- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – USDJPY hits 34 year highs, Gold surges

News & AnalysisThin trading in FX markets continued in a holiday shortened week with G10 FX mostly flat against the USD in Wednesday’s session also looking like traders are waiting for Fridays key US PCE inflation reading. The highlights were:

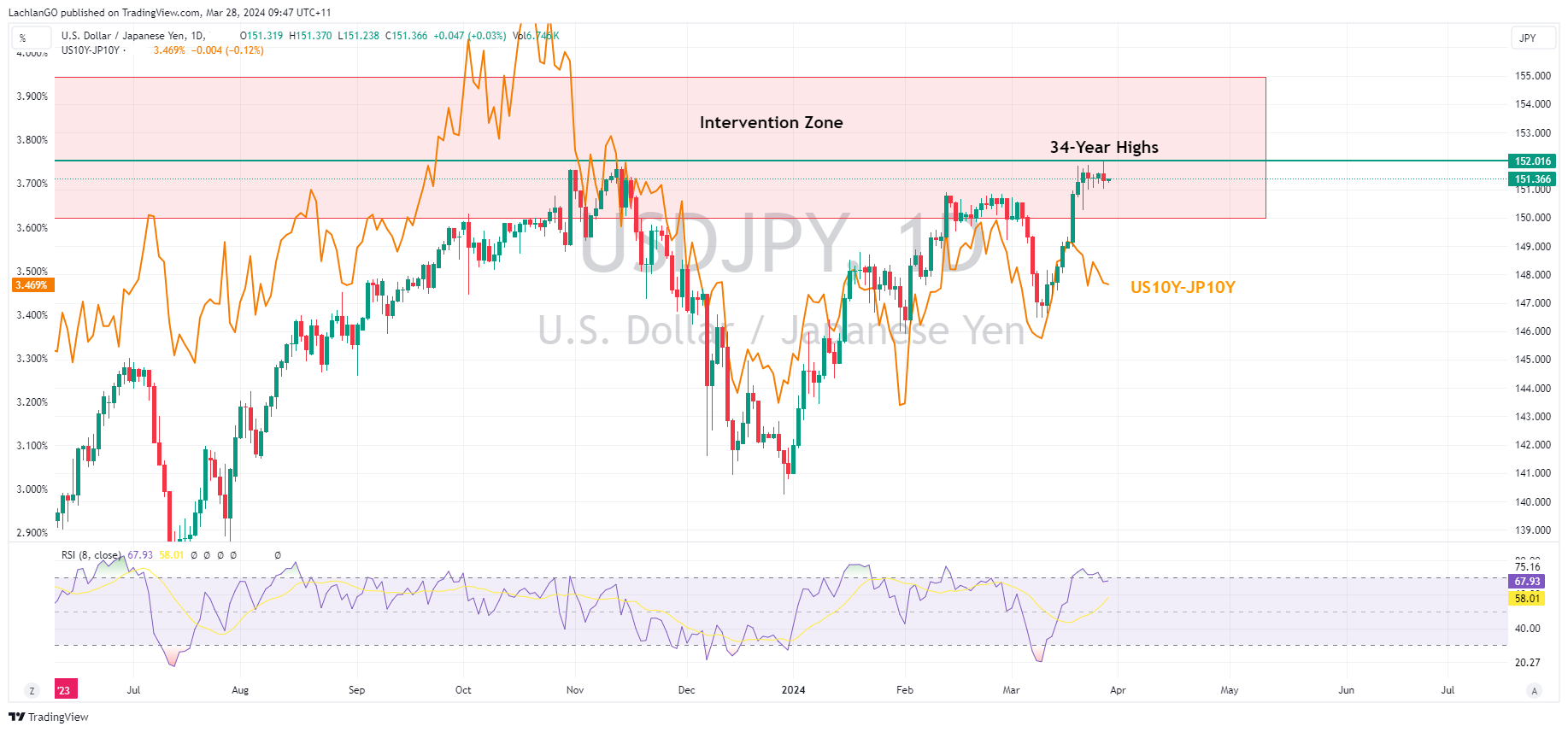

USDJPY pushed past its November 2023 high hitting 151.97 which is the highest level this pair has reached since 1990 and bringing intervention speculation to the fore once more, with some trading desks flagging the possibility of intervention during thin Easter markets. Comments from Finance Minister Suzuki who said he was closely watching FX moves and won’t rule out any steps including decisive steps to respond to disorderly FX moves also stoking the intervention fire.

