- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – AUDUSD stutters after RBA and weak Chinese data, USDJPY back above 150 testing the BoJ

- Home

- News & Analysis

- Forex

- FX Analysis – AUDUSD stutters after RBA and weak Chinese data, USDJPY back above 150 testing the BoJ

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – AUDUSD stutters after RBA and weak Chinese data, USDJPY back above 150 testing the BoJ

8 November 2023 By Lachlan MeakinAUDUSD dropped in Tuesday’s session with AUD being weighed on post-RBA decision, as the less hawkish RBA guidance outweighed the widely anticipated 25bps hike to 4.35%. Though the market reaction was a little curious given the small changes to the accompanying statement hardly made it dovish. The RBA changed its forward guidance to say “whether further tightening of monetary policy is required…will depend upon the data” from the previous “Some further tightening of monetary policy may be required”. The push lower was also exacerbated by based weakness in the commodity space after a miss in Chinese trade data. Looking at the chart for trading opportunities we can see AUDUSD is trading in a defined range with major resistance at the 0.6500 level and major support at 0.6300 which opens up range trading opportunities with defined stop losses above or below these key levels, another key level is 0.6400 being the mid-price of the range and a level that price has chopped around recently. I think we are likely to see a bit more weakness in AUD on the back of the RBA and risk premiums coming out of gold and oil putting pressure on those commodities.

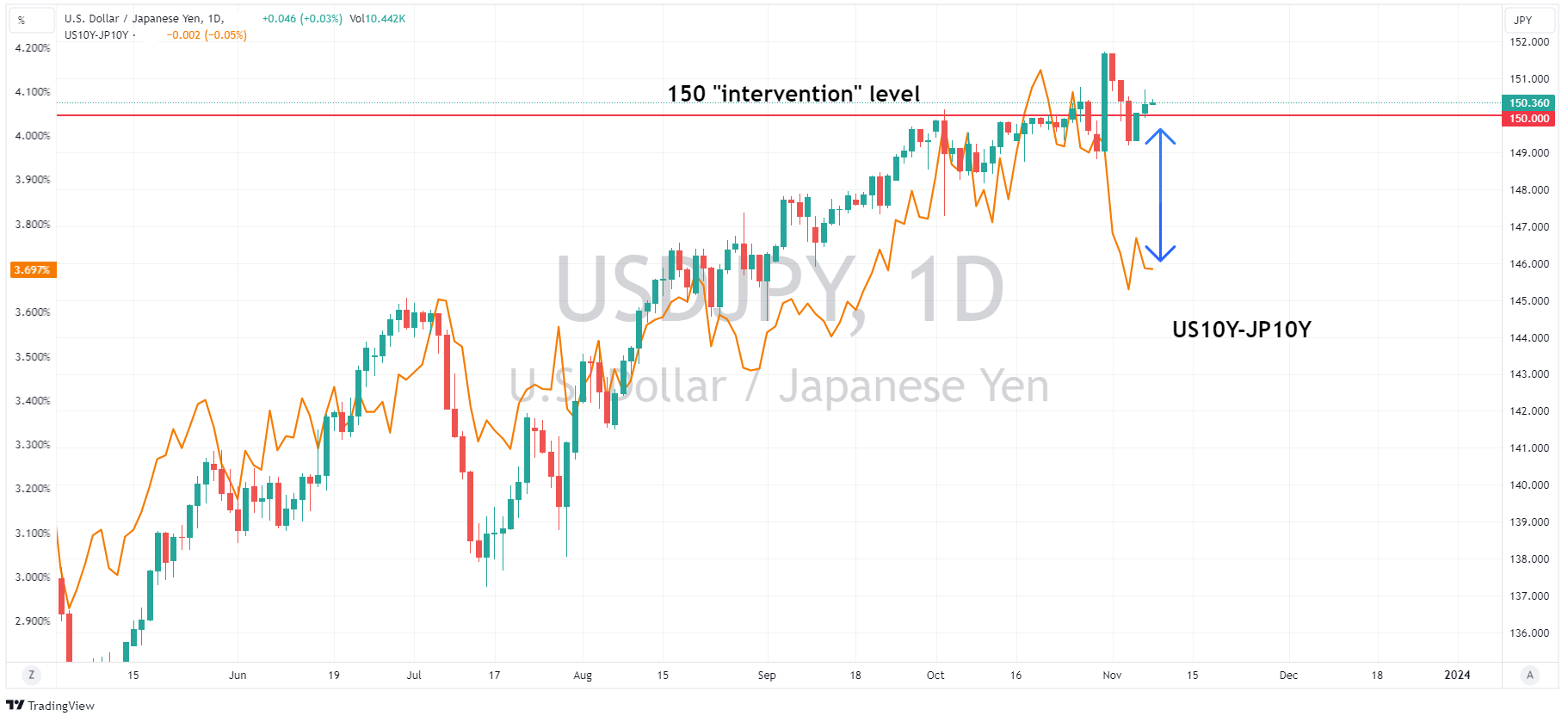

USDJPY continues to drift higher above the key 150 level into past intervention territory after the dip last week after the BoJ tweaked their YCC to extend the band, allowing Japanese yields to move higher and giving support the Yen. The drop in US yields over the past week and the modest gains in Japanese yields has seen the US 10-year / Japanese 10-year rate differential fall steeply, this rate differential has been a key driver of the USDJPY rate. However, as seen on the chart below USDJPY is remaining stubbornly high despite this, with a decent gap opening up between the rate differential and USDJPY rate. Whether this gap “fills” i.e. a drop in USDJPY to reflect this rate differential is the question, going from the recent past it would look likely unless we see another leg higher in US yields. For Yen traders the October BoJ SOO released on Thursday will be the next decent data point to keep an eye on.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

XAUUSD Analysis – Further Downside in Gold possible as Risk Premium unwinds

Golds safe haven status was reaffirmed as markets opened on the 9th of October to the news of conflict in the Middle East, this saw XAUUSD go on an impressive run, rallying almost 10%, breaking the psychological 2000 USD an ounce level and hitting 6-month highs. This week we have seen some of that risk premium unwind as reduced haven flows and p...

November 9, 2023Read More >Previous Article

Uber results have arrived

Uber Technologies Inc. (NYSE: UBER) released its latest earnings results before the market open in the US on Tuesday. Let’s see how it performed in ...

November 8, 2023Read More >Please share your location to continue.

Check our help guide for more info.