- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – EUR and GBP rally on PMIs, USDJPY tests key level.

- Home

- News & Analysis

- Forex

- FX Analysis – EUR and GBP rally on PMIs, USDJPY tests key level.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – EUR and GBP rally on PMIs, USDJPY tests key level.

24 November 2023 By Lachlan MeakinMarkets were predictably quite due to holidays in the US and Japan on Thursday.

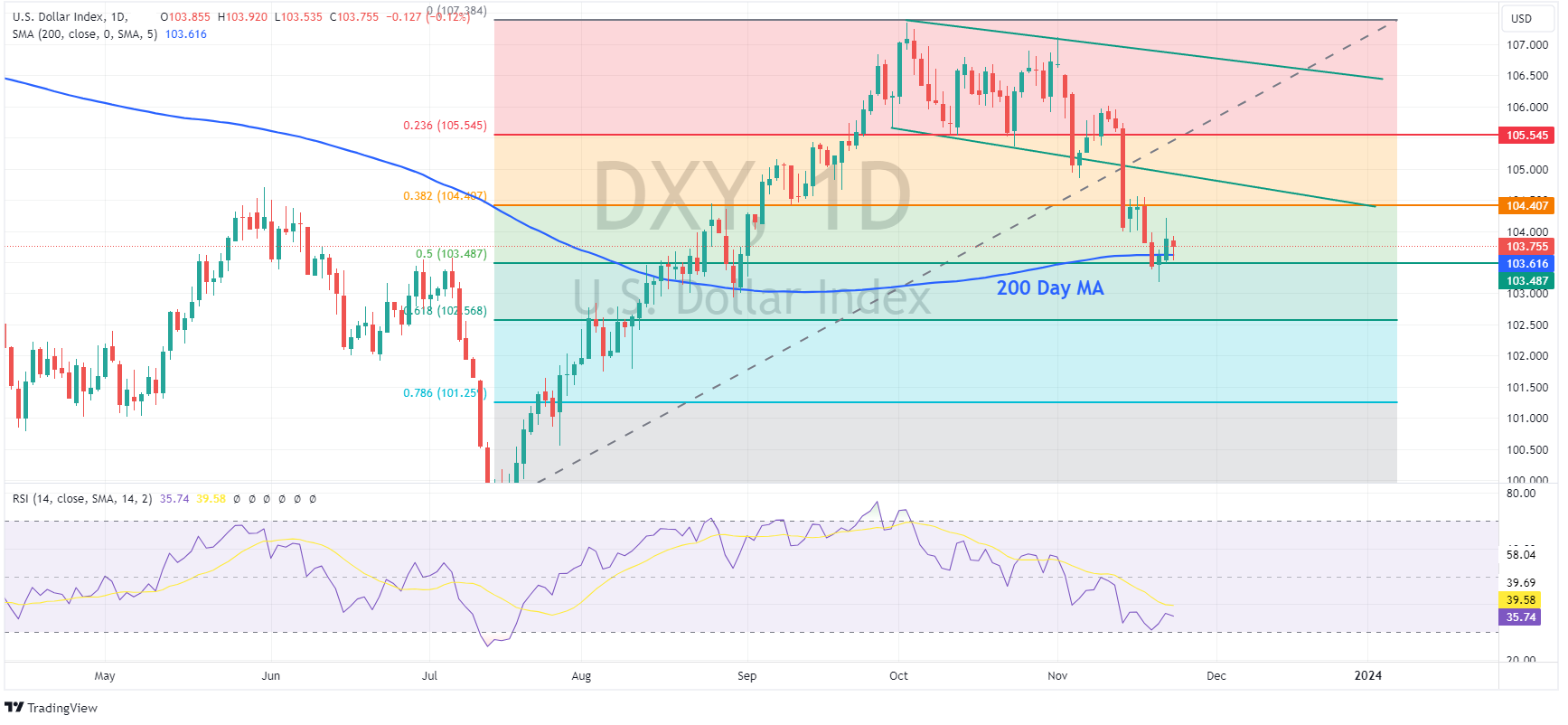

USD was marginally softer overall with DXY dropping to test the support at the 200-day MA before recovering modestly amid the holiday lull for Thanksgiving.

Source:TradingView.com

EURUSD managed mild gains with price action choppy around the 1.0900 level but eventually managed to hold that key level. There were several hawkish leaning comments from ECB officials and ECB Minutes noting that members argued in favour of keeping the door open for a possible further rate.

