- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – CNH strengthens on intervention talk – JPY breaks losing streak – Gold breaks key support

- Home

- News & Analysis

- Forex

- FX Analysis – CNH strengthens on intervention talk – JPY breaks losing streak – Gold breaks key support

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – CNH strengthens on intervention talk – JPY breaks losing streak – Gold breaks key support

18 August 2023 By Lachlan MeakinFX WRAP

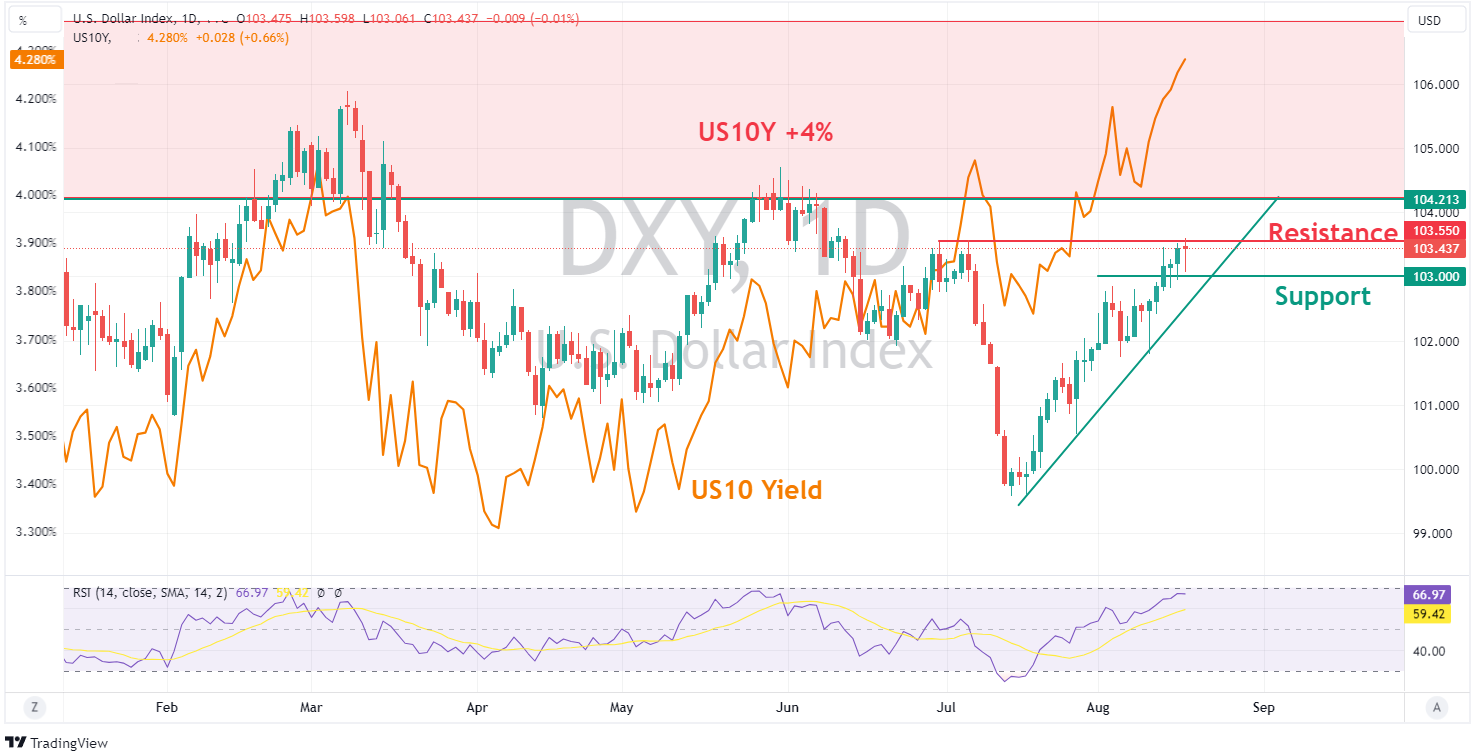

USD was choppy with the US Dollar Index ending the session flat in range bound trade. Unemployment claims dropped to 239k from 250k the prior week which was in line with consensus and having little effect on the USD, though Philly Fed Manufacturing figures did have a big beat coming in at +12.0 vs an expected -9.8, which was the highest print since April 2022. This, along with stubbornly high yields and a general risk-off background, saw the USD reverse some early weakness on Yuan intervention headlines. DXY pushing its head above the resistance at July’s highs before stalling.

