- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – Treasury Yield surge Pushes USD Higher, AUD Outperforms on Hot Jobs Report

- Home

- News & Analysis

- Forex

- FX Analysis – Treasury Yield surge Pushes USD Higher, AUD Outperforms on Hot Jobs Report

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – Treasury Yield surge Pushes USD Higher, AUD Outperforms on Hot Jobs Report

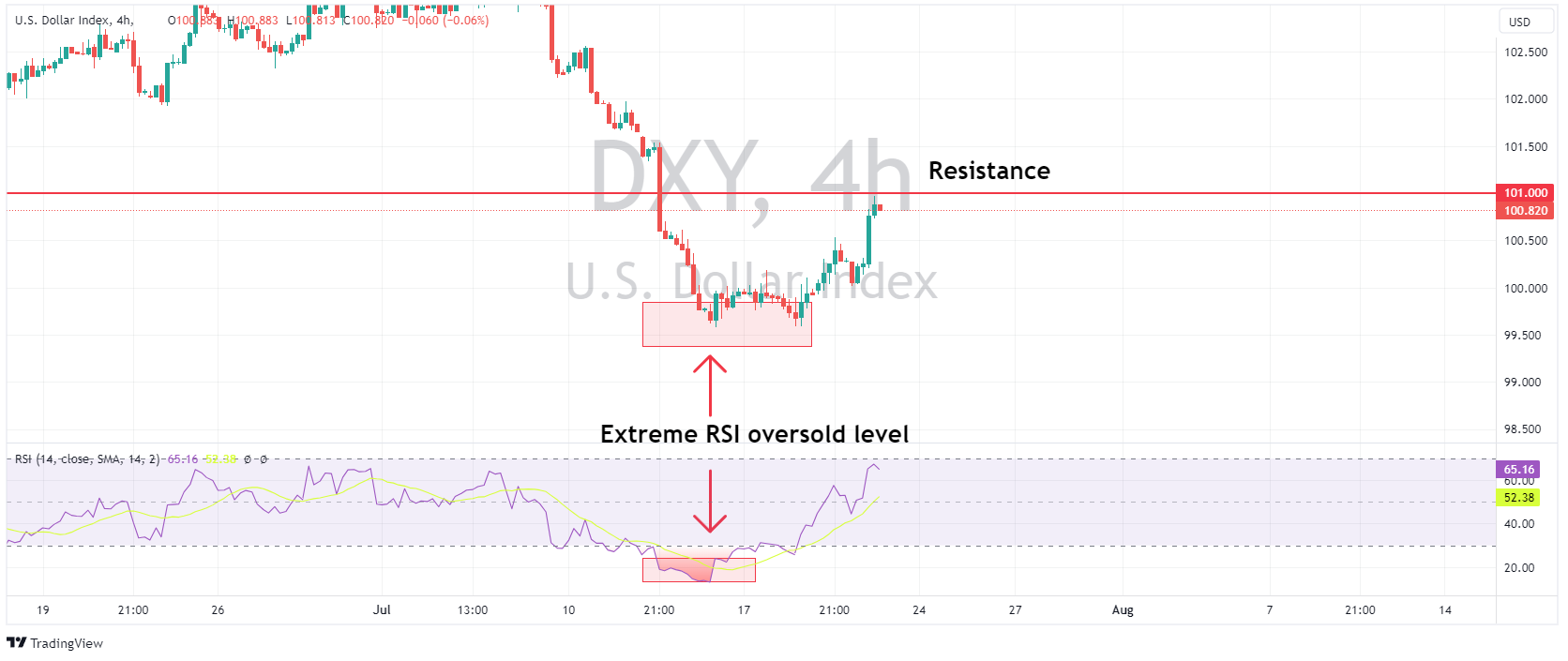

21 July 2023 By Lachlan MeakinThe US Dollar was firmer Thursday, continuing its bounce from extreme oversold levels, the DXY peaking at 100.97, just short of the major resistance at the big 101 figure. A much lower than expected initial jobless claims figure saw a jump in US treasury yields, propelling the USD higher with the DXY having it biggest up day since May.

