- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Forex

- AUD drops on Employment Figures

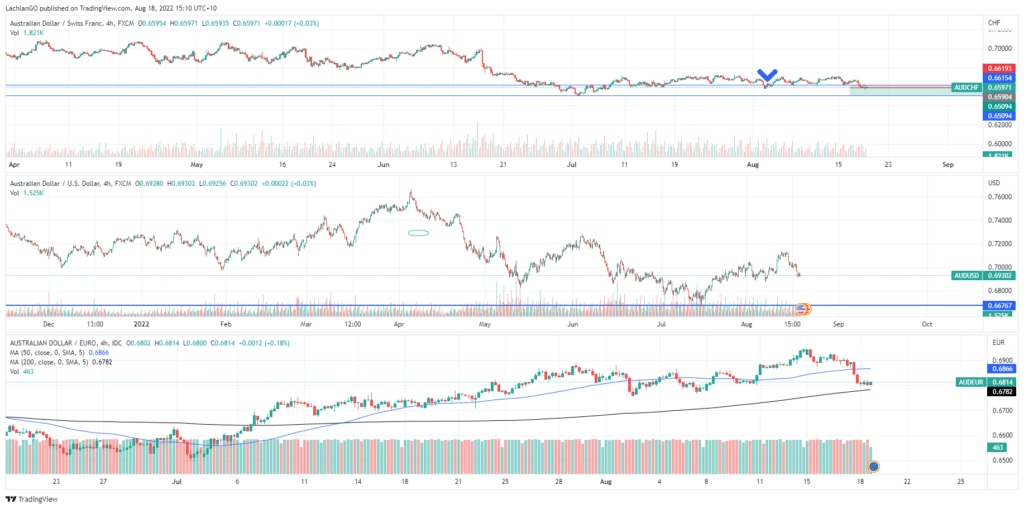

News & AnalysisThe Aussie Dollar has seen a drop in its price due to wage and unemployment data released over the past day and a half. The economic data shows that unemployment has fallen to its lowest level in nearly 50 years with the jobless rate at 3.4% compared to analysts expecting the figure to remain at 3.5%. Wages also rose modestly in the last quarter to 2.7%, however this is still a far cry from the 6.1% inflation figure. The AUD’s weakness came on the removal of 40,900 roles from the economy vs the previous month as opposed to expectations of a gain of 25,000. The report indicates that the labour market might just be starting to feel the pinch and that growth is beginning to slow. These figures give the RBA more flexibility in its next cash rate decision with the option for a 25 bps rise instead of 50 bps now being a realistic possibility after 3 consecutive 50 bps raises.

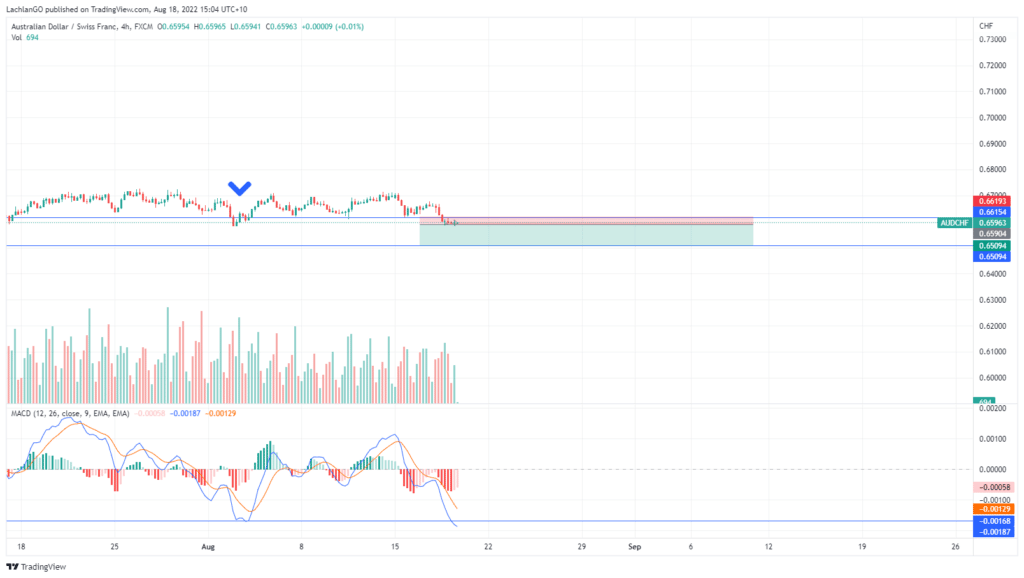

In response the Aussie dollar dipped against most of the main currencies. It fell back below 0.70 USD after a recent rally, to 0.6801 Euros and to 0.659 CHF. With the currency experiencing negative sentiment due to the employment figures and recessionary fears pushing commodity prices lower, there is an opportunity for a short trade. Specifically with the recent strength of the CHF compared to the general weakness s of the AUD, it represents the best opportunity for a trade.

The current price is sitting just near the last level of support at 0.6584 CHF, providing a potential entry point. If this level fails to hold then it is possible that the price may drop to 0.6509, which is the first price target. The current pattern of the MACD also supports this trade. The last time the price was at this level of support the MACD Moving Averages had already found support. However, on this occasion, the Moving Averages are still accelerating to the downside indicating that there may be more selling to be done. The trade involves placing a stop loss just above 0.66 CHF to reduce the potential loss if the trade does go as expected for a Risk Reward of close to 3.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Qantas outlook report

Overview Qantas is Australia’s national carrier and the largest and oldest airline in the country. With the Qantas group comprising of Jetstar, Qantas, QantasLink, its frequent flyer service and a freight service, the airline is the sector leader domestically and a global competitor in the international aviatio...

August 19, 2022Read More >Previous Article

Target falls short in Q2 – the stock is down

Target Corporation (TGT) reported its second quarter earnings results before the opening bell on Wall Street on Wednesday. The US retailer reported...

August 18, 2022Read More >Please share your location to continue.

Check our help guide for more info.