- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Asian Session Update – AUD, NZD continue decline, Hot Japan CPI sees Yen strength

- Home

- News & Analysis

- Forex

- Asian Session Update – AUD, NZD continue decline, Hot Japan CPI sees Yen strength

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAsian Session Update – AUD, NZD continue decline, Hot Japan CPI sees Yen strength

21 April 2023 By Lachlan MeakinMajor Asian stock indexes are following the lead from Wall St where US stocks finished broadly lower in a choppy, low volume session as economic news disappointed, Fed talking heads remained hawkish and a mixed batch of earnings.

The ASX200 and Nikkei down around 0.24% while the Hang Seng down just over 0.5 a %

FX Markets

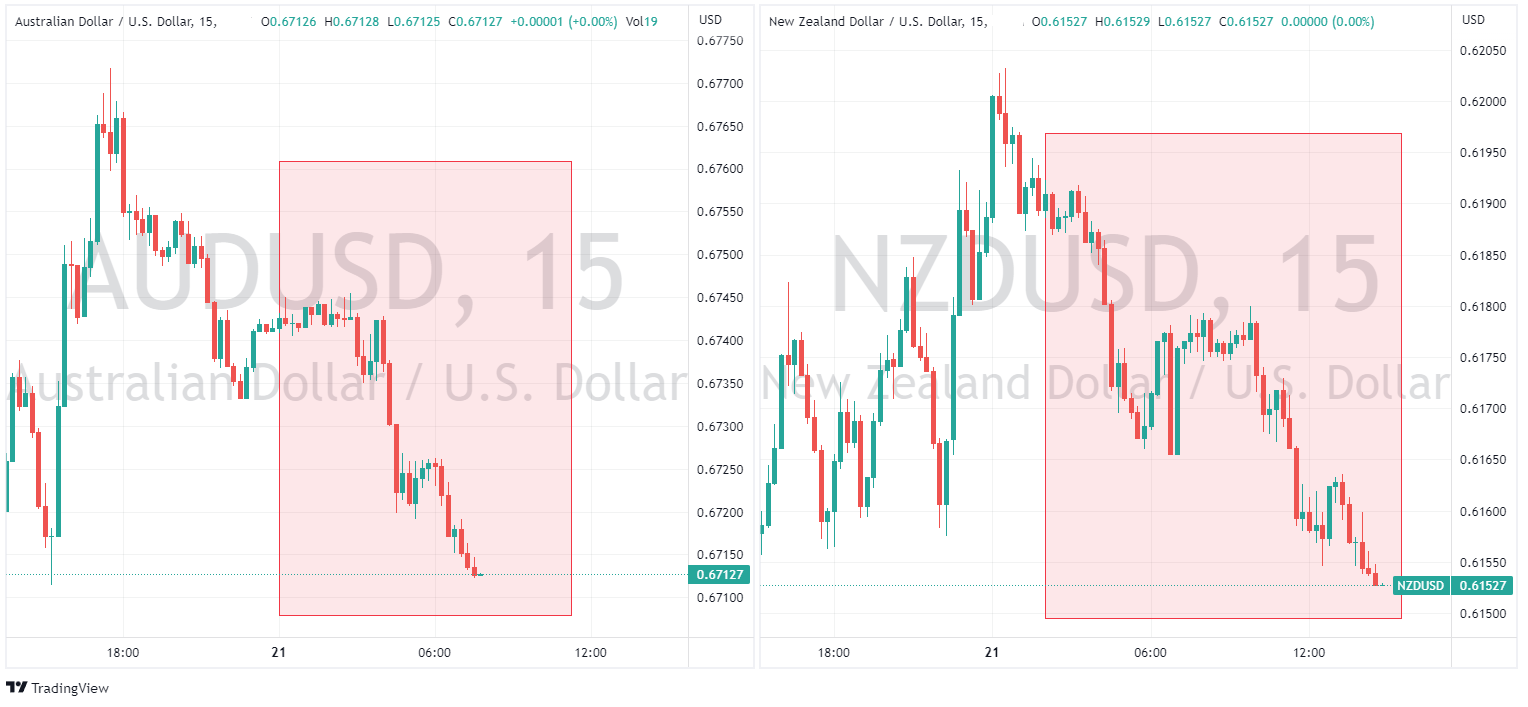

Have mostly continued with US dollar strength, the Aussie and Kiwi dollars have both declined against the greenback in the Asian session so far. The Aussie dollar is looking to test the 0.67 level where it found support yesterday, and the Kiwi dollar in similar action looking to also test yesterdays lows at 0.6150.

Both the Aussie and Kiwi suffering from a risk off mood to the markets on the weak economic data released in the US overnight.