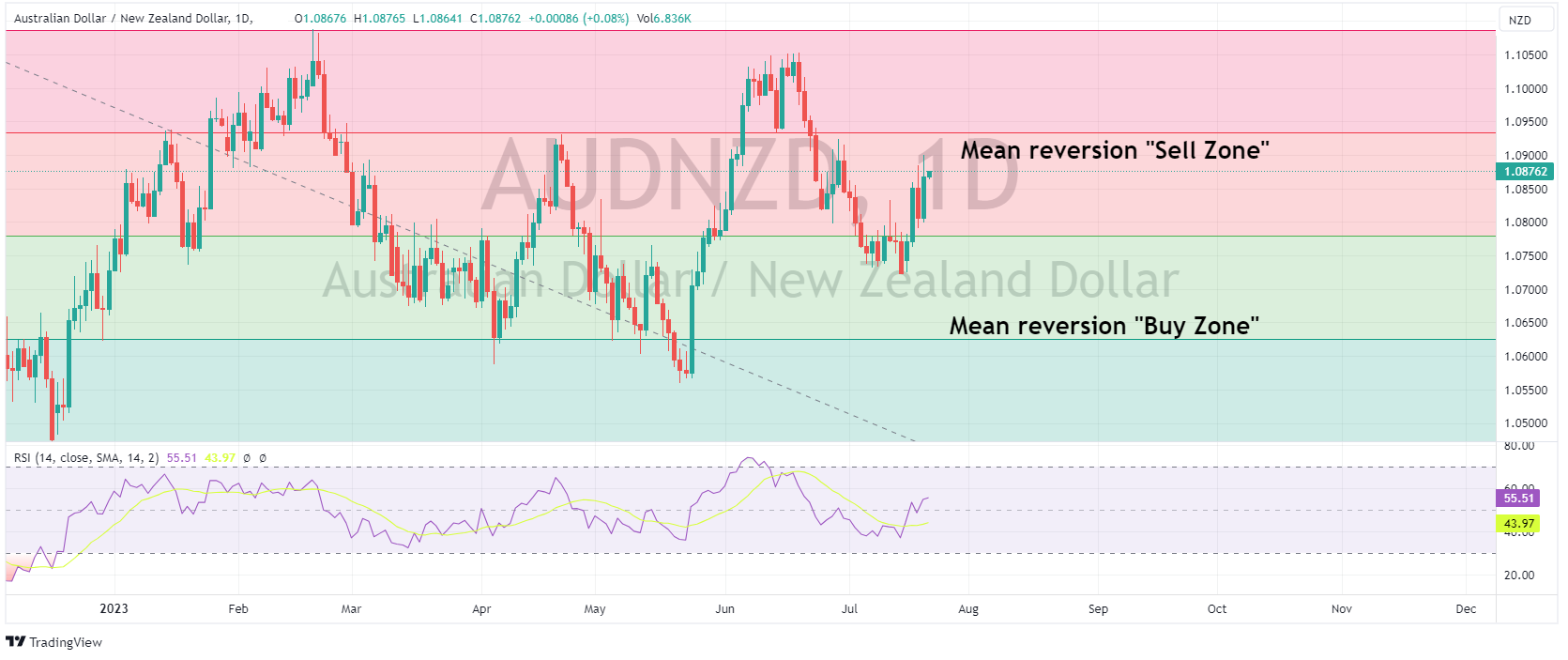

AUD was the G10 outperformer, holding its own against the resurgent USD and easily outperforming its peers. A hot jobs report where employment increased 32.6k vs an expected 15.4k and an unexpected fall in the unemployment rate, saw odds of a RBA rate hike next month jump to 43%, pushing the AUD higher. NZD underperformed on general risk aversion, seeing AUDNZD push higher into the overvalued “sell zone”.

