- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Forex 10 Year Challenge

News & Analysis

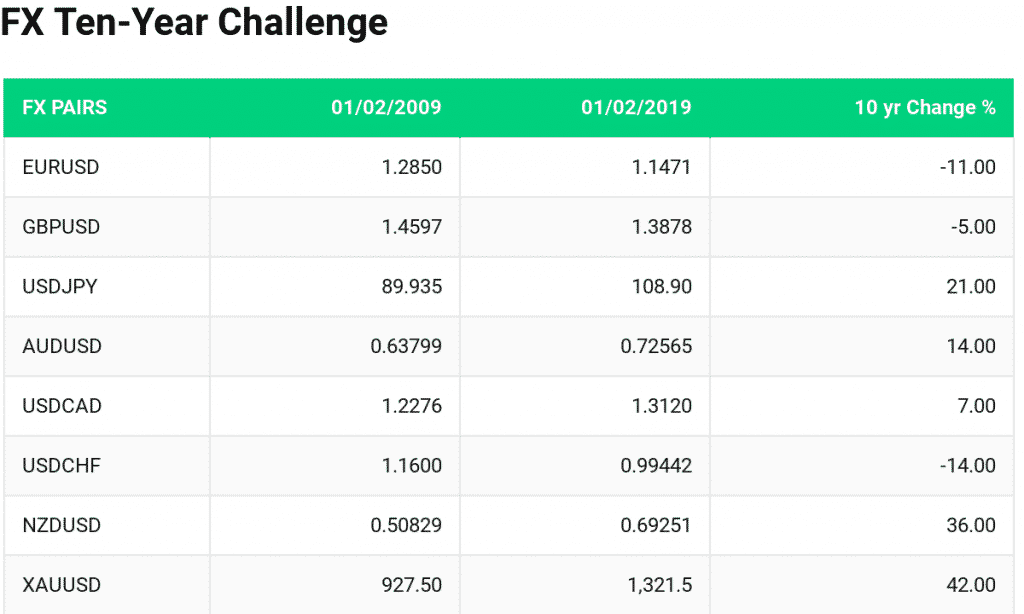

To begin the week, I thought we’d do something a little bit different. We have taken the current ten-year challenge sweeping social media and tried to apply it to a brief technical analysis summary of the major FX pairs. Where were they trading in early 2009? And where are they now?

Judging by the list below, it would seem gold wins the gold medal regarding overall performance. The following summaries will delve further into each trading pair.

EURUSD

Even though current price action is trading just above the 200 MA suggesting the longer-term trend is bullish, the price action since 2009 provides more significant evidence of a strong downtrend in place, most notably the lower highs witnessed in 2009, 2011, 2014 and last year respectively. Following the rather dull consolidative period between 2015 to 2017, the Euro-Dollar pair has shown a new lease of life and has found the 1.25 level to play a significant role once again. At current levels though, the danger here is that we could slip back into the familiar rangebound territory if the supportive structure seen at 1.14 fails to contain sellers going forward. The highlighted head and shoulders pattern might be a precursor to a EURUSD reversal back towards the 1.05 lows.

GBPUSD

Surprisingly, only a 5% difference in value since this time ten years ago. We see mostly rangebound moves since 2009, with the Brexit catalyst in 2016 providing fuel for an extended step down in price. The recovery from 2017 to the beginning of 2018 may give a clue to future movements within the pair. Notice how the price has respected the 200 MA in recent years, it would appear the region of 1.35 could be a potential barrier if tested, resulting in a continuation of the longer-term downtrend. In this scenario, the previous 1.20 support is a target worth considering.

USDJPY

In 2009 the Dollar-Yen pairing appeared somewhat heavy towards the downside. However, we’ve seen a steady recovery since the 2012 lows, and a validated bullish trendline is currently in play. In December last year, price attempted a sharp move down to 104 levels but was quickly rejected, resulting in further Dollar strength. Key areas to note are the Fibonacci retracements of the 2015 high including the 50% level which has provided strong support around 100.00 and the 23.6% retracement at 113.80 which continues to act as tough resistance. Perhaps we’ll see another rally north to re-test 113.80 longer-term, especially when RSI (Relative Strength Index) levels are looking oversold.

AUDUSD

Like a boomerang that’s been thrown and come back, the Aussie has returned to where it began in 2009 following some large swings higher. Currently, in a residual downtrend, it’s difficult to see where this pair may up longer-term, but the key takeaway over the last decade would be the importance of the 0.70 zone regarding support and resistance levels.

USDCAD

It is also a case of ‘Back To The Future’ for the Loonie. Despite some significant price moves over time, current levels are almost identical to those seen this time ten years ago. Technically still within a longer-term uptrend, price action has maintained a presence around the 200 MA and has produced a textbook series of higher highs and lower lows since mid-2017. It is also worth pointing out that the 50% retracement level near the 1.20 mark has provided strong support for the pair in both 2015 and 2017. The future outlook appears to be indecisive moves heading sideways.

USDCHF

Not too much change for the Swissie either since 2009. Following the SNB crisis in 2015, price action has been practically non-existent with 1.03 acting as somewhat of a ceiling slowly squeezing the price into submission. We could either see a massive breakout after this extended consolidation phase or perhaps more of the same longer-term.

NZDUSD

An impressive 36% gain since 2009. Longer-term we have settled around the 50% Fibonacci retracement level of the Jun 2014 high. Current levels also coincide with the 200 Moving Average which price action has failed to break above in recent years convincingly. There is still a slight bias to the downside, and the previous support level of 0.62 could be a potential target should the Kiwi Dollar continue to grind lower.

XAUUSD

An impressive price rise in the last decade for the precious metal, and similar to Kiwi Dollar, current price action is sitting around the 50% Fibonacci retracement level from the August 2011 high. The overall longer-term trend has been sideways since 2013 with no clear directional bias in sight. The only thing worth noting here is the current RSI situation which appears overbought and could spell some bearish activity in the weeks and months ahead.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more resource on Forex trading check out our Forex Trading For Beginners introduction, Forex Trading Courses, open a Forex Demo Account or open a live Forex Trading Account.

Sources: Go Markets MetaTrader, Google, Datawrapper, Tradingview.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Margin Call Podcast – S1 E4: Khim Khor | Executive Director & COO of GO Markets

Khim Khor (Linkedin) is GO Markets’ COO and Executive Director. He started out as a Sales Manager for the Asia business, when this demographic was just opening up for the CFD/Forex industry. Five years later he stands as COO and is an integral part of the GO Markets team with a unique and innovative perspective on Asia. As a lifelong stud...

February 6, 2019Read More >Previous Article

Boeing and Facebook Earnings

Boeing (BA) The Aerospace giant beat estimates and reported a record $101.1bn revenue for the year 2018. It is the first time that the company repo...

January 31, 2019Read More >Please share your location to continue.

Check our help guide for more info.