Source:TradingView.com

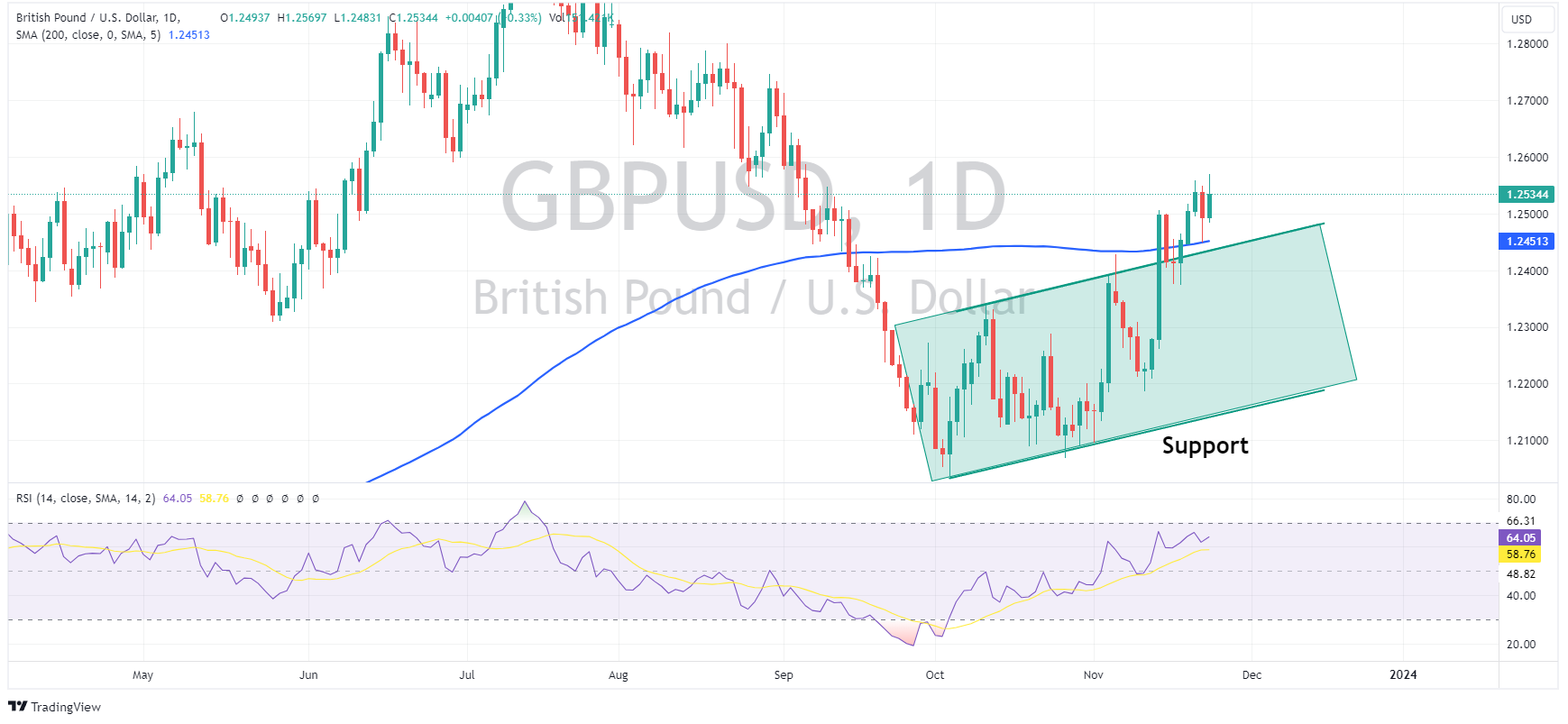

GBPUSD extended on its mid-week bounce and made further progress above 1.2500 after UK manufacturing and services PMI figures beat forecasts.

Source:TradingView.com

USDJPY ended flat for the session but not before a sharp dip reversed following a bounce off support at 149.00 and seeing the pair again settle above 149.50.

Source:TradingView.com

Ahead on Fridays , US traders will be mostly offline meaning another likely low volume session, we do have Manufacturing and Services PMI figures out of the US later today though.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

PDD Holdings shares skyrocket as earnings top estimates

PDD Holdings Inc. (NASDAQ: PDD) reported Q3 financial results before the market open in the US on Tuesday. The Chinese company beat both revenue and earnings per share (EPS) estimates, sending the stock higher. Company overview Founded: 2015 Headquarters: Shanghai, China Number of employees: 12,992 (2022) Industry: Internet, Agricu...

November 29, 2023Read More >Previous Article

Deere & Company results top estimates but the stock is falling

Deere & Company (NYSE: DE) reported the latest results for the fourth-quarter ending October 29, 2023 and full fiscal 2023 before the market opens...

November 23, 2023Read More >Please share your location to continue.

Check our help guide for more info.