- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – USD drops, Gold pops on soft data, falling yields

- Home

- News & Analysis

- Forex

- FX analysis – USD drops, Gold pops on soft data, falling yields

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisA raging US equity market fuelled by soft data, a drop in treasury yields and blowout earnings from NVDA (which saw its stock price hit an all-time high) saw risk-on trading through Wednesdays session.

USD was choppy on Wednesday with an initial rally in DXY, which saw it briefly pierce the major resistance at 103.60, dramatically reversing course on big misses in US Manufacturing and Services PMIs which showed the US economy contracting faster than forecast. DXY hovering just above lows of 103.30 at the close after the earlier rally (driven by EUR weakness after their own PMIs disappointed) saw a high of 103.980.

AUD and NZD were among G10 outperformers, with AUD benefitting more from the risk-on sentiment outperforming the NZD to see AUDNZD hit a 10 day high of 1.0846. Rallies in iron ore and gold prices also helping the AUD. AUDUSD continued its bounce from the 0.6400 support level to highs of 0.6482, the next key level is the big figure at 0.6500 which until recently had been major support and now likely to be the next resistance level and certainly a key level to watch.

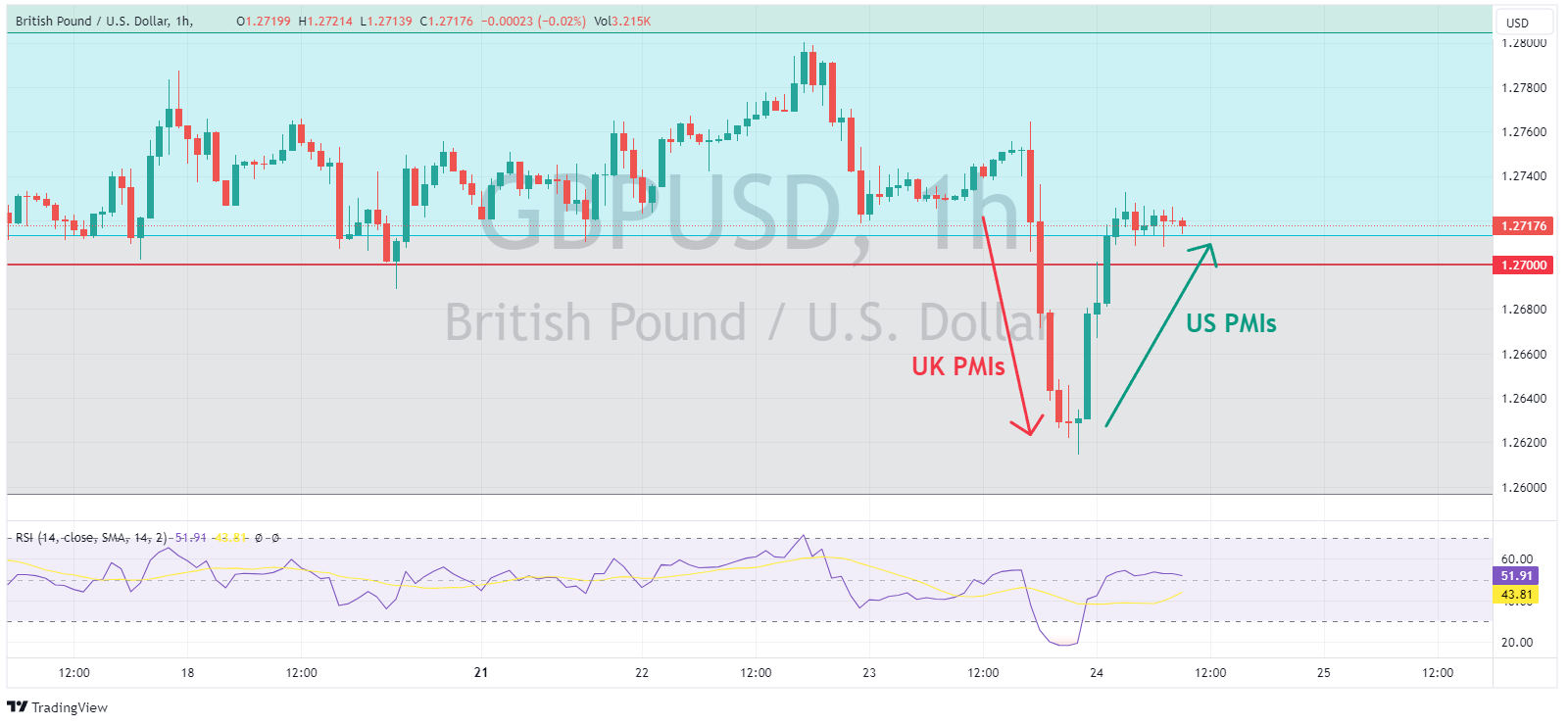

GBP was the G10 underperformer as dire PMI readings saw the Sterling Bears in charge. Services and Manufacturing figures all sharply declined, slipping into contractionary territory. GBPUSD printed a low of 1.2616 after the figures after hitting a high of 1.2717 earlier in the session. GBPUSD did bounce back to regain the key 1.2700 level in the US session though, recouping most of its losses on positive risk sentiment and the USD slide on its own weak PMI figures.

