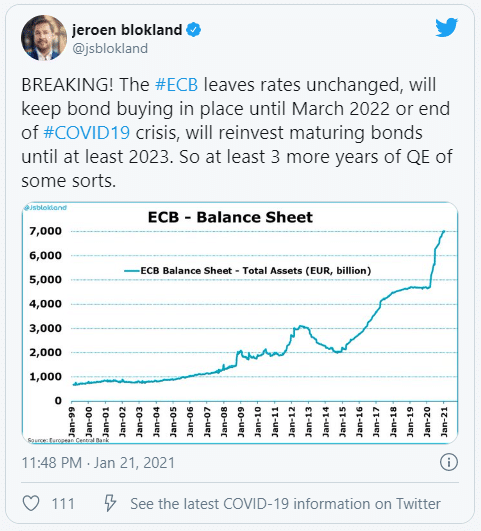

22 January 2021 By GO MarketsWe had an eventful week on global markets with the inauguration of a new US administration and a dovish stance from the European Central bank fuelling hopes of extended fiscal stimulus in the new year.

Equity markets

Risk appetite got a boost this week from a push by US authorities for nearly $2 trillion in additional spending and plans to jumpstart a federal response to the COVID pandemic.

US equity markets had the best post inauguration performance since the 1980’s driving the S&P 500, Dow Jones and NASDAQ indices to record highs.

The NASDAQ was also helped along by big beats from Netflix and Intel who reported earnings this week.

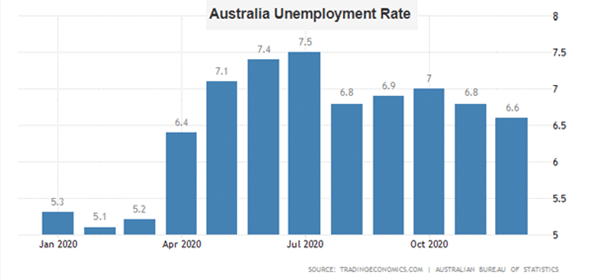

With this lead Australia’s share market hit 11-month highs, with help from an improved unemployment rate supporting investor optimism.

European markets also performed well after ECB’s decision to reconfirm its very accommodative monetary policy last night.

Source: TwitterCOVID

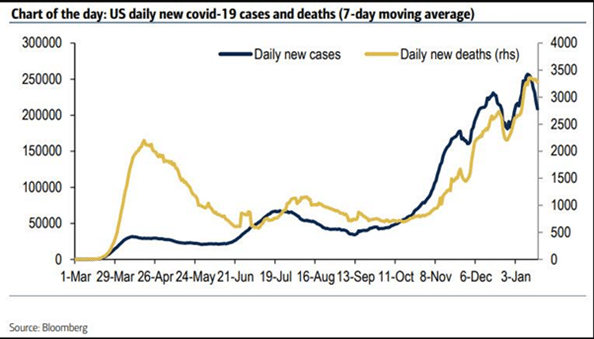

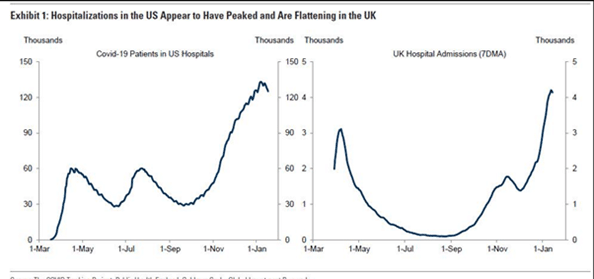

With Executive Orders from the new US administration seeking to accelerate the rollout of vaccines and the seeming peak in US COVID cases there was optimism this week from major Wall St analysts that we could be seeing “the beginning of the end of the COVID crisis” in the US.

Goldman’s top economist Jan Hatzius, writes that “a vaccine-driven reduction in hospitalizations is likely to kick off the growth rebound through relaxed restrictions and some reductions involuntary consumer social distancing.”

Source: Zerohedge

Forex market

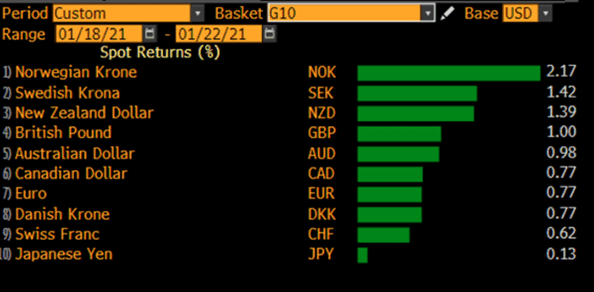

While record planned US stimulus helped push equities higher it also created a headwind for the US Dollar which continued its downtrend. All major currencies performed strongly against the greenback this week.

