- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- A Pivotal Moment For Sterling

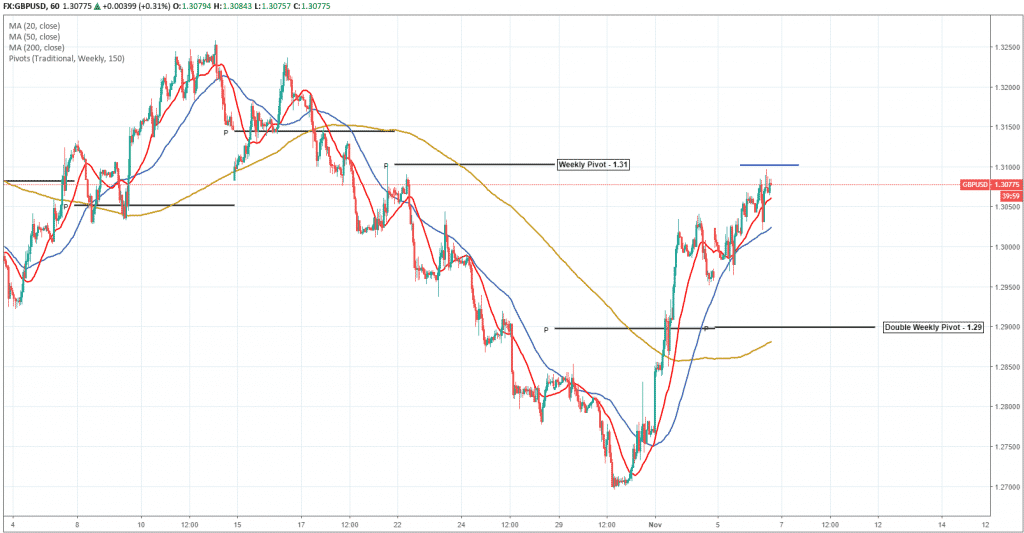

News & AnalysisGBPUSD – Has Cable run out of steam?

Looking at GBPUSD, we can see the month of November has kicked off with some impulsive moves higher off the back of potential Brexit deals concluding behind closed doors.

In the short-term, we might be witnessing the tail end of the recent rally as price action is showing signs of exhaustion, particularly as it reaches the previous weekly pivot region of 1.31. We can clearly see some resistance emerging here. Another element to remember is that the trend remains firmly bearish on the daily timeframe, so hints of selling pressure creeping in is perhaps to be expected.

If sellers do regain some control, the chart above suggests a key target for the pair would be the double weekly pivot area of 1.29. Generally speaking, whenever we see these type of pivots, price tends to gravitate towards them as market participants seek a middle ground.

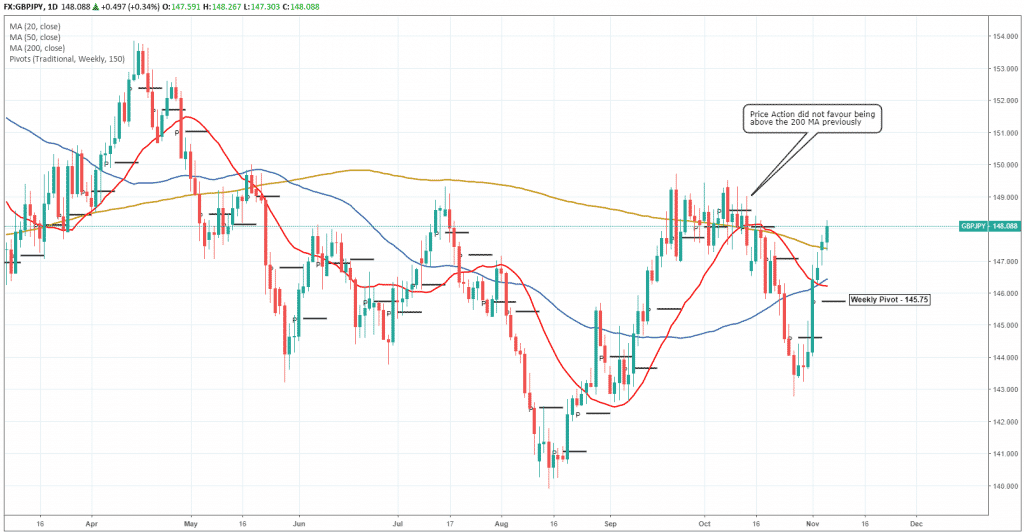

GBPJPY – Looking Shaky Above The 200 Day MA

Switching to GBPJPY, we are technically in bullish territory thanks to yesterday’s close above the 200 Day Moving Average (Gold Line). Considering how price reacted last time above these levels, it might be temporary unless we see further positive reports released for Sterling in the coming days.

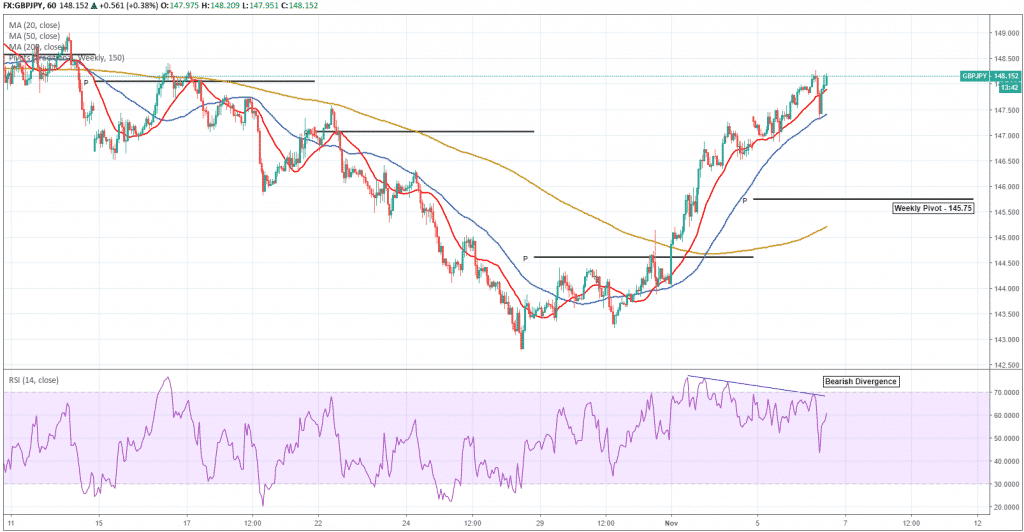

Similar to GBPUSD, I see a potential drop on the horizon for the pair, targeting another weekly pivot. On the hourly chart below, we see evidence of some bearish divergence developing on the RSI (Relative Srength Index), coupled with price teetering around overbought levels. It may well become the fuel that sparks a shift towards the weekly pivot of 145.75.

If you would like to see more pivot point action, take a look at our Chart Of The Day on the daily report by Klavs Valters.

For more information on trading Forex, check out our regular free Forex webinars.

Sources: TradingView.com

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

WTI in Bear Mode

Deteriorating demand and rising global output are the main factors that sent the WTI Crude into a bear market territory. There is a shift of sentiment in the oil markets. The US sanctions have been the primary influence behind the rally in oil prices, and now that fears have eased, fundamentals took over, and economic forces- demand and su...

November 9, 2018Read More >Previous Article

What to expect from the RBA this Tuesday?

Australian’s weak inflation report this week has set the tone for the RBA’s Rate Statement next Tuesday. The underlying inflation readin...

November 4, 2018Read More >Please share your location to continue.

Check our help guide for more info.