- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USD dips on dovish Powell, JPY continues lower after BoJ

- Home

- News & Analysis

- Forex

- FX Analysis – USD dips on dovish Powell, JPY continues lower after BoJ

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD dips on dovish Powell, JPY continues lower after BoJ

21 March 2024 By Lachlan MeakinUSD was notably lower after what was seen as a dovish FOMC meeting on Wednesday. The Fed 2024 median dot was left unchanged with 3 cuts for 2024 still the Fed forecast but the dovish part came at the presser where Fed Chair Powell downplayed the hot January and February CPI numbers. This dovish tilt saw risk assets surge and the USD dump.

USDJPY bucked the weak Dollar trend pushing up to 152 before the result from the FOMC saw it pare some of those gains. A hawkish BoJ source reporting in Nikkei that suggested another hike could come in July or October also supporting the Yen somewhat. There is also speculation if the Yen weakness were to continue the BoJ/MoF could step in to intervene, with ING noting that local accounts felt that 155 would be red line.

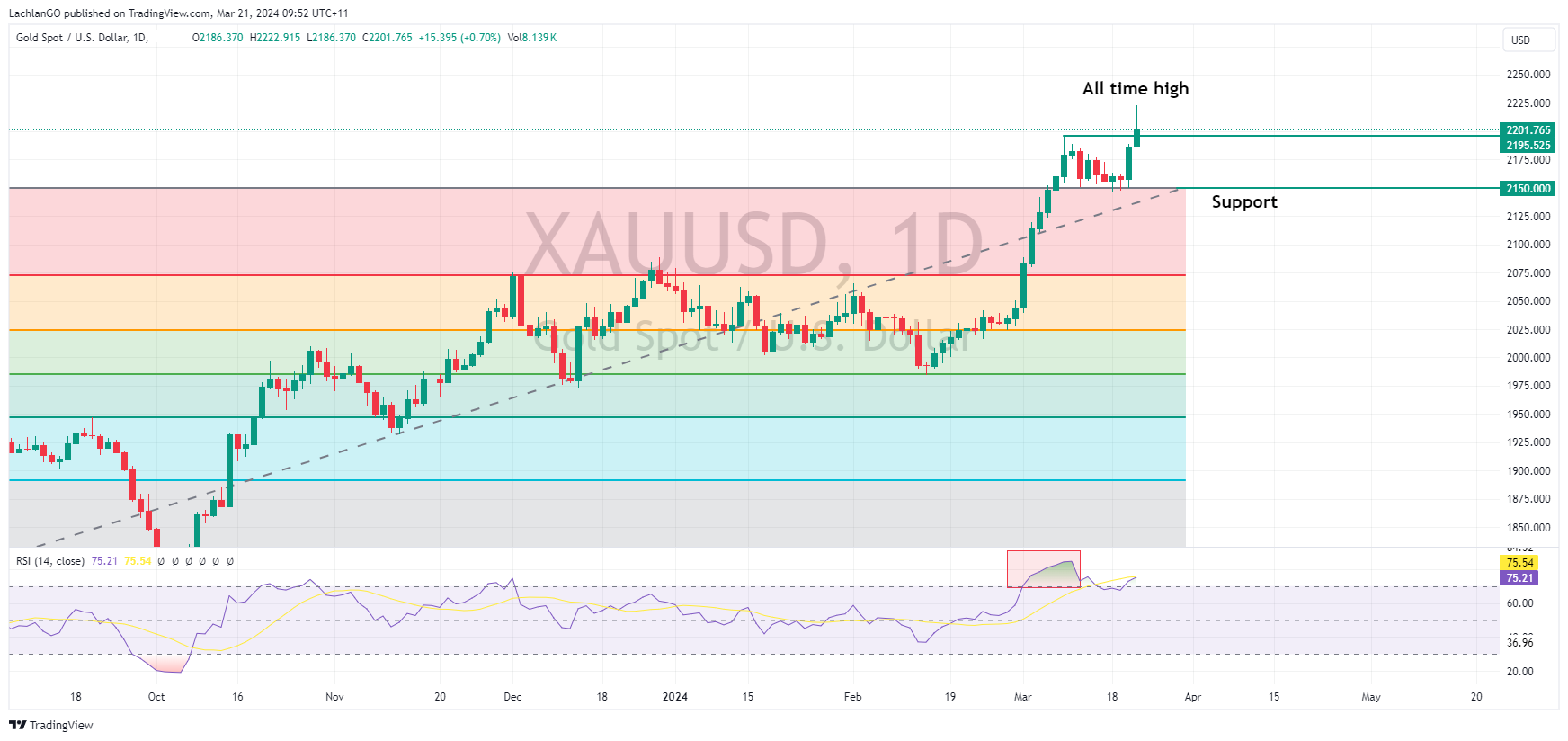

Gold ripped to all time highs, with XAUUSD hitting a high of 2222 USD an ounce on the back of USD weakness and falling yields post FOMC, before falling back just above the old high at 2195 heading into the APAC session.

Today ahead, more Central Bank action out of the BoE and SNB for FX traders to look forward to.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Accenture stock dips after earnings

Accenture plc (NYSE: ACN) announced Q2 of fiscal 2024 earnings results before the US market opened on Thursday. Irish-American professional services company reported revenue that fell slightly short of analyst estimate of $15.847 billion at $15.8 billion. Earnings per share reached $2.77 for the quarter vs. $2.661 per share expected. Compa...

March 22, 2024Read More >Previous Article

Micron earnings top estimates – the stock is flying in the after-hours

It was a busy day in the US today, with investors waiting on the latest policy decision from the Federal Reserve. The Fed left interest rates uncha...

March 21, 2024Read More >Please share your location to continue.

Check our help guide for more info.