- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USD continues decline on dovish Fedspeak, JPY outperforms, AUD and NZD breakout

- Home

- News & Analysis

- Forex

- FX Analysis – USD continues decline on dovish Fedspeak, JPY outperforms, AUD and NZD breakout

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD continues decline on dovish Fedspeak, JPY outperforms, AUD and NZD breakout

29 November 2023 By Lachlan MeakinUSD continued its recent decline on Tuesday with the US dollar index (DXY) hitting its lowest level since mid-August at 102.60 before finding some support at the 61.8 Fib level. The decline accelerated after voting Fed member Waller who is seen as a hawk, made some dovish remarks regarding rates and inflation namely he was “increasingly confident” policy is well positioned to slow the economy and get inflation back to 2%, he also hinted at rate cuts next year if inflation and the economy continued on its current path. There were also some comments from Fed member Bowman which skewed hawkish, but as she is already considered a hawk there wasn’t a comparable market reaction as to the Waller comments.

Chart Source:TradingView.com

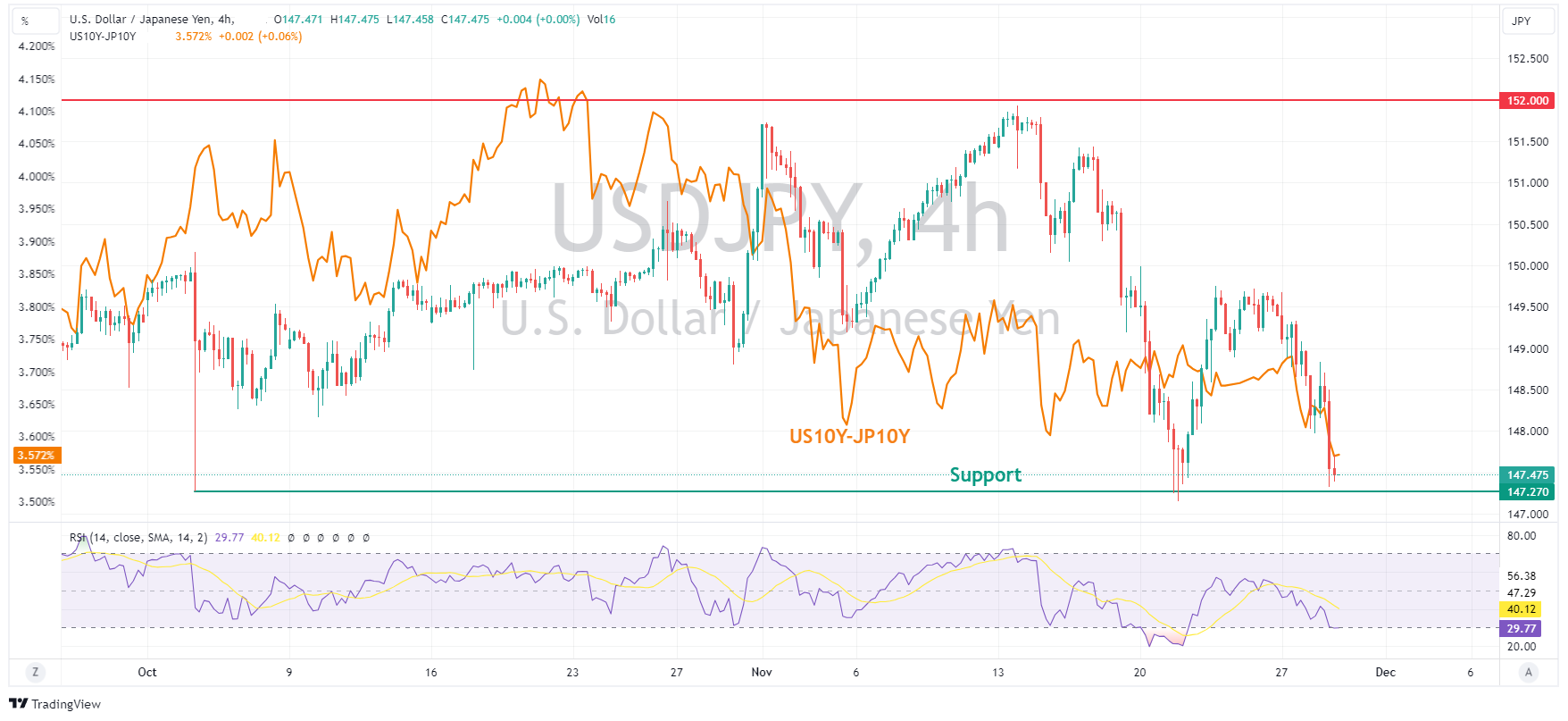

JPY was the G10 outperformer benefitting the most from USD weakness and lower US Treasury yields that saw the US 10 year and JGB 10-year yields compress further. USDJPY hitting a low of 147.32 and testing the November lows and support level at 147.27. Today the BoJ’s Adachi is due to speak ahead of a raft of Japanese data released during the remainder of the week.

