- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Hot CPI fails to hold AUDUSD above key level

News & AnalysisAustralian CPI released today surprised to the upside coming in at 6.8% y/y , well above the consensus of 6.4% which itself was an increase on March’s figure of 6.3%

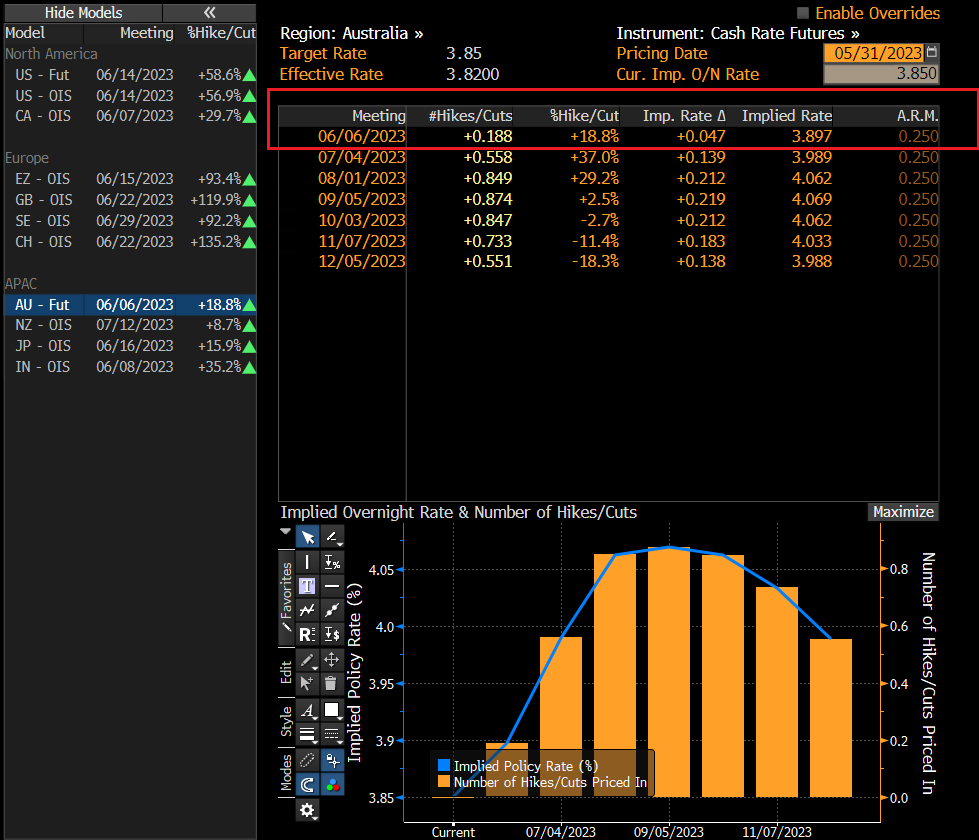

Coming into the figure futures markets had priced in a measly 2.5% chance of a hike next week by the RBA, that changed dramatically with odds jumping to 18.8% for a 25bp hike according to cash rate futures traders.

Initial reaction in AUDUSD was predictable, with a sharp spike to the upside as markets repriced the RBA odds, this has quickly retraced though and AUDUSD has now breached the major support at 0.6500.

While this move in AUDUSD might seem unexpected, the main driver of this pair for a while now has been risk sentiment, poor global risk sentiment = AUDUSD down, rather than the actions of the RBA.

The optimism from what was seen as a “done deal” on the US debt ceiling has soured somewhat as the deal does not look so “done” as squabbling in various factions of the Republican and Democrat parties threaten to derail it. We can see this in equity markets having a rough ride, with US futures pointing to a gap down in their cash session later today.

What next for AUDUSD?

Having broken the 0.6500 level, the next real support from a chartist view is the next big figure at 0.64 where we had a lot of chop and support/resistance switching places in late 2022.

Whether we test that or not I believe will depend on debt ceiling progress this week, USD is likely to remain well bid while risk appetite is shaky purely on safe haven flows, cyclical currencies like AUD, NZD and GBP to a lesser extent will all struggle in this environment. If we do get a confirmed deal this week(i.e. voted successfully through Congress), then those haven flows should unwind seeing AUDUSD rally if risk appetite returns to the market.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Market Analysis 5 – 9 June 2023

XAUUSD Analysis 5 – 9 June 2023 The overall outlook for gold prices is bearish in the short term. As there was a loss of buying momentum after testing the resistance area 2070, forming a Triple Top pattern on the Weekly timeframe, then there was a strong sell momentum, causing the price to fall below the price line. 1960s price line wh...

June 5, 2023Read More >Previous Article

Market Analysis 29 May – 02 June 2023

XAUUSD Analysis 29 May – 02 June 2023 Forecasting the price of gold in the short term, the price may move down to test the 1915 support a...

May 30, 2023Read More >Please share your location to continue.

Check our help guide for more info.