- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USD pushes above key level, AUD ahead of the the RBA

- Home

- News & Analysis

- Forex

- FX Analysis – USD pushes above key level, AUD ahead of the the RBA

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USD pushes above key level, AUD ahead of the the RBA

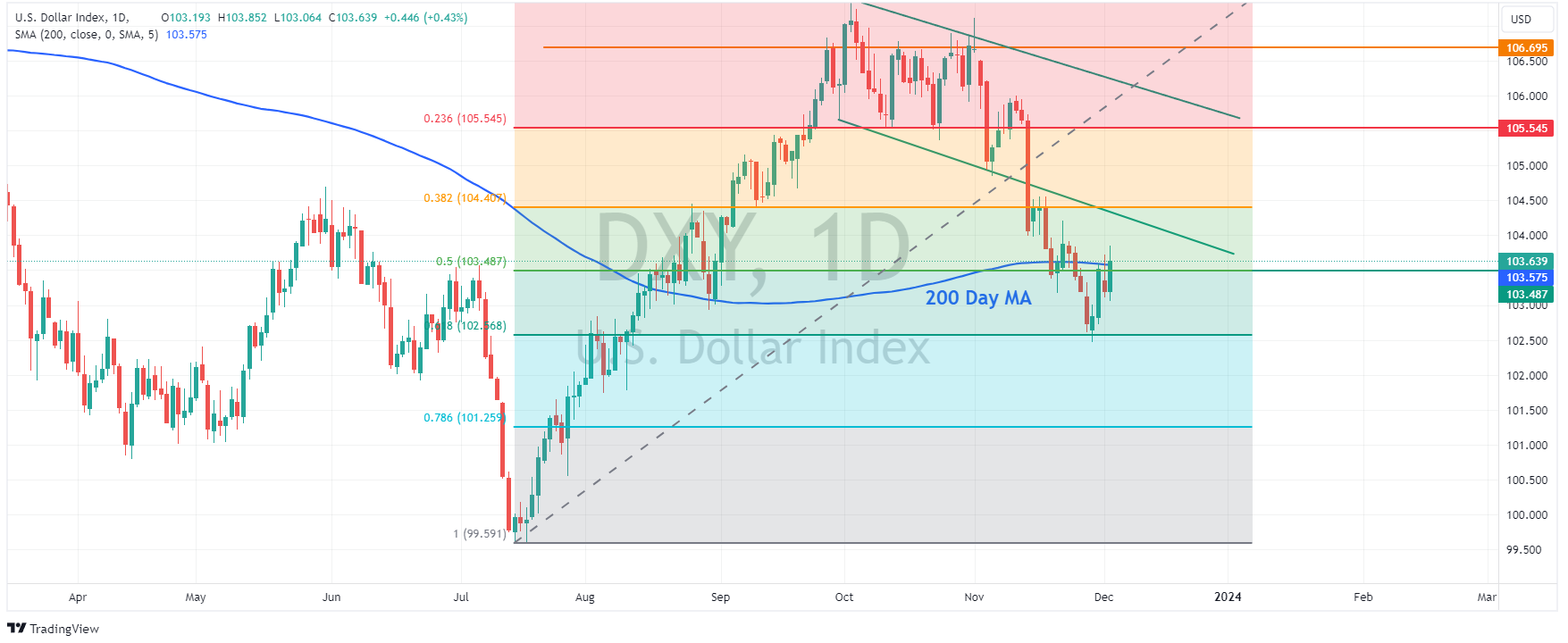

5 December 2023 By Lachlan MeakinUSD bounced back to start the first full week of December after a horror run in November where the Dollar Index (DXY) fell around 3%. DXY breaking through the 200 Day SMA resistance and printing a high of 103.850. Sour risk sentiment and higher treasury yields (particularly in the short end) helping DXY erase the Powell inspired drop on Friday. With the Fed having entered their blackout period ahead of next week’s FOMC meeting (meaning no Fed member jawboning) data this week will take on extra importance with USD traders particularly watching Services PMI data today and the NFP jobs report on Friday.

