- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Market Analysis 5 – 9 June 2023

News & Analysis

XAUUSD Analysis 5 – 9 June 2023

The overall outlook for gold prices is bearish in the short term. As there was a loss of buying momentum after testing the resistance area 2070, forming a Triple Top pattern on the Weekly timeframe, then there was a strong sell momentum, causing the price to fall below the price line. 1960s price line which used to be the old high when viewed from the Daily and Weekly timeframes, but nevertheless, the price is still moving in an uptrend for the medium term as the highs and lows have been established. Up when observed from the Daily time frame. There are also no lower highs and lower lows, although the triple top pattern on the weekly timeframe suggests that the price of gold may reverse to a downward trend in the medium term.

Therefore, the gold price forecast In the short term, the price may retrace to test the 1915 support area, which is where the price is expected to test before rebounding. There is still strong selling momentum from last Friday’s NFP (Nonfarm Payrolls) report, giving the price a chance to move further down. And if the price can stand on the support 1915 without falling further. Price may have a sideways correction before rallying to test the 1960 resistance again on the Daily timeframe.

But if the price has a sharp drop with continuous selling momentum, it can break out the 1915 support level further down, the next important support that should be closely monitored and there is a chance that the price will fall Go to test before rebounding back up, that is 1880, which is a support level at the Daily time frame.

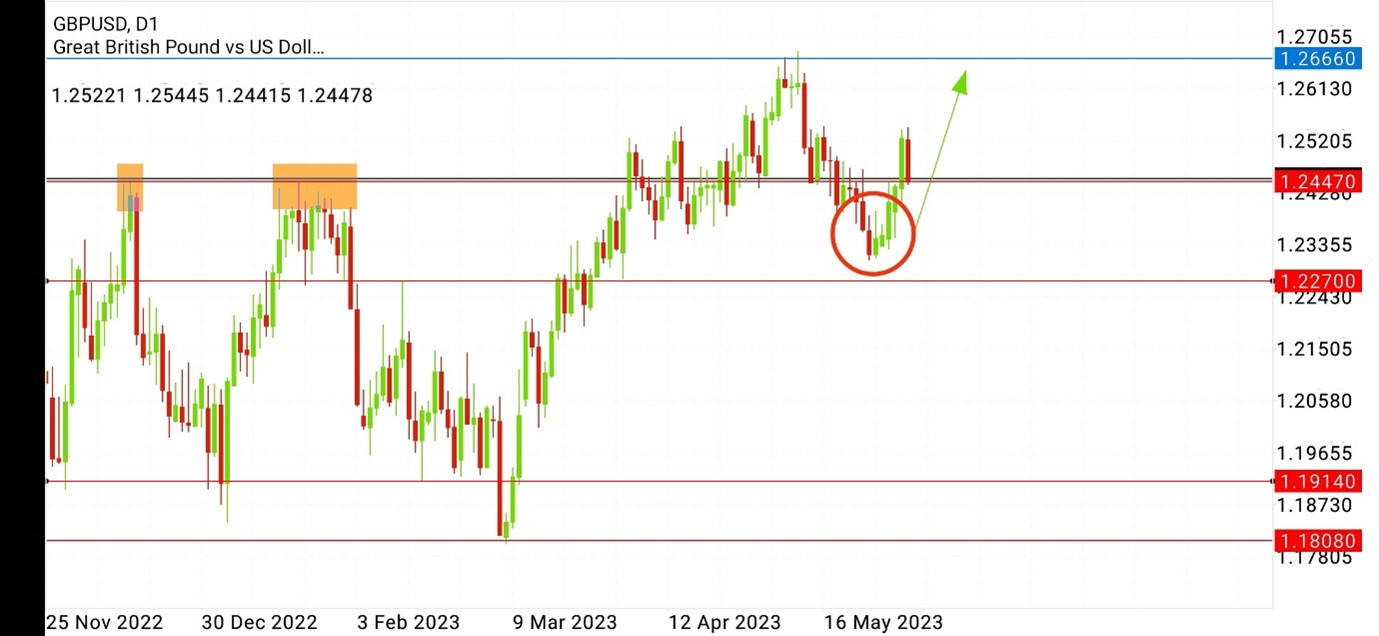

GBPUSD Analysis 5 – 9 June 2023

GBPUSD is bullish in the medium term after rallying to test the 1.26660 resistance to successfully form a new high on the daily timeframe before showing strong selling momentum on the Daily and Weekly timeframes. As a result, the price has continued to fall for three weeks in a row. Before breaking through the important price line that the price used to form a Double Top on the daily time frame at 1.24470, moved above the support level of 1.22700, and last week the price had strong buying momentum, resulting in an increase. Revisiting the 1.24470 price line, which is an important level at the daily timeframe level.

Forecasting that price This week the price may continue to rise. There is a high probability that the price will rise to test the resistance area that the price previously created a new high at the daily time frame level of 1.26660 again, as the price continues to move in an uptrend pattern. Because higher Highs and Lows are made.

But if the selling momentum continues to sell continuously and is very strong This will result in the price being able to break out around the 1.24470 price line and go further down to test the next support, 1.22700, which is an important support at the Daily timeframe level.

EURUSD Analysis 5 – 9 June 2023

EURUSD is bullish in the medium term after rallying to test the 1.11000 resistance zone, which was the last high on the daily timeframe, but failed to make a new high and the price has strong selling momentum. It appears clearly when looking at the closing of the sell pressure candlestick on the weekly time frame for the past four weeks. And the previous week closed in a Doji candle, indicating the market’s hesitancy to continue falling or bouncing back.

forecasting that price This week, the pair may face a short-term sideways trend with a high probability of a correction at the 1.07450 support area before a rebound to test the 1.11000 resistance. Again, as the price continues to move in an uptrend pattern, higher lows have been formed, although the high has yet to rise beyond the 1.11000 price line.

But if the selling momentum continues to sell continuously and is very strong This will result in the price being able to break out at the 1.07450 support level and continue down to test the next support, 1.05250, which is an important support at the daily timeframe level that should be watched.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Could the Reserve Bank of Australia hike rates further?

The Australian interest rate is currently at 3.85% and the most recent consumer price index (CPI) released at 6.8% which indicates slightly higher than expected inflation growth (expectation was 6.4% with previous data at 6.3%). This puts more focus on the upcoming interest rate decision from the Reserve Bank of Australia (RBA). While further rate ...

June 6, 2023Read More >Previous Article

Hot CPI fails to hold AUDUSD above key level

Australian CPI released today surprised to the upside coming in at 6.8% y/y , well above the consensus of 6.4% which itself was an increase on March...

May 31, 2023Read More >Please share your location to continue.

Check our help guide for more info.