- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – USD , EUR, AUD, JPY

News & AnalysisUSD was flat on Tuesday with the US dollar index (DXY) trading either side of the 200-day SMA and 50% Fib level at 103.50. FX traders turning their attention to the pivotal FOMC rate decision on Wednesday followed by the non-farm employment report on Friday. A better than expected JOLTS job opening report lending some support early in the session to the USD.

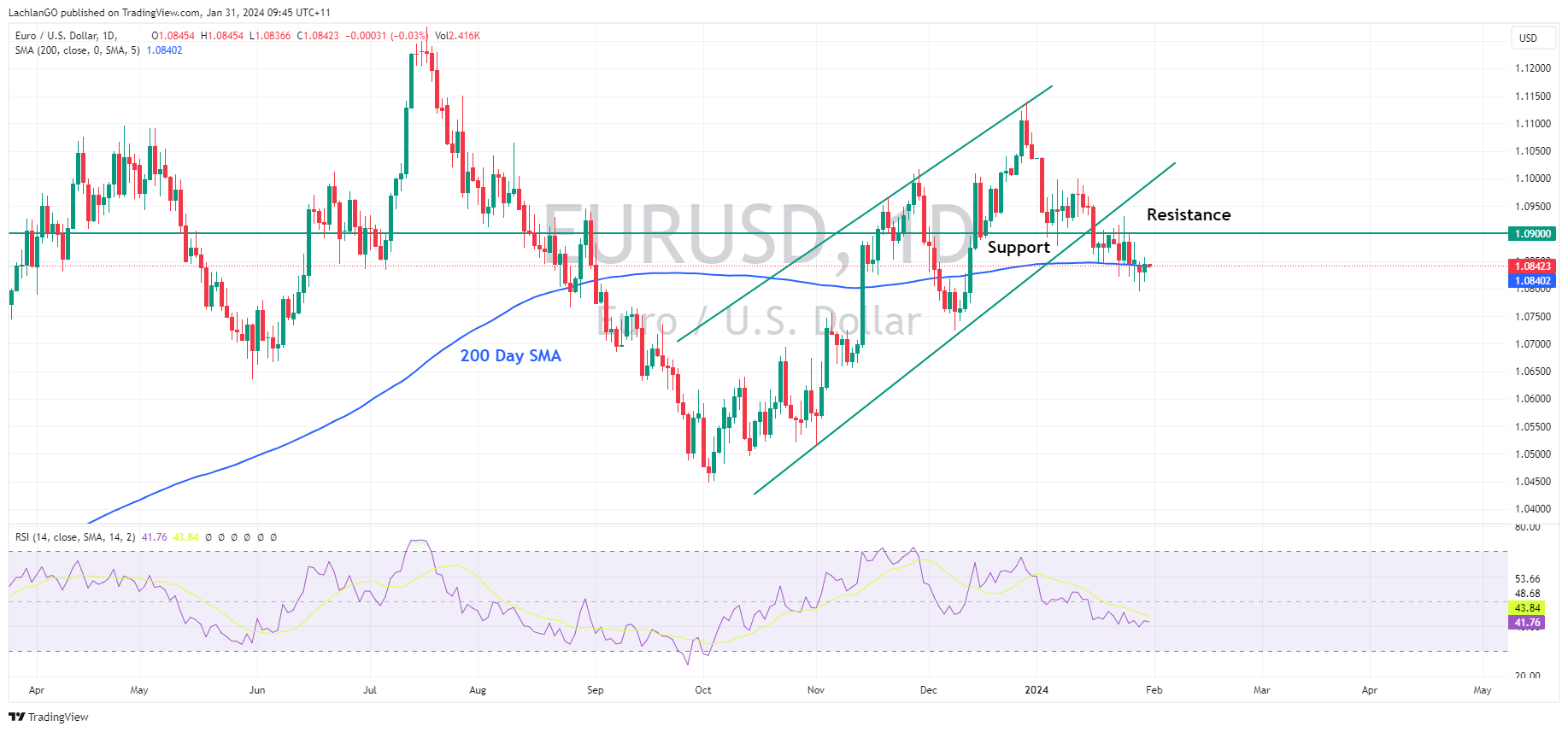

EURUSD rebounded from lows of 1.0796 after Spanish CPI printed hotter than expected and no misses on various EZ GDP figures. EUR traders attention will now turn to the German and French CPI figures due today after the hot Spanish print.

