- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- USD and yields firmer ahead of US CPI

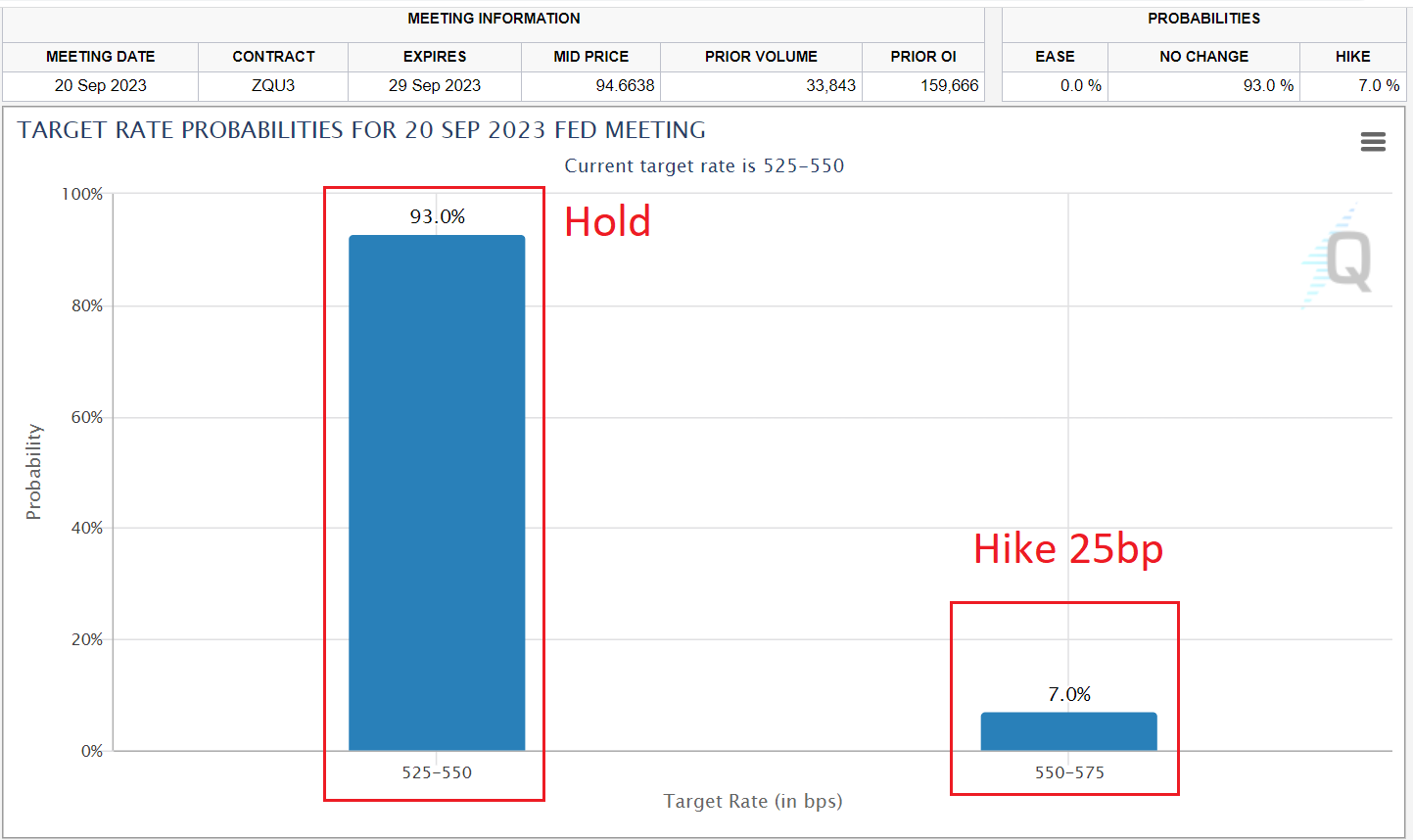

News & AnalysisThe USD has remained bid today heading into today’s pivotal US CPI where both the headline M/M and Y/Y figures are expected to show an increase over Julys readings. This is the last major inflation figure before next weeks FOMC meeting where the Fed is widely expected to hold rates (Fed Funds futures pricing in only a 7% chance of a 25bp hike).

A beat on CPI today is unlikely to sway the rate hike odds much but it will cast doubt on any narrative that the Feds work on inflation is done. A CPI coming inline with expectation or higher will likely see a reasonably hawkish FOMC statement and presser, where despite unchanged rates, the Fed may give a dot plot projection indicating one more hike this year.

