- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Know the Score: Holding Costs of Daily Fx Positions

News & AnalysisMany traders consider trading daily timeframes but when used to trading the shorter timeframes, overnight holding costs of positions may not be something they have come across previously.

This brief article has the aim of understanding why these trading costs exist and how they are calculated.But First…An important message about holding costs…

Let us start by stating a little “reality check” perspective. Holding costs, like “slippage” and Pip spreads are NOT ultimately the deciding factors as to whether you become a successful trader with sustainable positive results. Much is made of these, but the reality is there are other things which are far more impactful such as effective position sizing and appropriate and timely exits from trades.

Nevertheless, for those of you that are treating trading seriously enough, indeed, let’s use the term “trading as a business”, as with all the above, holding costs should be considered in your trading.So how does it work…

To understand overnight holding costs it is worthwhile starting by looking at what you are doing when you trade a currency pair.

If you are buying 0.5 EURUSD position for example, in practical terms you are ‘borrowing’ US dollars and buying euros with the proceeds.

If this position is held “overnight”, (i.e. in practical terms this means at 4.59pm US EST), you pay interest on the US dollars you borrow, but earn interest on the euros you bought.

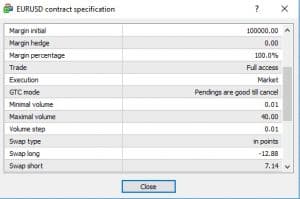

There is a long rate and a short rate which you can find on your MT4 platform (This obviously changes daily). Rates are set globally, and the actual dollar figure is dependent on the size of position you have.To find this on your platform:

a. Right click on your chosen currency pair in “Market Watch”

b. In the drop-down menu choose “Specification”. This brings up a pop-up with details of the contract information relating to that specific currency pair.

c. Scroll down to find the long and short swap rates (the example shown is of EURUSD).

This calculation creates either a debit or credit to your account per day (termed the swap rate) and is shown in the “swap” column in your trade window at the bottom of your screen.

The calculation is as follows:

Current long/short rate x number of lots = swap debit/credit in second currency

For example, if we held long 5 mini-lots of EURUSD, the “swap long” shown is Long Swap rate of -12.88.

Therefore this looks like -12.88 x 0.5 (contracts) = -$6.44USD

This is then converted into your account currency (so AUD if based in Australia) and shown accordingly as a debit.Likewise, If we held short 5 contract of EURUSD, then the calculation would be:

7.14 x 0.5 (contracts) = $3.57

This is then converted into your account currency) and shown accordingly as a credit.We trust that helps. Of course, please get in touch with us if you need any more clarity on holding costs at any time.

This article is written by an external Analyst and is based on his independent analysis. He remains fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Margin Call Podcast – S1 E8: Adam Taylor | Head of GO Markets London

Adam Taylor (Linkedin) is a Director of GO Markets London. Adam has a brilliant ability to see patterns, whether it’s playing Chess, or using Point & Figure Analysis to better understand the sentiment in the market. This chat was a great insight into what makes a GO Markets London Director tick, plus how things are looking within the ...

March 6, 2019Read More >Previous Article

Black and Yellow Gold

Commodities markets were on sell-off mode on Friday. The black and yellow gold was sent to the downside dragged by the disappointing Purchasing Man...

March 4, 2019Read More >Please share your location to continue.

Check our help guide for more info.