Chart Source:TradingView.com

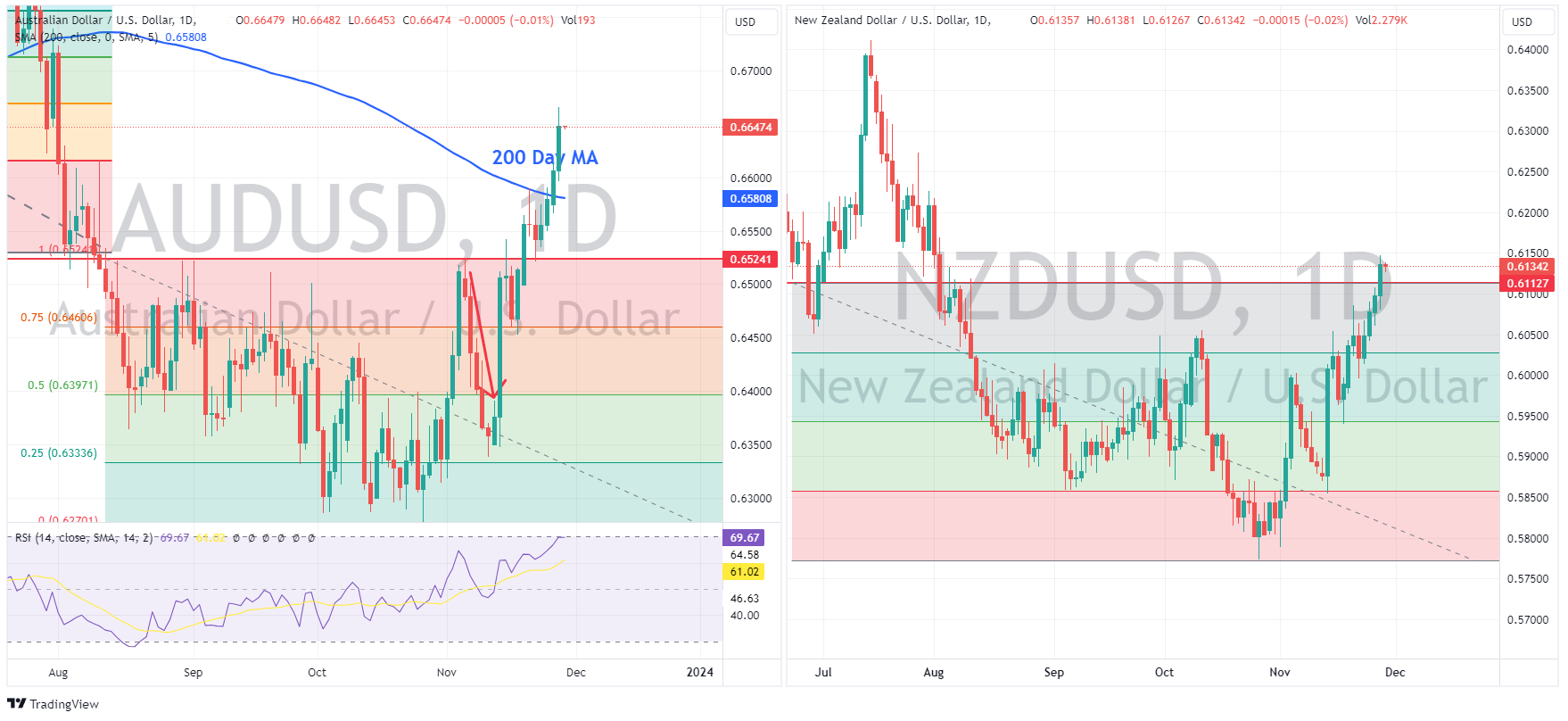

AUDUSD and NZDUSD both hit 3-month highs of 0.6665 and 0.6147 respectively, with broad USD weakness and a risk-on market supporting both cyclical currencies. Strength in the commodity markets and recent hawkish comments from RBA governor Bullock also lending a tailwind to AUD. Both currencies come into Wednesday with key economic readings to navigate, with Aussie CPI, where a drop to 5.2% Y/Y from 5.6% is expected, and a RBNZ rate decision due. The RBNZ is widely expected to hold rates at 5.50% so it will be the forward guidance kiwi traders will be watching closely.

Chart Source:TradingView.com

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

FX Analysis – Euro softens on cool CPI readings, Gold rallies again, NZD surges on RBNZ

The Euro was softer In Wednesdays US session with EURUSD failing to hold above the psychological 1.10 level with cooler than expected inflation readings out of Spain and Germany weighing on the single currency. EURGBP dropped for the fifth straight session and setting new November lows. Comments from ECB member Stournaras pushing back on April ra...

November 30, 2023Read More >Previous Article

Intuit results announced

US business software company Intuit Inc. (NASDAQ: INTU) announced the latest financial results for first quarter of fiscal 2024 after the closing bell...

November 29, 2023Read More >Please share your location to continue.

Check our help guide for more info.