- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- China’s slow growth a worry for Australia?

News & AnalysisChina, Australia’s savior during the 2009 Global Financial Crisis may not provide the same security in what may be an impending recession. This does not bode well for the Australian economy which so far has performed relatively well in the recent volatile market conditions. The ASX which has been resilient in the global sell off, on the back of its strong energy sector and certain elements of the resources industry.

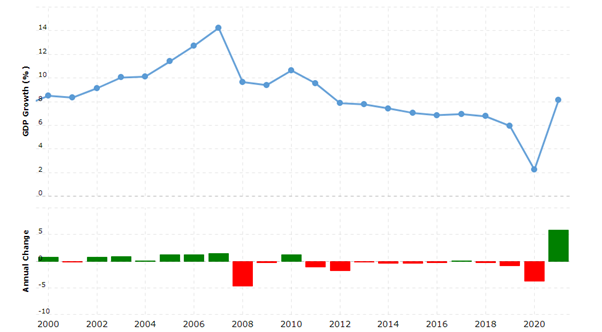

China on the other hand has struggled immensely in its post Covid 19 recovery. In fact, after a strong 2021 in which the economy grew by more than 8%, the recovery has stagnated largely due to Xi Jinping’s Covid 0 policy even as the rest of the world has dropped many restrictions. Prior to Covid 19, the economy had been growing at a controlled rate of almost 5% which was also the projected rate for this year. However, this year’s rate has been adjusted multiple times and according to the Bloomberg Survey, the adjusted estimate of growth for 2022 is now 3.5%. It is also very possible that the country is in a recession although it is difficult to verify.

Adding fuel to the fire is that China has seen its real estate sector plummet. The country’s GDP relies heavily on its property sector for its growth in jobs and growth and accounts for around 30% of its total GDP. With Property developer Evergrande, on the brink of collapse, it left the sector without confidence with house prices dropping in many Chinese cities. With such a reliance on the property sector for its economic growth and confidence dwindling, the situation has only further slowed the overall growth.

How will this impact on Australia?

A weak China can have a major effect on Australia’s commodity and housing market. Chinese investors contributed 32 billion dollars at their peak to Australian property but just 7.1 billion during the 2019/2020 period. The country is also a massive source of tourism for Australia and education with students and tourists from China being a major segment of the Australian economy.

A shifting landscape for Australian companies

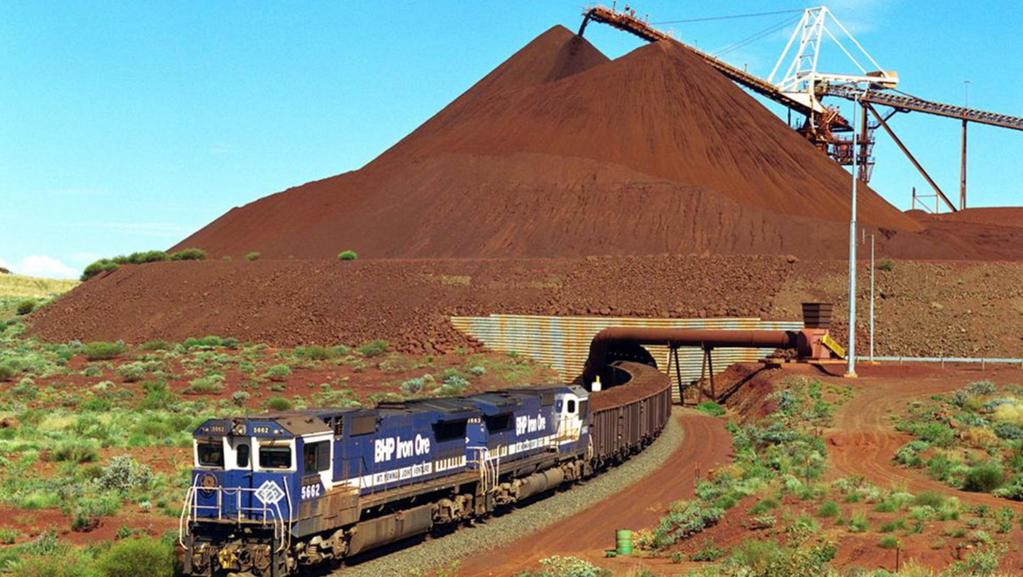

With the slowing growth in the Chinese economy and the globe on the brink of a recession big miners who were crucial in the development of the country’s infrastructure growth such as Rio Tinto, BHP and FMG have the seen the demand for their resources dwindle. As the demand for Iron ore cools, powerhouse miners will need to find alternative ways to increase their cashflows. This doesn’t mean that China won’t continue to grow, in fact in certain areas China is expected to expand and one of those is in the renewable energy and electric vehicle space. The government desires for 20% of all cars to be electric by 2025 and 70% of all new vehicles in 2030 will be ‘new energy’, including a substantial proportion of EV’s

Sydney, April 26, 2001. A train loaded with iron ore departs the BHP Iron Oreís Yandi Mine in the Pilbara, Western Australia. (AAP Image/BHP) Lithium for instance represents a great opportunity for these miners. Rumors have been circulating that Rio Tinto is searching for Lithium companies to acquire to accelerate their pivot and Fortescue has taken a different route trying to expand into the Hydrogen field. Other critical resources such as copper, graphite, rare earths are essential for advancing China into the second half of the 21st century and are opportunities for Australian companies.

A weak China also has a detrimental impact on the Australian dollar. The Aussie dollar has already been suffering as fears of a recession have led to a shift in growth prospects for the economy and its commodity sector. The flow on effect means that the AUD is sitting at lows not seen since the 2020 Covid 19 lows. The impact of China is important because even if the global economy improves, if China’s growth is relatively weaker by its owns standards, this may create a headwind for the AUD and the Australian economy.

Ultimately, a weak China is a problem for the entire global economy. With an impending recession a slowing Chinese economy is not something the West would like to see. However, with some stability around Xi Jinping maintaining the country’s growth ambition it may still recover. Overall, in the short term at least, a bumpy ride awaits.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Understanding CFDs: An introductory guide to CFDs

What are CFDs? A contract for differences (CFD) is an agreement between a buyer and a seller that the buyer will pay the seller the difference between the current value of an asset and its value at the time of the contract. CFDs provide traders and investors with the opportunity to profit from price movements without owning the actual asset...

October 23, 2022Read More >Previous Article

Procter & Gamble beats estimates – the stock is up

The Procter & Gamble Company (NYSE:PG) reported its latest financial results before the opening bell on Wednesday. The largest consumer goods c...

October 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.