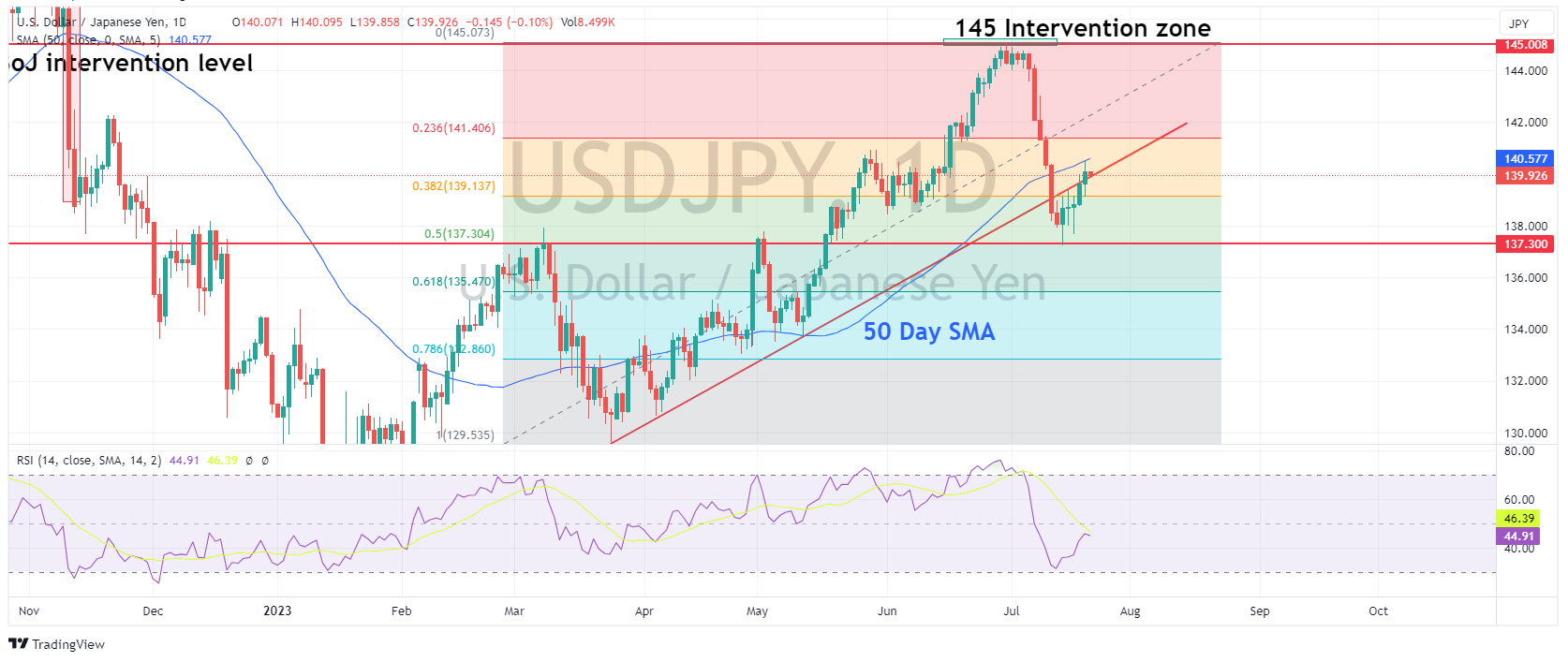

JPY saw losses, with USDJPY continuing it’s bounce off the 50% fib retracement at 137.30, pushing briefly through the psychological 140 level. USD saw highs of 140.49 before finding selling at the 50-day SMA, pulling back to find support at its previous bullish trend line. Japanese CPI was released earlier today where a reading 0f 3.3% came in right as expected, JPY traders will be eyeing next weeks pivotal BoJ meeting where tweaks to their yield curve control policy are expected.

