- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- GBPAUD – Containing A Sudden AUD Price Surge

News & AnalysisMarkets Eager To Resume

As the Easter holidays fade, we quickly saw a market resurgence of traders looking to resume normality. Perhaps one of the more stand-out movers during today’s London session was none other than the Pound Aussie cross (GBPAUD). Following the Reserve Bank of Australia’s announcement to hold interest rates at 0.1%, the recently stronger Pound took a tumble, and we’ll be looking at where the price may end up.

A Sizeable Move

Since early hours, the price of GBPAUD declined by 1.05% or roughly 200 pips. Considering the Average True Range (ATR) tends to sit around 100-120 pips, it’s not something to ignore. Is this just a one-off move, or is something larger happening here?

RBA Rates On Hold Until 2025

Perhaps the overriding factor that spiked AUD demand today is the dovish comments made by the RBA that suggest they’ll aim to keep the current rates on hold until 2025. In an uncertain environment mainly consisting of negative rates worldwide, the ability to offer stability, however small, speaks volumes. But is it enough to stave off economic risks associated with the pandemic? Probably not.

Risky Business

The Australian currency will remain risk-sensitive, and with Covid-19 cases continuing to rise throughout Europe and America, demand for the ‘Aussie’ will potentially struggle to find enough demand. By contrast, the Pound looks to build on vaccine success and hopefully reignite the economy in June/July by further easing lockdowns. The potential for GBPAUD to turn bullish longer-term looks more probable at this stage.

The idea that the pair could resume an upward trajectory is backed up by some relatively strong technical signals on both the hourly and daily Ichimoku charts listed below.

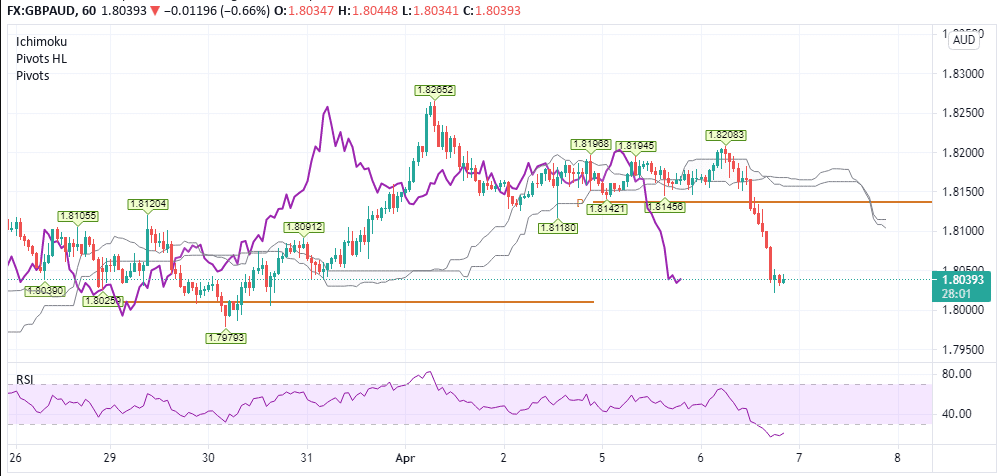

Ichimoku Hourly Chart Analysis

Beginning with the hourly, we can see today’s bearish price action is heading towards the previous weekly pivot point of 1.8010 before finding some support. Despite the decisive move to the downside, now that the pair found some short-term support, we’d generally expect some corrective price behavior during the upcoming sessions. Notice the RSI indicator (Relative Strength Index) is also in heavily oversold territory, further fueling speculation to the upside. The current weekly pivot point of 1.8145 makes an attractive potential target or a consideration for resistance.

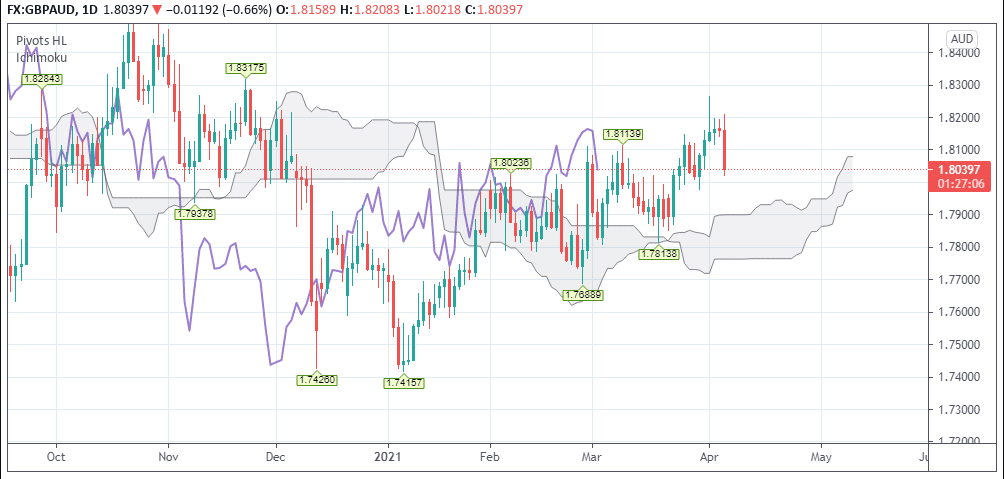

Ichimoku Daily Chart Analysis

The daily Ichimoku chart helps put today’s price moves into perspective, further highlighting the bullish indicators in play. Note, the current price action is still trading well above the cloud, as is the lagging span (purple line). The thickness of the cloud also suggests plenty of support above 1.80 levels.

Remaining Tentatively Bullish

So despite the sudden bearish activity seen today, the outlook for GBPAUD remains bullish across multiple timeframes, not accounting for any new Covid-19 issues that may emerge.

Sources: Go Markets, MetaTrader, TradingView, Bloomberg

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Facebook hits an all-time high

Facebook has had a fair share of negative news headlines in recent times with lawsuits filed against the company and calls to improve the monitoring of information that is posted on the social media platform. Despite that, the share price of Facebook hit an all-time high this week after trading at above $314 per share for the first time during the ...

April 8, 2021Read More >Previous Article

Tesla delivers in Q1

The electric vehicle industry has had a tough few weeks with the global chip and battery shortages affecting electric vehicle manufacturers around the...

April 6, 2021Read More >Please share your location to continue.

Check our help guide for more info.