- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- AUDNZD falls from the top of its range

News & AnalysisThe AUDNZD pair has seen a large drop in the last few weeks and months as the Reserve Bank of Australia has brought about softer interest rate changes then compared to many other countries. Most other countries have dealt with inflation by raising interest rates aggressively. However, the AUD has been the victim of the RBA’s softer stance. The last two interest rate rises have only been 25 bps hikes which is less aggressive than England and the USA where both increased rates by 75 basis point it has weakened the Australian dollar.

Technical Analysis

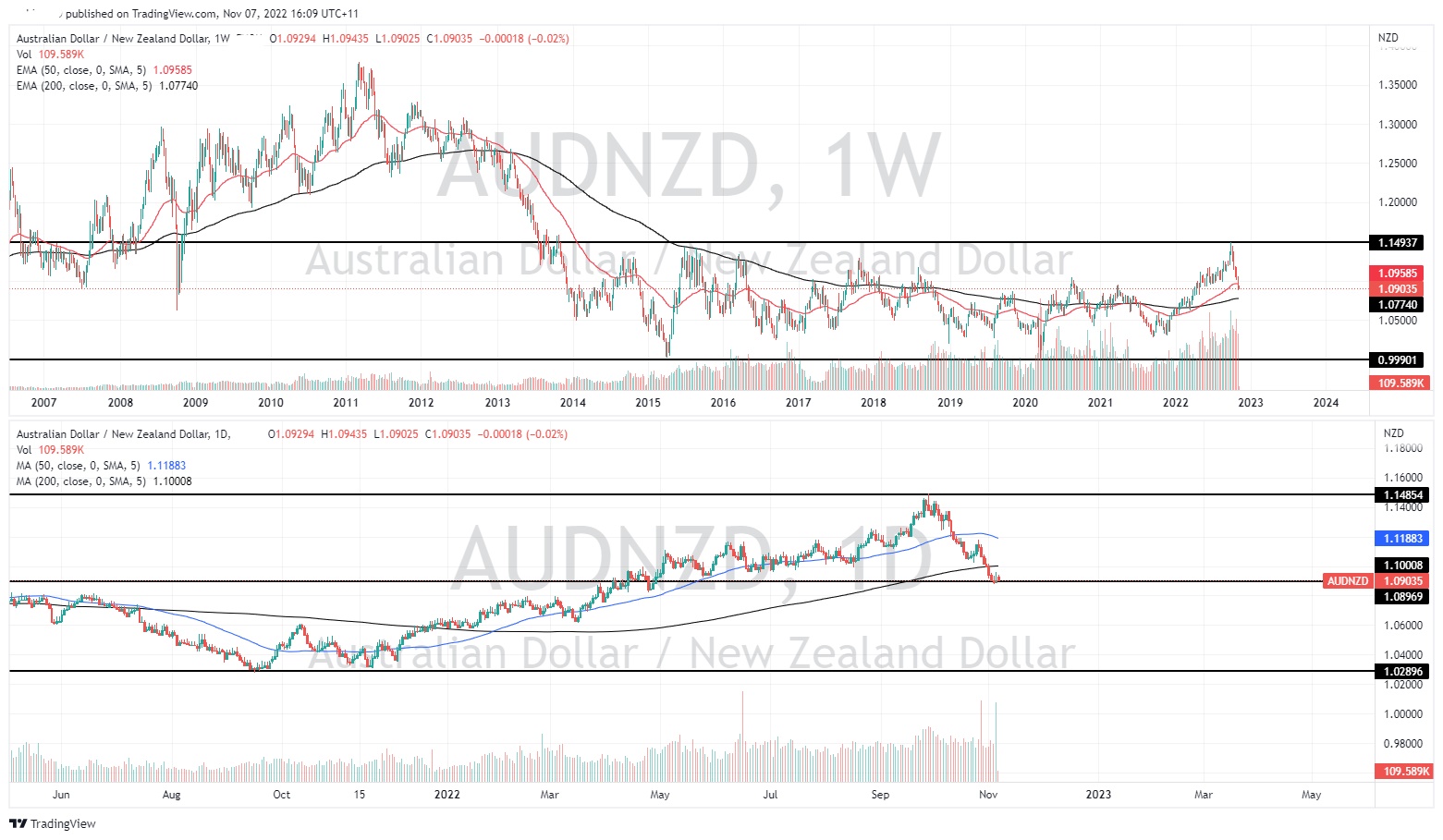

The AUDNZD has been in a long-term range between 1.00 and 1.15 since 2015. As it can be seen on the weekly chart, the pair has fallen from the top of its range which it reached in early October. Since then, the price has fallen 5.37%. Both Australia and New Zealand are very similar geographical, political, and how they react to macroeconomic events. Therefore, the currencies are quite similar in how they are seen and act.

When assets trade in this range pattern, they often revert to the mean. This means they move back to some long-term average. On the weekly chart the price has fallen all the way back to the 50-week moving average which is an important support level. It is almost right in the middle of the long-term range which can be seen as a long-term average. The chart is quite choppy and can make for difficult trading. Although, due to the aggressiveness of the selloff it may indicate either a short-term bounce is imminent or a longer-term reversal may occur, if the price approaches 1.00.

Ultimately both currencies are risk on currencies and whilst they tend to move quite closely, the softer approach to interest rate hikes that the RBA has taken so far has seen it perform worse than the NZD. If the RBA decides to become more aggressive with their rate hikes, the price may move back towards the top of the range.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

BioNTech tops Q3 expectations – the stock is up

BioNTech SE (NASDAQ:BNTX) reported its third quarter financial results on Monday. The German pharmaceutical company beat both revenue and earnings per share (EPS) estimates for the quarter, sending the stock price higher. The company reported revenue of $3.392 billion vs. $2.024 billion expected. EPS reported at $6.841 per share vs. $3.352...

November 8, 2022Read More >Previous Article

US mid terms loom as a potential catalyst for equities.

The US midterm elections are coming up next week on 8 November and have the potential to have a big say on the direction and volatility of the US and ...

November 4, 2022Read More >Please share your location to continue.

Check our help guide for more info.