- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- AUD/USD finds new buyers at the 0.70 price mark

News & Analysis

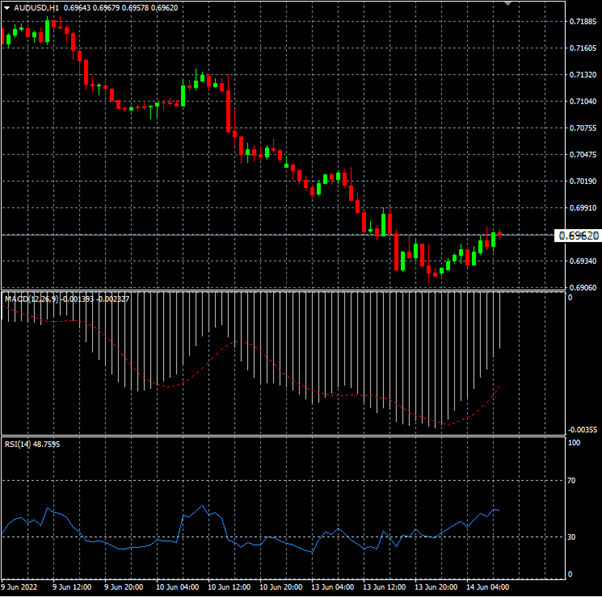

As depicted in the AUD/USD hourly chart above, the pair has recently reached a monthly low of 0.69117 as it enters today’s European session. As it continues to decrease in value, it generates a sloping resistance line at 0.6970, this is the trendline from Friday’s prices.

Although the trend might appear bearish at the moment, the MACD indicates a bullish trend and the 14 period RSI shows that it is slowly recovering from the recent oversold periods. This shows that the pair still has some room left to rebound from this level.

This in conjunction with the 0.70 psychological level and the 50-HMA level being near the 0.7015 price mark, has encouraged buyers to enter the market to potentially capitalise on the opportunity.

To contrast the above information, the one week long resistance line at 0.7050 will be a good price point to watch as there are potential bullish investors waiting to strike at this level.

However, the current downward trend has found its new support line at around the 0.69 price mark. This is quite close to the yearly low of 0.6830, which was set just last month.

All in all, we now have two price points to observe as these levels will be reached over the upcoming period and once it has been reached, it will be a new trend.

If you would like to take this opportunity to invest in the movement of the AUD/USD forex pair and you do not yet have a trading account, you can create a CFD trading account with GO Markets.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Oracle beats estimates

Oracle Corporation (ORCL) reported its latest financial after the closing bell in the US on Monday. The company beat both revenue and earnings per share estimates, sending the stock price higher. The US software and hardware manufacturer reported revenue of $11.84 billion for the quarter (up by 5% year-over-year and up 10% in constant currency) ...

June 15, 2022Read More >Previous Article

NIO Q1 results announced

NIO Inc. (NIO) reported its first quarter financial results before the market open in the US on Thursday. The Chinese electric vehicle maker report...

June 10, 2022Read More >Please share your location to continue.

Check our help guide for more info.