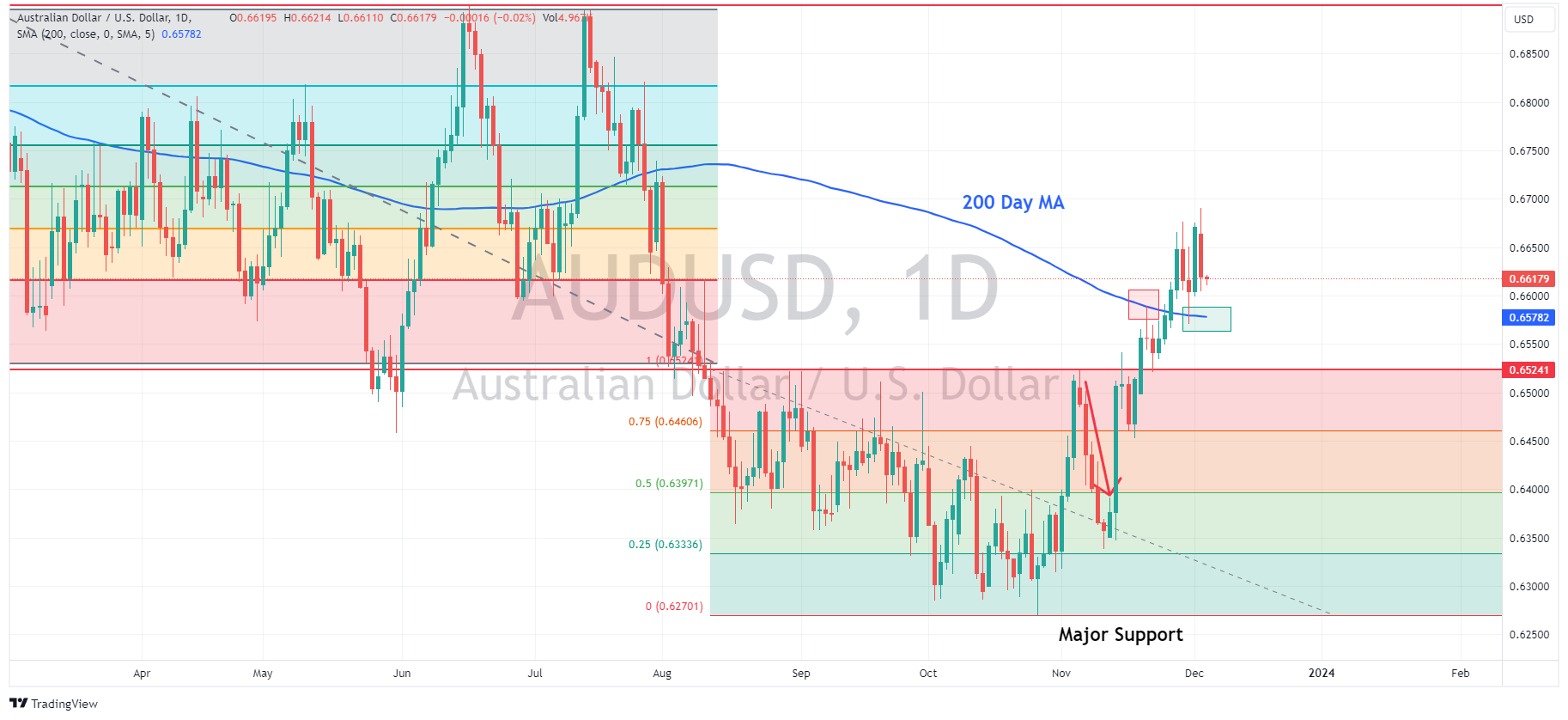

AUD and NZD were the G10 underperformers, a strong USD and a broad risk-off backdrop the main drivers rather than anything specific to the currencies. AUDUSD was looking to test the 0.67 resistance early in the session before reversing course to test the support at 0.66 before finding some buyers. Aussie traders have the December RBA meeting to navigate, with the Central Bank widely expected (95% chance according to futures) to keep rates unchanged. What AUD trader will be watching is for any change of language in the accompanying statement with regards to futures hikes, will the RBA leave the door ajar, wide open or shut it completely? Expect some volatility in the AUD as traders race to work that part out at announcement time.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

NIO Q3 results have arrived – the stock is rising

Chinese electric vehicle company, NIO Inc. (NYSE: NIO), reported Q3 results before the opening bell in the US on Tuesday. Company overview Founded: November 2014 Headquarters: Shanghai, China Number of employees: 20,000+ (2023) Industry: Automotive Key people: William Li (CEO), Lihong Qin (President), Wei Feng (CFO) The resul...

December 6, 2023Read More >Previous Article

Kroger tops third quarter expectations

One of the largest food retailers in the United States, Kroger Co. (NYSE: KR), announced Q3 earnings results before the opening bell in Wall Street on...

December 1, 2023Read More >Please share your location to continue.

Check our help guide for more info.