- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – AUDUSD at key resistance ahead of RBA minutes and wage data

- Home

- News & Analysis

- Forex

- FX analysis – AUDUSD at key resistance ahead of RBA minutes and wage data

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX analysis – AUDUSD at key resistance ahead of RBA minutes and wage data

20 February 2024 By Lachlan MeakinWith the US closed for a holiday FX markets on Monday struggled to find much direction though China re-opening in the green after an extended leave did lend some support to the Aussie dollar ahead of todays RBA minutes. The February 6th RBA meeting saw a statement that had a bit of both ways, acknowledging broad progress on the inflation front but also pointing to the concerning level of inflation despite recent progress. This was seen as a hawkish leaning hold, seeing AUDUSD rally modestly on the day, today’s minutes will fill in the gaps as to the discussion between RBA members leading to the official decision.

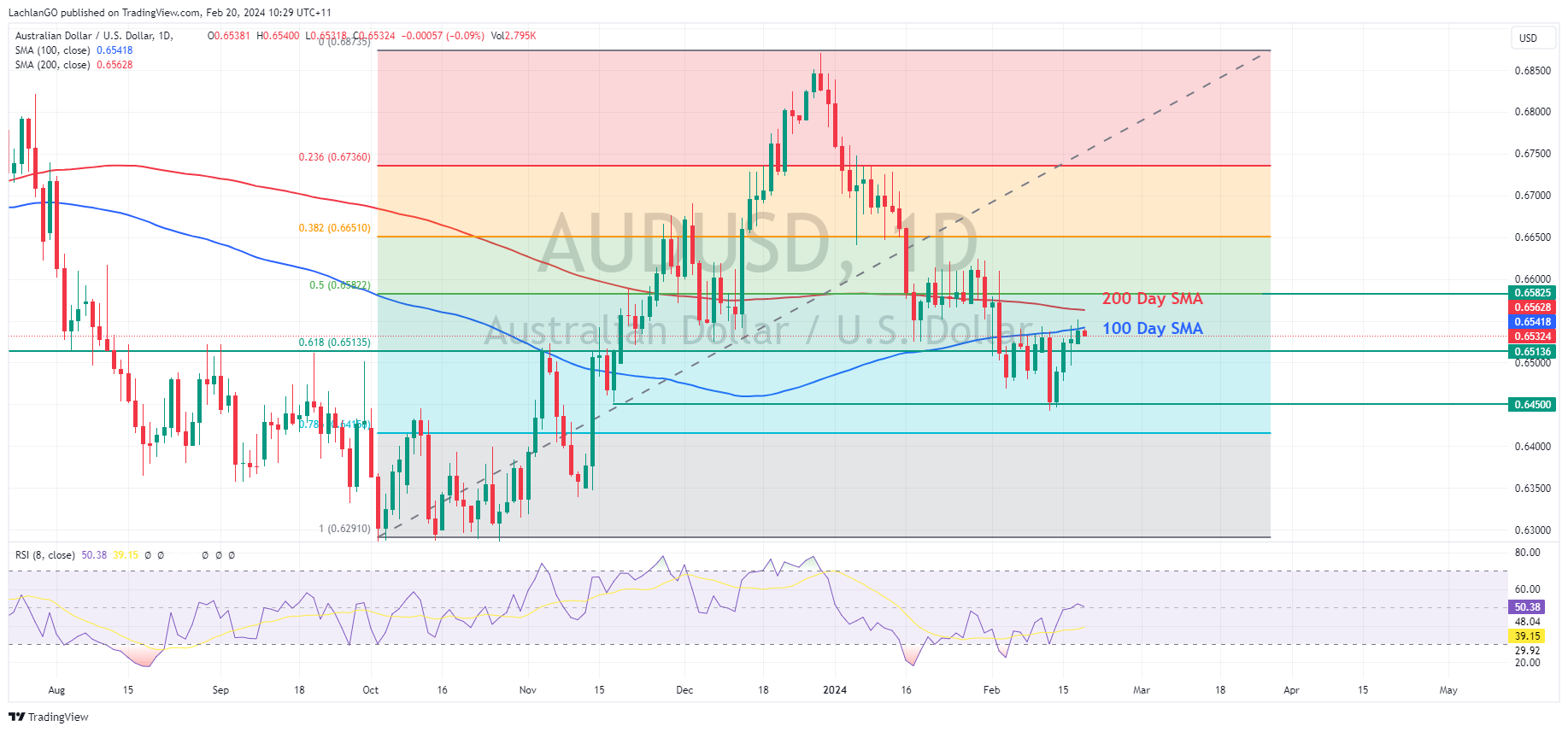

AUDUSD Technical analysis

AUDUSD has bounced in the last week after setting new 2024 lows at 0.6442 on the 13th of February. The steady advance retaking the 0.65 handle and breaching the February resistance level of 0.6525, which has so far held as support. AUDUSD has hit some technical resistance levels here, firstly the 100 Day SMA, which has so far capped further price increase, and further to the upside is the 200 Day SMA and 50% Fib level at around 0.6580 which could also provide technical resistance to any further Aussie upside.

Technical support to the downside could be found firstly at the 61.8 fib level at 0.6513, failing that the 2024 lows at 0.6450.

For Aussie traders, along with the RBA minutes today, the main data point will be Wednesdays Wage Price Index, a gauge the RBA has referenced in regards to their rate decisions and could be a big Aussie mover if outside of expected range.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Home Depot earnings results announced

US home improvement chain Home Depot Inc. (NYSE: HD) reported Q4 financial results before the opening bell on Wall Street on Tuesday. The company reported revenue of $34.786 billion for the quarter (down by 2.9% year-over-year) vs. $34.643 billion expected. Earnings per share also topped analyst estimates at $2.82 (down by 14.54% year-over-ye...

February 21, 2024Read More >Previous Article

Vulcan Materials closes at a new all-time high after earnings

US manufacturer of building materials Vulcan Materials Company (NYSE: VMC) announced its latest financial results on Friday. Vulcan Materials repor...

February 19, 2024Read More >Please share your location to continue.

Check our help guide for more info.