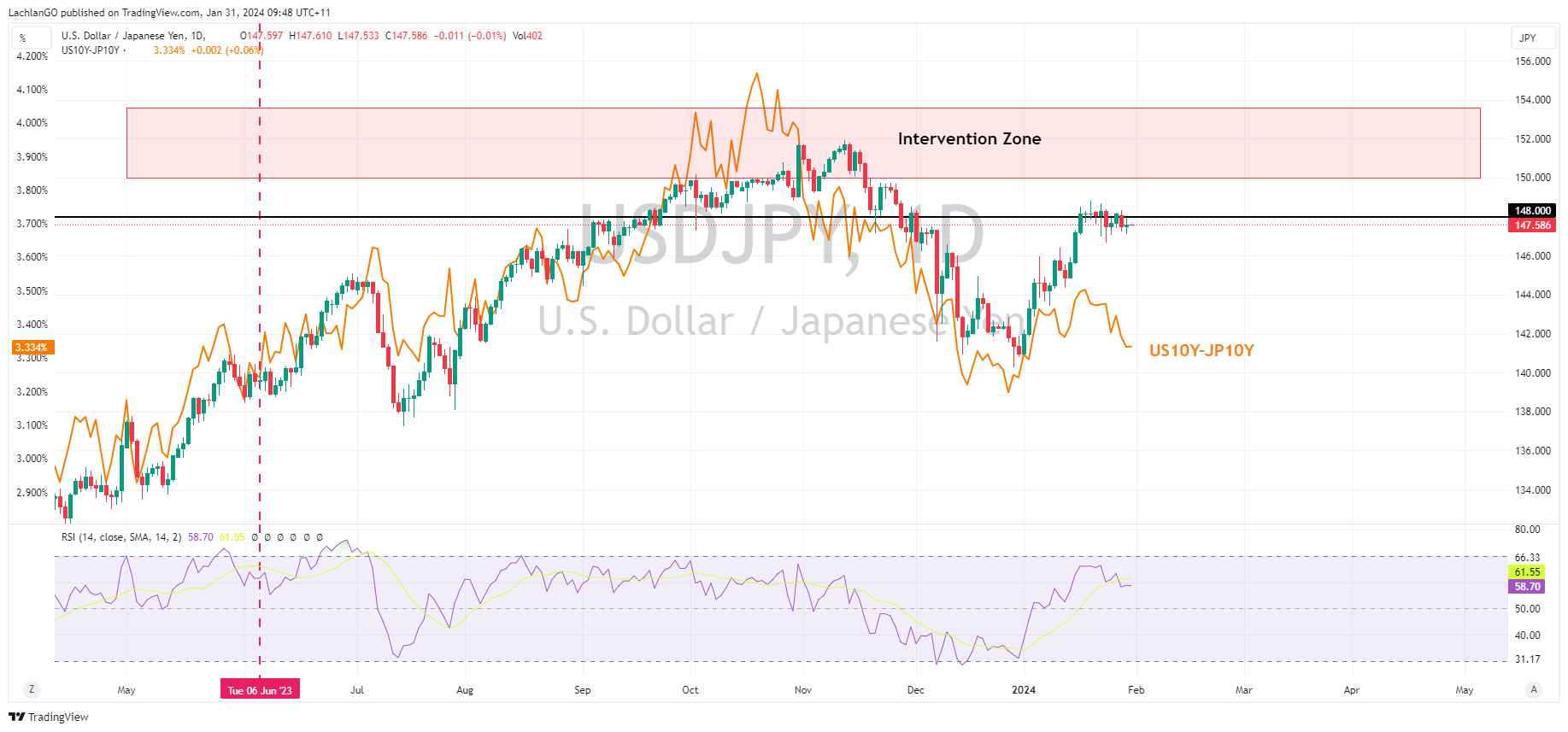

USDJPY was flat for the session, still holding below the psychological 148 level ahead of the rest of the weeks risk events. The gap between US and JP 10-year yields and price growing which should put some downward pressure on this pair.

AUD underperformed on disappointing retail sales figures ahead of today’s CPI print. AUDUSD did find support at its 200-day moving average at 0.6575 where it has revolved around for the last few sessions. Look for this level to establish strong support should we get a hot Aussie CPI today.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Boeing stock takes off as earnings land above estimates

The Boeing Company (NYSE: BA) reported Q4 2023 financial results before the market open in the US on Wednesday. World’s largest aircraft manufacturer’s revenue reached $22.018 billion for the last three months of 2023, above analyst estimate of $21.184 billion. Revenue rose by 10% year-over-year. Boeing reported a loss per share of -$0.47...

February 1, 2024Read More >Previous Article

Microsoft results announced

Microsoft Corporation (NASDAQ: MSFT) recently overtook Apple Inc. (NASDAQ: AAPL) as the largest company in the world, reaching $3.036 trillion market ...

January 31, 2024Read More >Please share your location to continue.

Check our help guide for more info.