Source: BloombergAussie Dollar

AUDUSD strengthened this week driven by US dollar weakness and a better than expected unemployment rate of 6.6% indicating continued recovery of the Australian economy from the COVID economic shock. AUD is trading in a tight range and has managed to hold the important 0.77c support level.

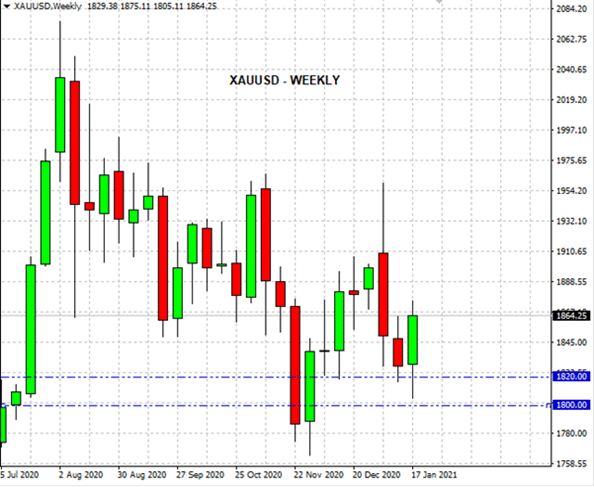

Gold

Spot gold (XAUUSD) had a strong week on the back of US dollar weakness and stimulus hopes, it bounced strongly from the 1820 -1800 support zone making 2 week highs and being up around 2% for the week at time of writing.

Negotiations in the US on the particulars of the proposed stimulus bill and positive or negative news on regarding COVID are expected to play a part in the next few weeks of future price movements.

Source: GO MT4Cryptocurrencies

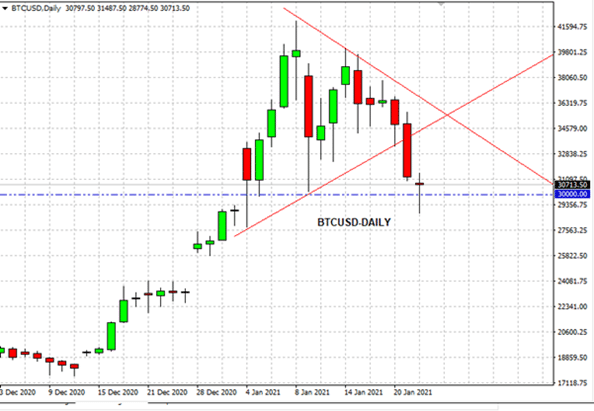

It was a tough week for Cryptos with flag bearing tokens Bitcoin and Ethereum among others sliding dramatically after recent stellar rallies.

Bitcoin dropped 10% alone on Thursday and down almost 20% on the week.

The drop seems to be a long overdue correction and sustained profit taking, it wasn’t helped on Thursday by a report in a trade blog suggesting that there had been what’s known as a double purchase, where the same “coin” is used in two separate transactions. This rumour went viral casting doubt on the security of the Bitcoin blockchain. Industry veterans and people familiar with blockchain technology downplayed the notion, but with so many new investors with a poor understanding of blockchain technology the damage was done.

From a chart technician’s point of view, Bitcoin broke the lower barrier of the wedge pattern it has been consolidating in and has headed to the important 30000 support level.

Source: GO MT4Monday, 25 January 2021

Indicative Index Dividends

Dividends are in PointsASX200 WS30 US500 US2000 NDX100 CAC40 STOXX50 0 0 0 0.012 0 0 0 ESP35 ITA40 FTSE100 DAX30 HK50 JP225 INDIA50 0 0 0 0 0 0 0 Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

EURGBP – Sterling Applying The Pressure

EURGBP – Hourly Since the 12th of January, we've seen much choppy price action in the EURGBP cross, with Pound Sterling applying the more significant selling pressure. This shorter-term bearish bias is what we'll be looking at in today's Chart of The Day using the hourly time frame. Firstly, we can see the initial DiNapoli target of 0.8854 ...

January 26, 2021Read More >Previous Article

COTD: FTSE100

FTSE100 – Point & Figure The FTSE 100 looked to ride the tailwinds of positive sentiment sweeping through US markets today but instead fail...

January 20, 2021Read More >Please share your location to continue.

Check our help guide for more info.