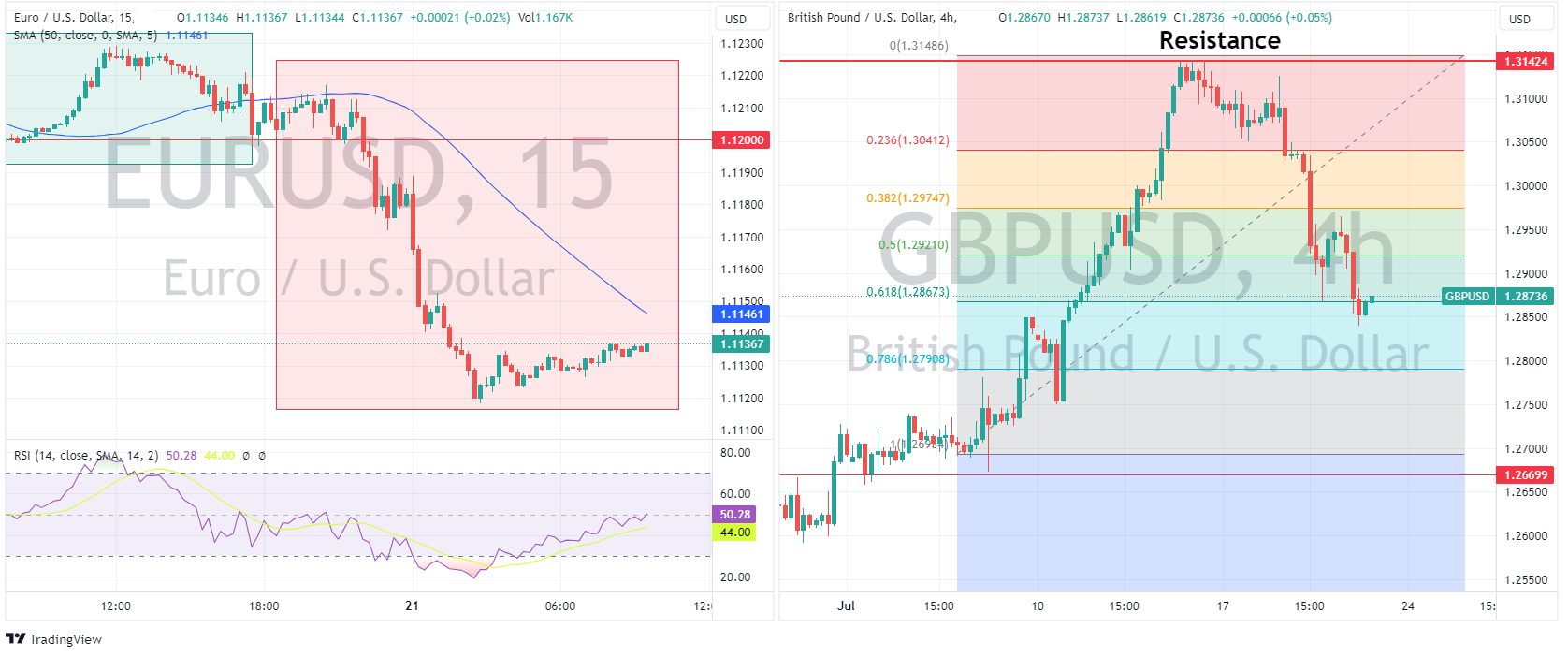

EUR and GBP saw similar losses vs the USD, EUR initially boosted by a not as weak as anticipated flash Eurozone consumer confidence figure which coincided with a miss in US existing home sales. Though it soon reversed to the downside with EURUSD hitting a low of 1.1119, managing to hold the key 1.1100 level. GBP continued to feel the effects of a softer UK CPI reading on Wednesday, with GBPUSD testing buyers around the key 1.2850 level, after losing sight of a Fib retracement level that helped contain declines on Wednesday.

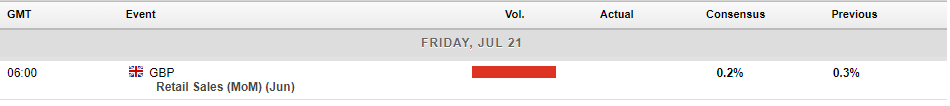

Today’s economic calendar is very light ahead of pivotal Central Bank meetings next week, with the only tier one release being only UK Retail Sales.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Gold eases heading into FOMC

After a fortnight of trending north, Gold has fallen over the past 5 days. It is currently trading at around $1960, showing a slight decline of approximately 1.35% from its recent high of $1987.53. Price is currently trying to break out of the downward channel that it has been in since late last week, so something to keep an eye on going into th...

July 26, 2023Read More >Previous Article

Eyes on EURUSD going into European inflation data

After surging close to 4% since early July off the back of a weakening USD, the EURUSD pair has stabilised around $1.123. With very little volatility ...

July 19, 2023Read More >Please share your location to continue.

Check our help guide for more info.