JPY outperformed with tumbling US treasury yields saw rate differentials tighten, taking the pressure off the USDJPY. USDJPY crashed below the key “intervention” level at 145 after printing an earlier high of 145.89. The Yen was also supported by a beat in Japanese PMI data. The next big data point for Yen watchers will be the Tokyo CPI figure released tomorrow, with the 145 level key to the next move in USDJPY.

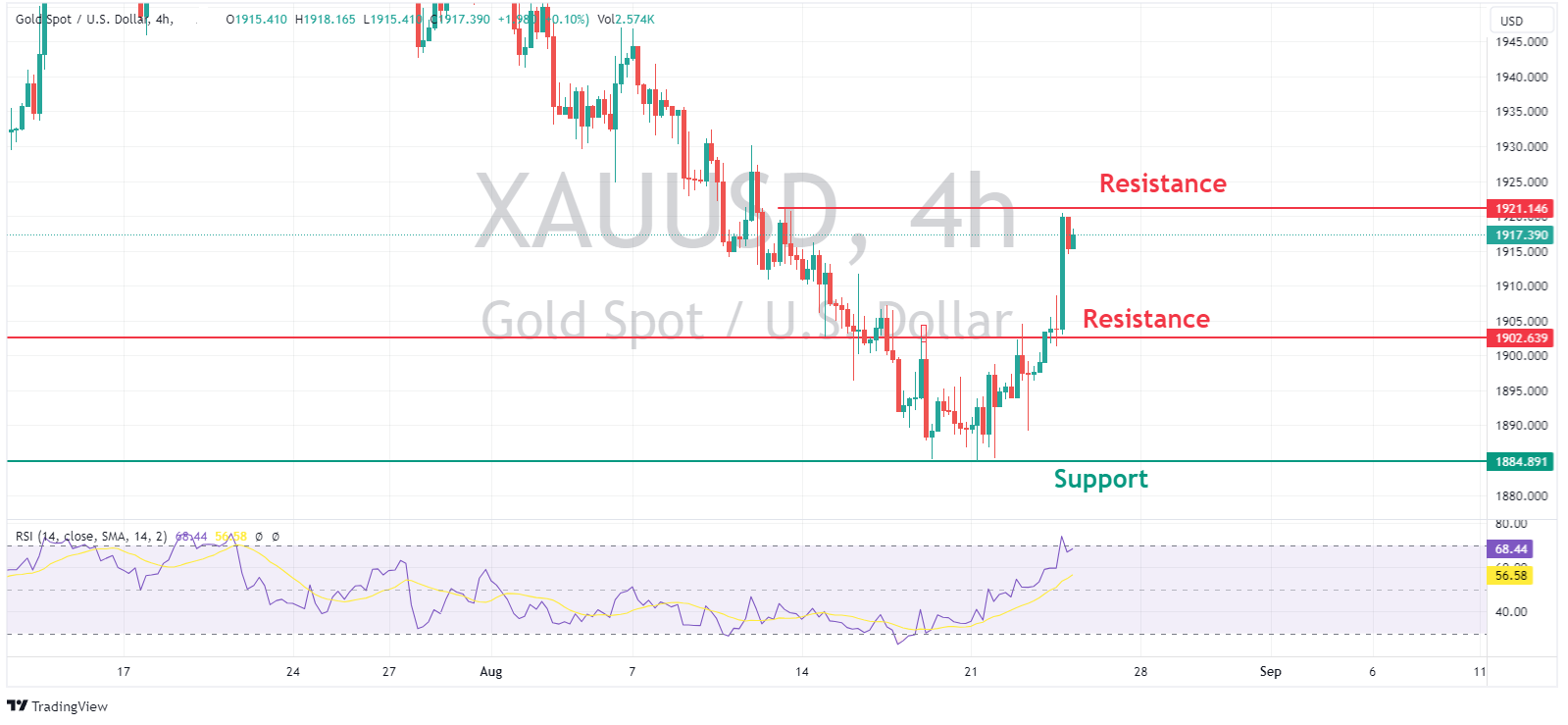

Gold blasted higher in Wednesday’s session, blowing through the 1902 resistance level and not finding any real selling until 1920, the high set back on 11th of August. A weak USD and more importantly catering US Treasury Yields lending a big tailwind to the precious metal.

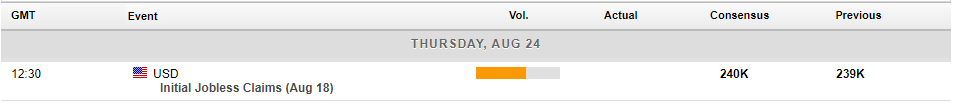

In today’s economic announcements, not much in the way of tier one releases with Jackson Hole looming on Friday. US unemployment claims being the headline.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

FX Analysis – USD rallies as markets turn risk-off ahead of Jackson Hole

USD was higher on Thursday, with The Dollar Index bouncing back strongly from Wednesdays decline, breaking through the resistance level of 103.60 to touch on the weekly highs at the big 104 level and hitting overbought levels on the daily RSI. Market risk-off, rising yields and a lower than forecast jobless claims figure giving the USD a boost as g...

August 25, 2023Read More >Previous Article

EURUSD tests near term support

After reaching the high of 1.1250, last tested in 2022, the EURUSD has been trading steadily lower and currently sits along the 1.0850 support level, ...

August 23, 2023Read More >Please share your location to continue.

Check our help guide for more info.