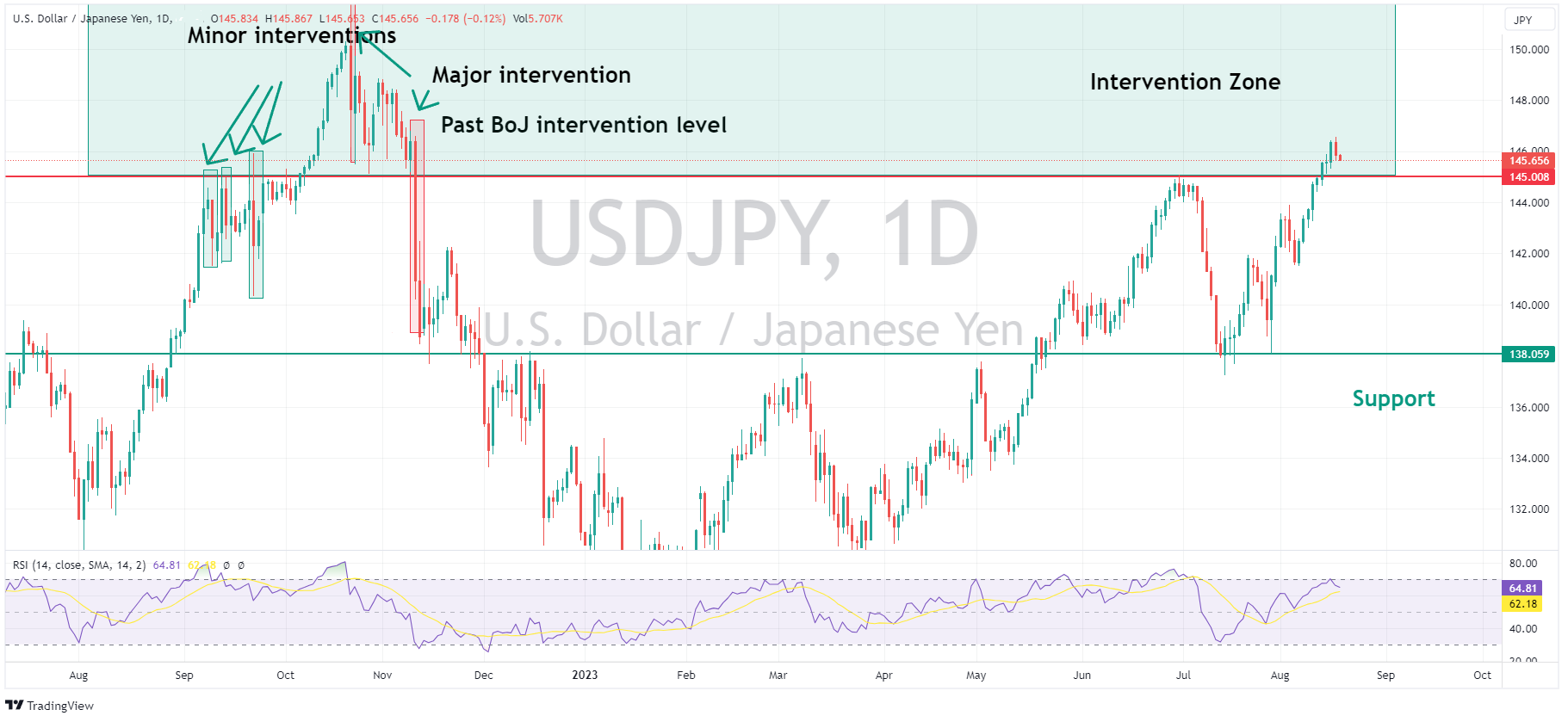

JPY was the G10 outperformer against the USD. USDJPY now having eight straight days printing higher highs and higher lows, its longest streak since October’s BoJ intervention-driven collapse from 32-year highs. USDJPY hit a high in APAC trading of 146.56 on weak Japanese data , before fading to hit a low of 145.62. Not a peep out of the Japanese MoF yet but desks put the recovery down to yield differentials as US Treasury yields plateaued, while a poorly received Japanese JBG bond auction saw Japanese yields spike on the 30 years.

