- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX Analysis – USDJPY holds key level, AUDNZD has best day of year, USD quiet ahead of CPI

- Home

- News & Analysis

- Forex

- FX Analysis – USDJPY holds key level, AUDNZD has best day of year, USD quiet ahead of CPI

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX Analysis – USDJPY holds key level, AUDNZD has best day of year, USD quiet ahead of CPI

13 February 2024 By Lachlan MeakinUSD Dollar saw mild strength in Monday’s session, DXY trading either side of the psychological 104.00 level but again being capped to the upside by the 100-day SMA resistance. The was little in the way of a catalyst with no tier one data released, that will change today with US CPI figures released, which will help market participants and the Fed gauge the timing of the first rate cut.

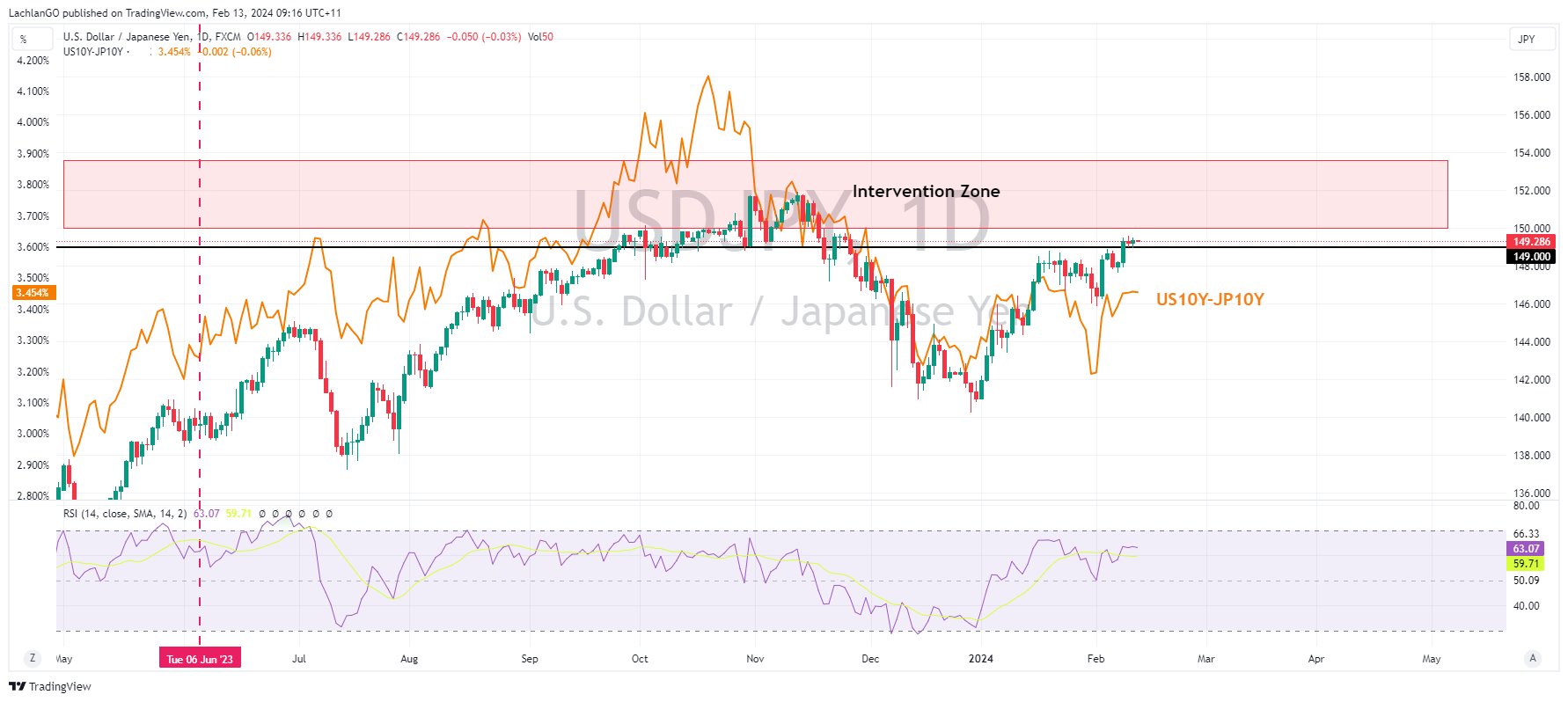

USDJPY was mostly flat for the second straight session, volume was low with Japan away for a holiday. USDJPY hit a low of 148.94 but failed to stay beneath 149.00 for long as a rise in US yields dragged the pair higher and held it above the key 149 level.

AUDUSD rallied through the 0.6525 resistance level, this will be a key level to watch for Aussie traders today to see if it can re-establish itself as support. NZD lagged despite hawkish RBNZ commentary where RBNZ Governor Orr said inflation is still too high, NZDUSD finding resistance at the February highs and dropping to a low of 0.6120. This also saw AUDNZD have its biggest up day of 2024 hitting a high of 1.0650 and retracing all and then some of Fridays steep drop. Attention turns to the New Zealand inflation expectations and RBA’s Kohler both on Tuesday.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Coca-Cola earnings announced

American beverage giant The Coca-Cola Company (NYSE: KO) reported the latest financial results before the opening bell on Wall Street on Tuesday. Coca-Cola reported revenue of $10.948 billion (up by 7% year-over-year) for the last three months of 2023 vs. $10.675 billion expected. Earnings per share reached $0.49 (up by 10% year-over-year) vs...

February 14, 2024Read More >Previous Article

Arista Networks Q4 2023 and full year results announced

It’s set to be another busy week of US earnings with The Coca-Cola Company, Shopify Inc., Airbnb Inc., Deere & Company and more expected to anno...

February 13, 2024Read More >Please share your location to continue.

Check our help guide for more info.