- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – Gold and USD eye key CPI figure

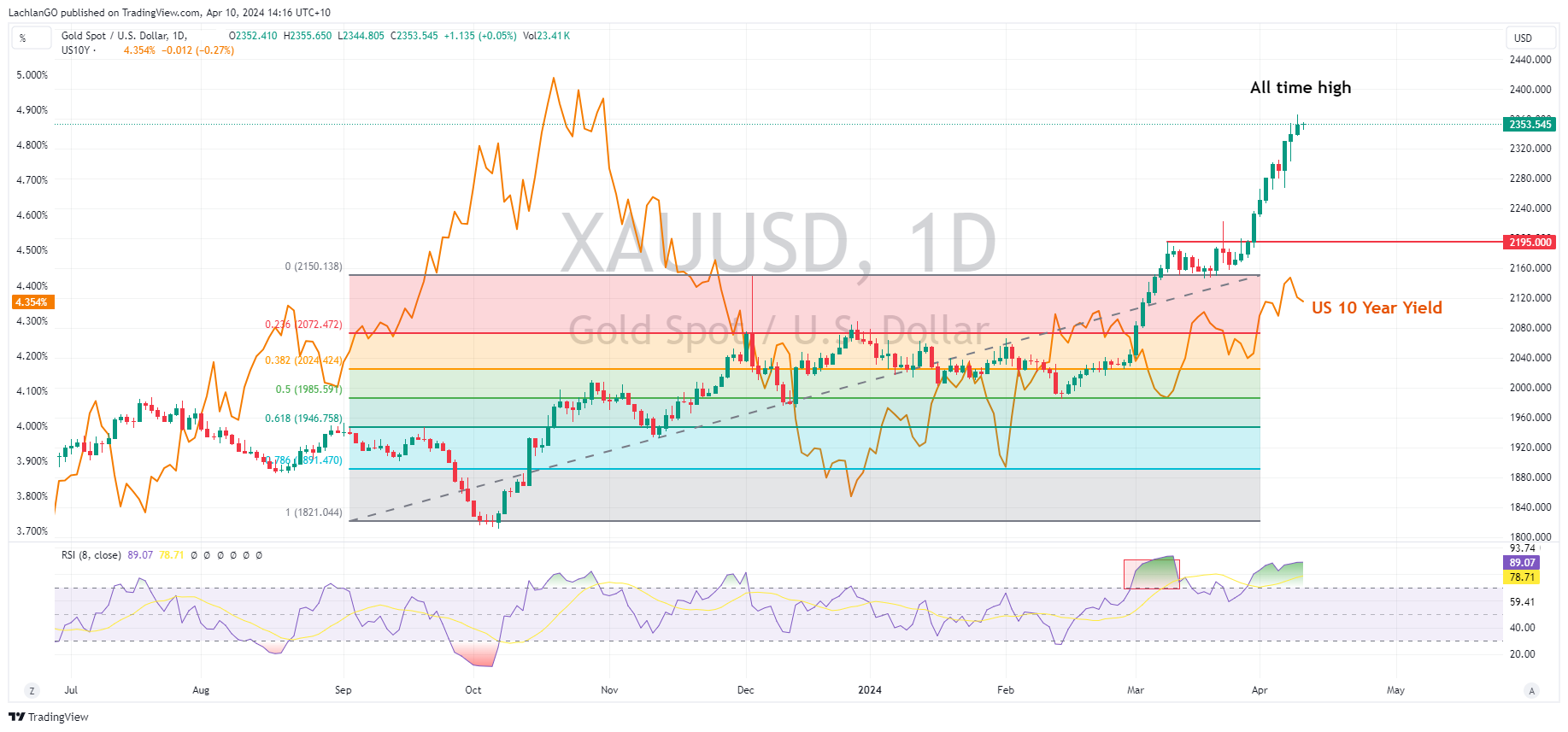

News & AnalysisAfter last week’s blockbuster NFP figure FX traders have a key US CPI reading to look forward to later today. Rates markets have seen see-sawing expectations on when the Fed will start cutting rates and today’s CPI will be another big part of that puzzle.

US CPI for March is expected to come in at a 0.3% increase, a slight cooling from Februarys 0.4% but still stubbornly holding the Year-on-Year rate at 3.4%, showing that not progress in the battle to bring down inflation is slow going and not over yet.

USD has been in a holding pattern during April with the US dollar Index range trading between the support at 104 and resistance at 105, the 104 support is certainly in play should a cooler than expected CPI reading come in, with the next support at the 200-day SMA at 103.81

Golds record run-up to all time highs has seen the precious metal take headlines during April. As an inflation hedge it should benefit from a hot CPI reading, but a cool reading would see yields and the USD drop which is also gold positive. It’s hard to predict how gold will react fundamentally to todays CPI, though from a chartist point of view XAUUSD is in serious overbought territory and a correction is overdue.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

FX analysis – USD rallies on hawkish Fed, JPY holds above 154

USD rallied in Tuesday’s session, with the US dollar Index hitting a 2024 high of 106.510 after hawkish Fed Chair Powell commentary where he noted recent data was showing a lack of further progress on inflation. Powell also added that if higher inflation persists the Fed can maintain current rate as long as needed. On data, building permits and h...

April 17, 2024Read More >Previous Article

FX analysis – USD strength to be tested by NFP

Data releases this week have hinted that the strong US activity story may be about to turn. The ISM services index declined more than expected, with t...

April 5, 2024Read More >Please share your location to continue.

Check our help guide for more info.