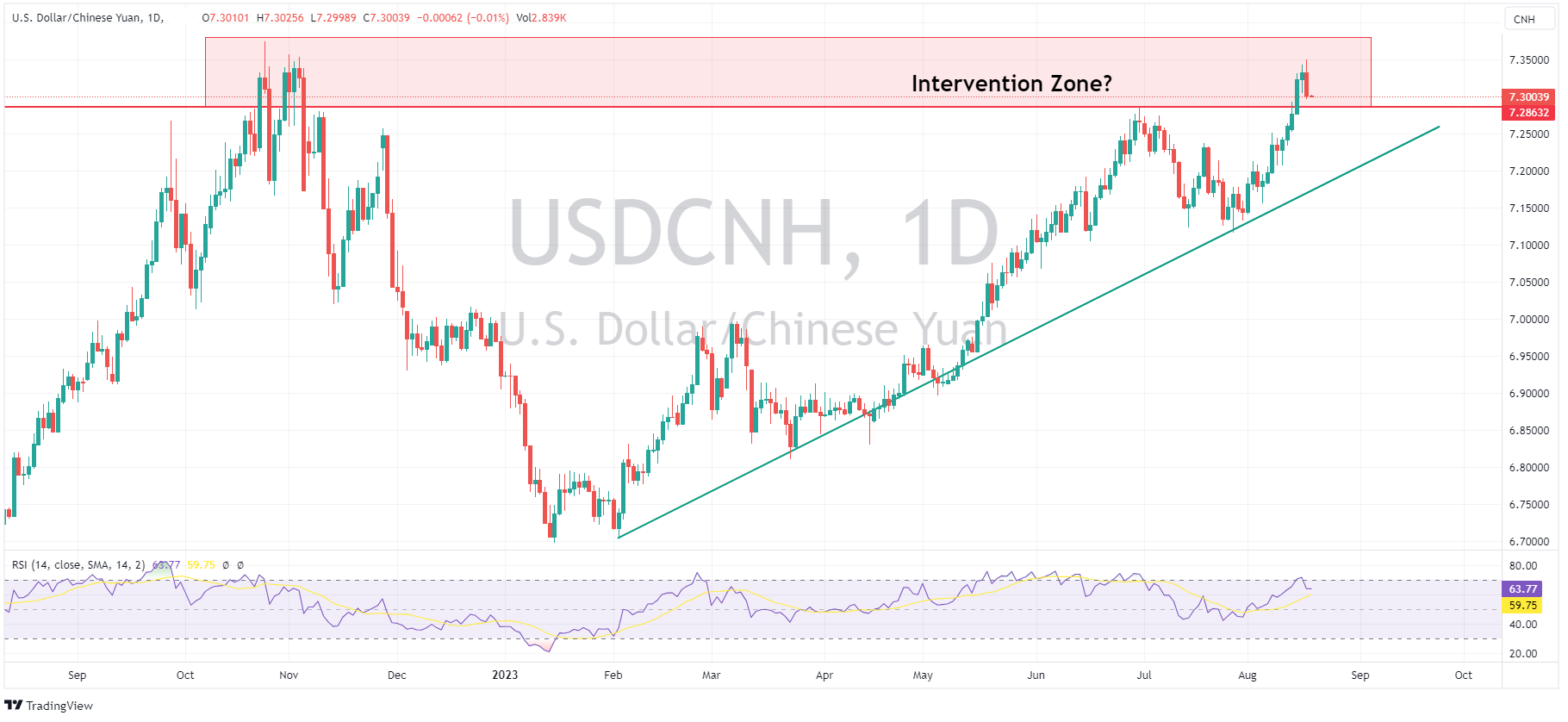

Another currency on the intervention watchlist is the Chinese Yuan. Bloomberg reports of Chinese authorities reportedly telling state banks to escalate Yuan intervention saw USDCNH have its largest drop of the month, breaking a 5-day rally. There is also theories floating around that China is funding Yuan intervention through selling US Treasuries, which would explain US treasury weakness (keeping yields elevated), which is unusual in an equity market risk off environment.

AUD and NZD were the G10 underperformers again, AUD underperforming the NZD after a big miss in the Aussie employment report, where unemployment unexpectedly rose to 3.7% and jobs fell by 14.6k vs a 15k rise expected. AUDUSD printed a low of 0.6366, but moved higher on the back of Yuan strength as the session went on. AUDNZD recovered the losses after the Aussie jobs report to move back above the key 1.080 level.

Gold again moved lower, with XAUUSD breaking key support at 1892, after a test of the 1902 resistance early in the session was forcefully rejected.

The economic calendar is very light today, with only UK retail Sales being of any significance.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Upcoming Nvidia earnings: Has the AI hype cooled?

Nvidia has been the star of the US markets since the AI hype kicked off late 2022. The trillion-dollar chip manufacturer’s shares have almost tripled in 2023 alone, with the price increasing every month so far this year. In May, Nvidia surprised the markets by posting earnings and revenue figures well above analysts’ expectations. This se...

August 21, 2023Read More >Previous Article

Market responses to actual versus consensus numbers in data releases

As traders and investors one of the important facts you need to get to grips with is the difference between Consensus (sometimes termed “expected”...

August 16, 2023Read More >Please share your location to continue.

Check our help guide for more info.