- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USD flat ahead of NFP, EUR rallies on PMI beats, JPY lags

- Home

- News & Analysis

- Forex

- FX Analysis – USD flat ahead of NFP, EUR rallies on PMI beats, JPY lags

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD flat ahead of NFP, EUR rallies on PMI beats, JPY lags

5 January 2024 By Lachlan MeakinBeats in US employment data ahead of today’s key Non-farm payroll figure saw the US Dollar Index eke out another gain after weakness in the APAC session reversed in the European session.

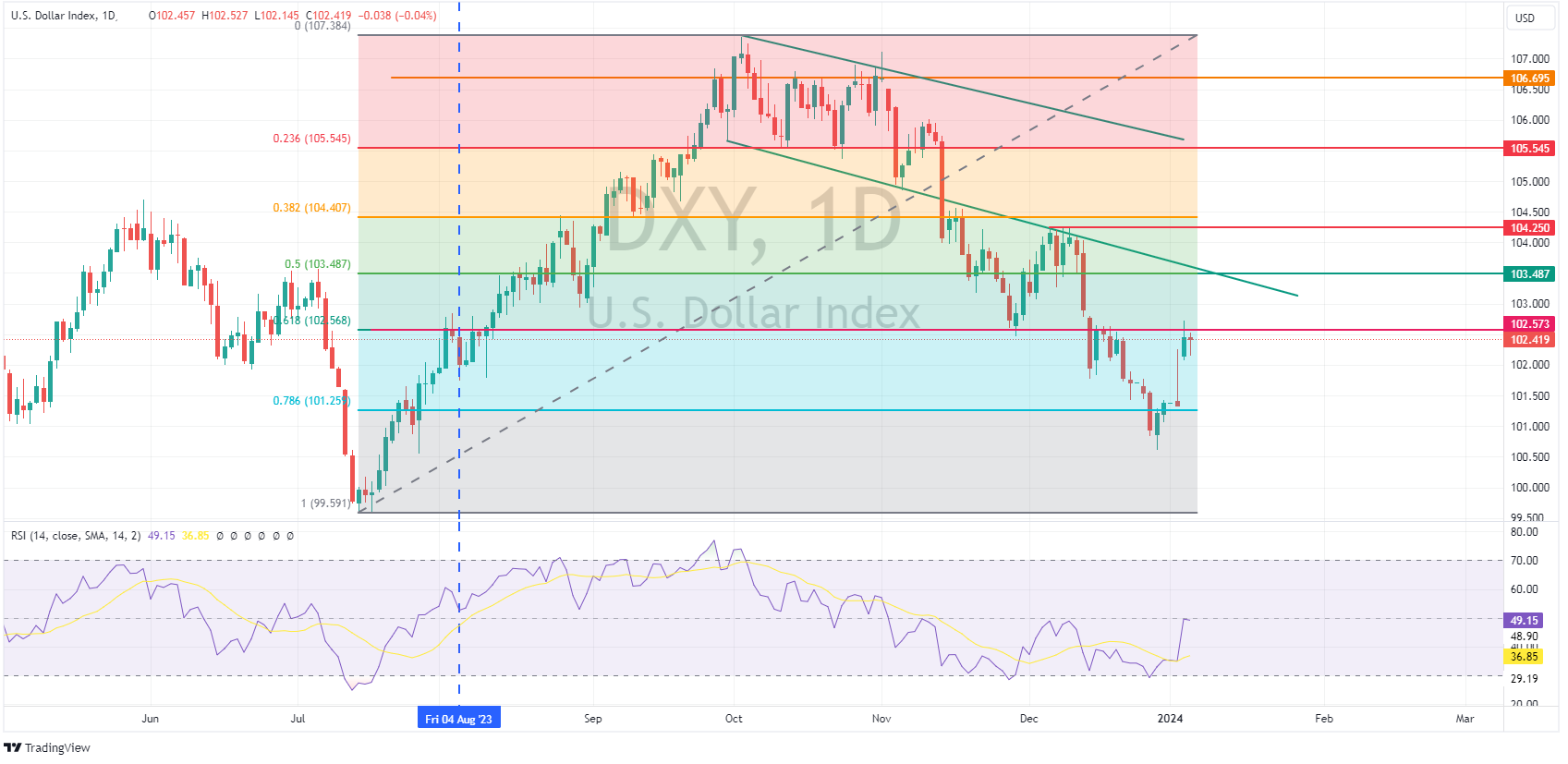

DXY up for the 5th straight day, having its longest winning streak since September and it’s best start to a year since 2005.

DXY hit a high of 102.53, still being held from further gains by the resistance at 102.57, a level that could be under pressure in the US session if the NFP report mirrors the beats in the ADP figure and unemployment claims released on Thursday.

The Euro was the G10 outperformer on Thursday with a spike in Eurozone yields after beats in French, German and Spanish PMI readings ahead of today’s Eurozone CPI figures. EURUSD continued its bounce off the psychological 1.09 support level, hitting a high of 1.0972 and keeping the upward trend channel intact that has been forming since October. With EZ CPI and NFP ahead today these will be key levels to keep an eye on.