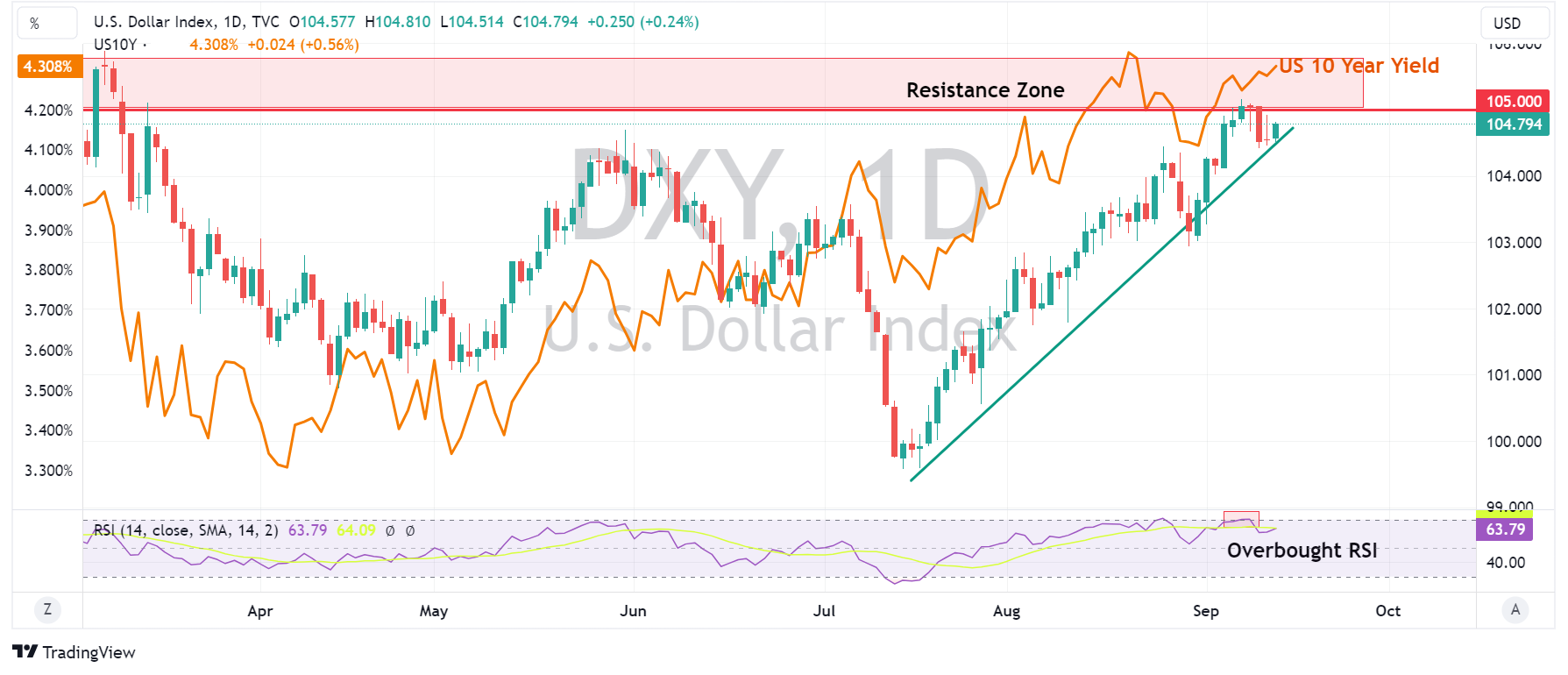

DXY has rallied in today’s session after yesterday’s whipsawing price action, with the upward trendline holding as support. US 10-year yields have also rallied to move towards the August highs as traders brace for a higher CPI and more hawkish Fed as a result, higher yields also a tailwind for the USD. Headwinds for the DXY will be the 105+ resistance zone which has capped further gains in DXY for the last 12 months, also 10-year yields in the recent past finding a lot of resistance when over the 4% level.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

WTI Crude Oil hits 10-month high, but there are some technical challenges ahead.

The WTI Crude Oil market is in an interesting spot on the charts, hitting a 10-month high in Wednesday's session. This strong performance comes after repeatedly testing and holding the $66-67 support level, resulting in an impressive climb of over 30% since the beginning of July. Having broken through a significant resistance level around $8...

September 14, 2023Read More >Previous Article

FX analysis – USD bounces back, JPY, GBP and AUD all under pressure as risk sentiment sours.

Tuesdays FX session is turning out to be a mirror image on Monday’s session Where the USD was battered against its major peers. Today, seeing almost...

September 12, 2023Read More >Please share your location to continue.

Check our help guide for more info.