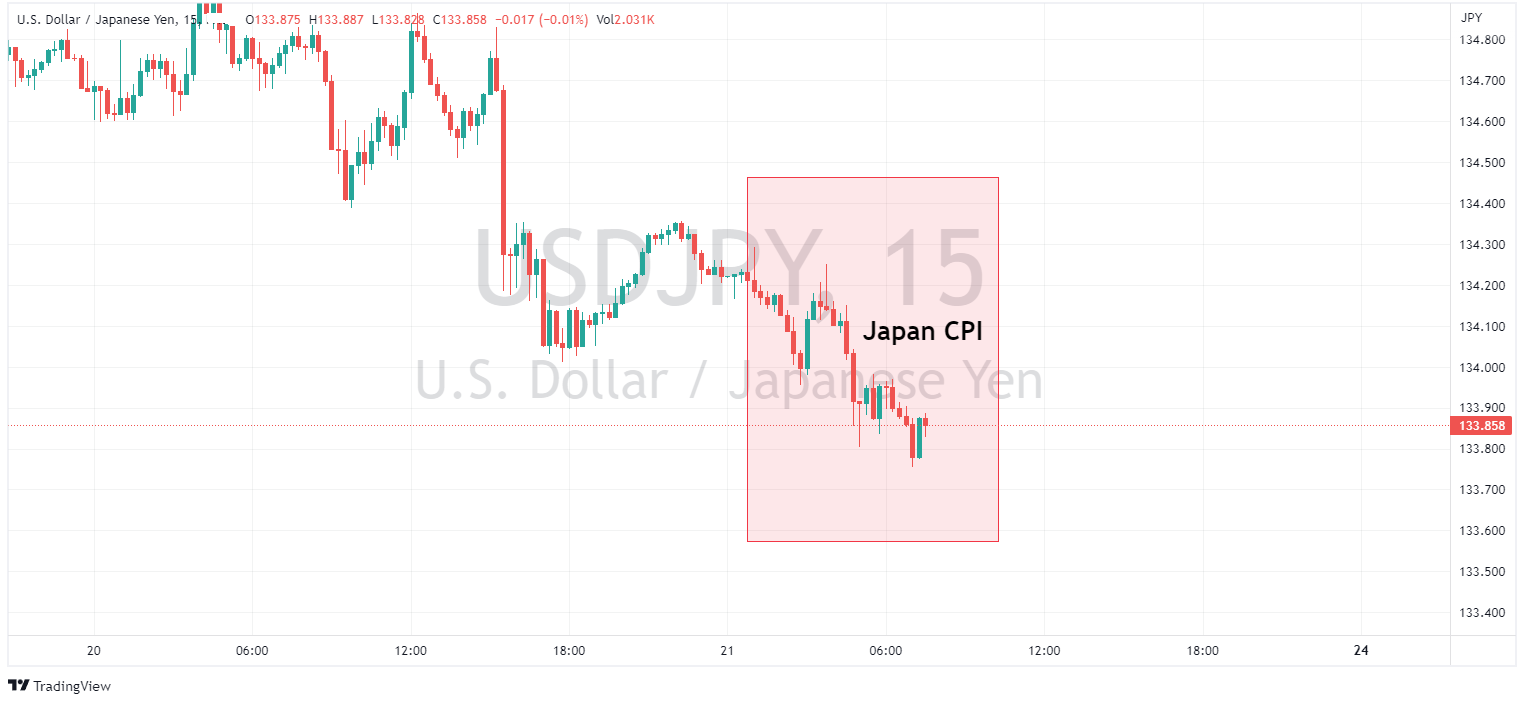

The JPY is bucking the USD strength trend though with a Hotter than expected CPI figure released today supporting the Yen as well as safe haven flows. core inflation came in at 3.1% vs 3% expected.

We also have a BoJ meeting next week, the first for the new governor and one where we may get a hawkish surprise regarding The BoJ policies going forward which seems to be adding to Yen strength.

commodities

Gold has modestly declined this morning, but holding just above the 2000 USD an ounce level where there has been a real battle between the bulls and the bears the last few days and will be an important level to watch going into tonight’s US and European session.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Procter & Gamble Company exceeds expectations – the stock rises

Procter & Gamble Company (NYSE: PG) announced third quarter fiscal 2023 before the opening bell in the US on Friday. World’s largest consumer goods company beat both revenue and earnings per share estimates for the quarter, sending the stock higher. Company overview Founded: October 31, 1837 Headquarters: Cincinnati, Ohio, Unite...

April 22, 2023Read More >Previous Article

American Express posts mixed results, sets a new quarterly record

American Express Company (NYSE: AXP) announced first quarter financial results before the market open on Thursday, setting a new quarterly revenue rec...

April 21, 2023Read More >Please share your location to continue.

Check our help guide for more info.