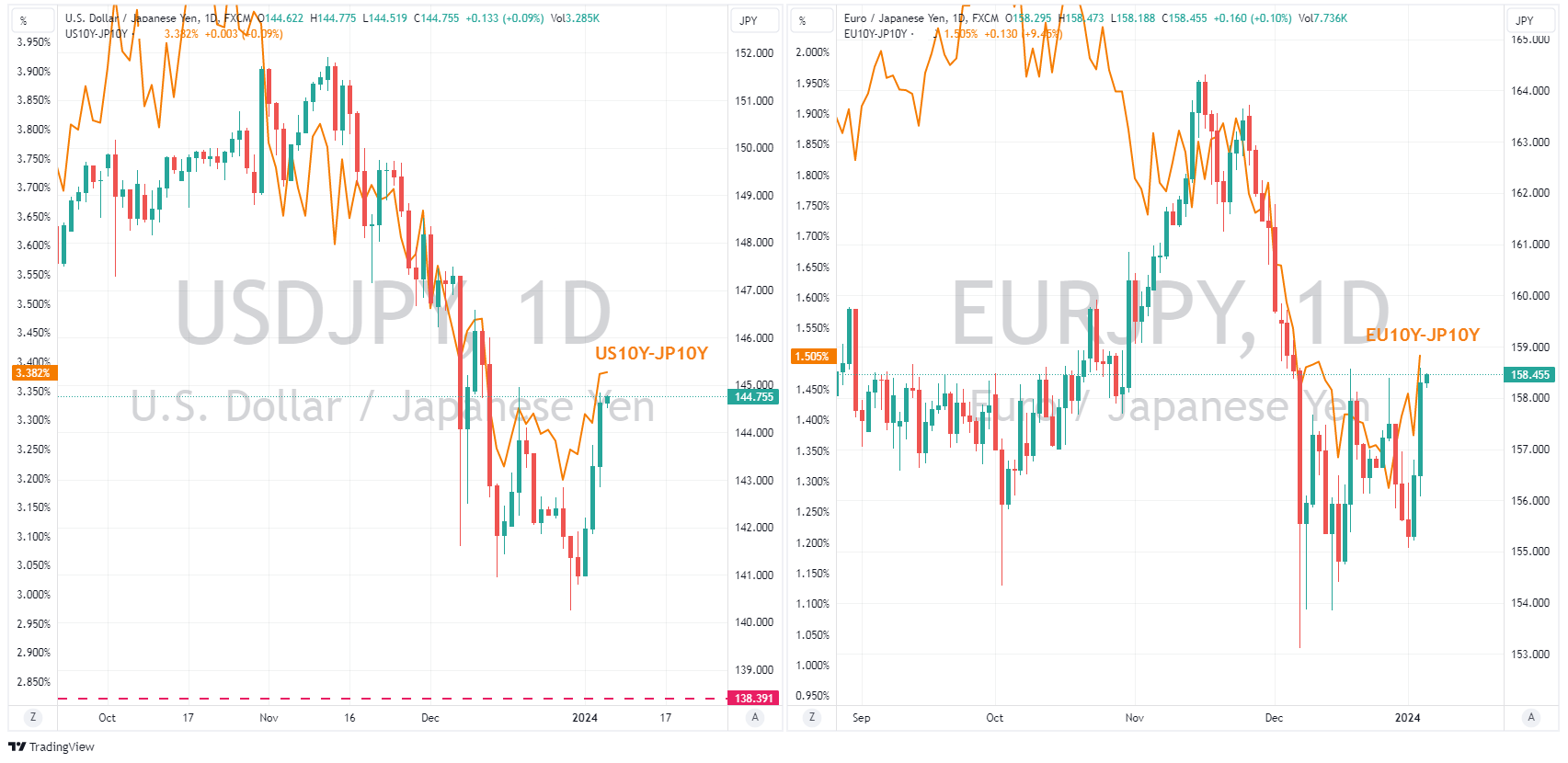

JPY was the G10 underperformer with USDJPY rallying within a whisker of the big figure at 145, Yen also showing weakness against the EUR as both US and EZ yields rallied, increasing yield differentials against their Japanese counterparts.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Constellation Brands posts mixed results

US producer and marketer of beer, wine and spirits, Constellation Brands Inc. (NYSE: STZ), announced Q3 fiscal 2024 financial results before the market opened in the US on Friday. The company reported revenue of $2.471 billion for the quarter, which fell short of $2.538 billion expected. Earnings per share topped analyst estimates at $3.19 pe...

January 8, 2024Read More >Previous Article

Walgreens Boots Alliance tops estimates but the stock is falling

Walgreens Boots Alliance Inc. (NASDAQ: WBA) released first quarter of fiscal 2024 financial results before the opening bell in Wall Street on Thursday...

January 5, 2024Read More >Please share your location to continue.

Check our help guide for more info.