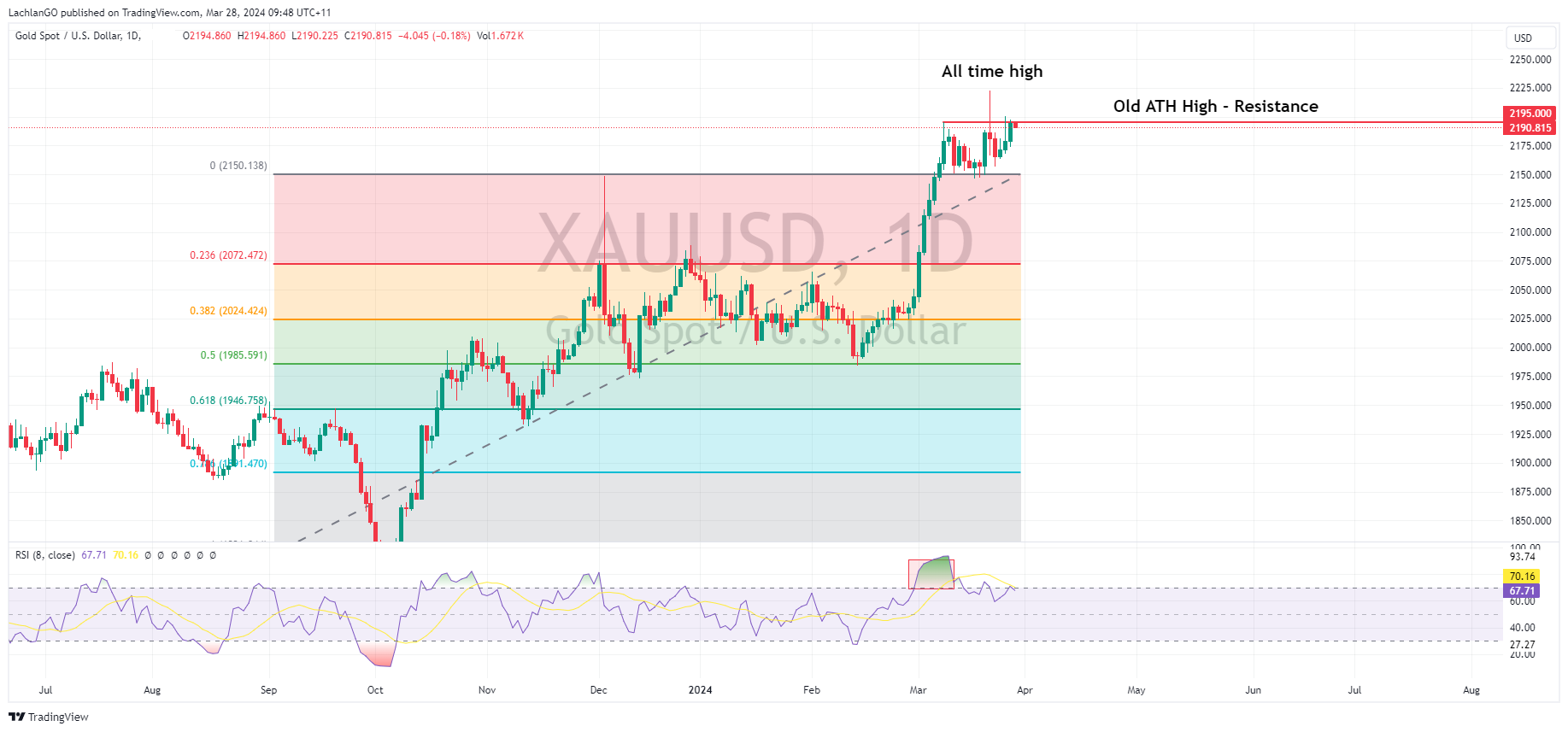

Gold surged higher with XAUUSD testing the previous all-time high and resistance level at 2195 USD an ounce after an earlier sell-off on a Reuters report that India is to drastically cut its gold imports in March. While the USD was flat, treasury yields did have a decent drop which supported the gold price.

Today ahead in economic news, the highlights are US jobs and GDP data.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

GO Markets Achieves ISO 27001 Certification

GO Markets proudly announces its achievement of ISO 27001 certification. This milestone underscores GO Markets' unwavering commitment to safeguarding its clients’ information assets and affirms its commitment to maintaining information security at an industry-leading level. This standard, part of the ISO 27000 series, sets out the specificatio...

April 3, 2024Read More >Previous Article

Cintas exceeds estimates and raises guidance – the stock reaches a new all-time high

Q1 earnings season is nearly finished but there are still a few companies expected to release their latest results for the previous quarter. On Wed...

March 28, 2024Read More >Please share your location to continue.

Check our help guide for more info.