- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Forex

- Snapshot – AUDNZD, EURUSD, USOIL

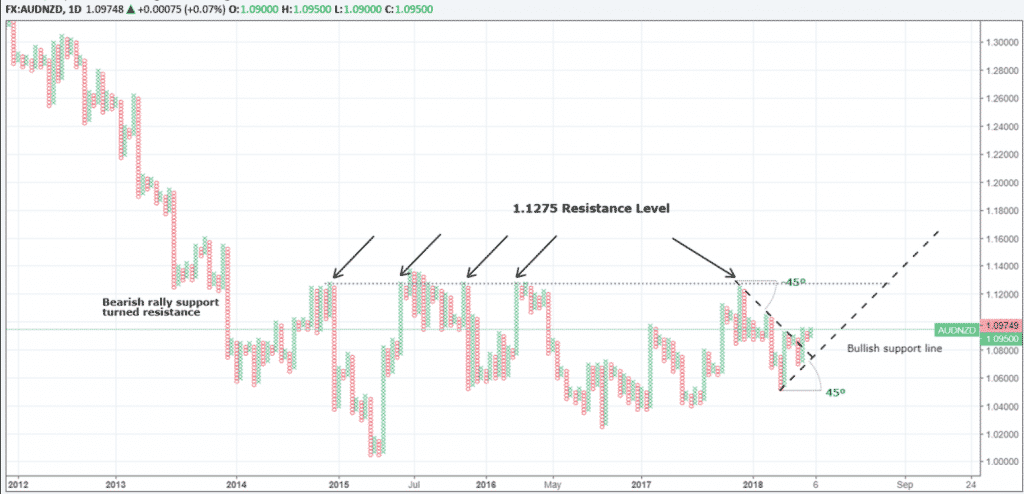

News & AnalysisAUDNZD – Point & Figure Chart

AUDNZD – As we approach the upcoming policy meetings this week, the expectations for both central banks (RBA and the RBNZ) is to keep their respective interest rates on hold. The only difference is that the New Zealand camp appears to be more dovish concerning fiscal policy going forward. We could also mention the slight boost in commodity prices which has helped the Australian economy, while the Kiwis struggle with softening dairy prices. It’s these subtle differences that could be translating into a stronger Australian Dollar on the technicals against its counterpart.

The Point and Figure chart above confirms the critical resistance level of 1.1250/75 within the longer-term range. Notice price has tested the area five times previously and continues to be a formidable barrier to the upside.

At present, the price is trading around 1.0970 levels and has formed a double top at 1.0950. We will be looking for a close above 1.0975 for a potential buy signal and perhaps the next leg up towards the 1.12 region. Also, despite the sideways action, we are technically in an uptrend as per the bullish support line displayed on the chart.

A move below 1.08 would suggest a change in the overall trend and a possible step towards the recent low of 1.0525.

RBA Rate Decision – Tuesday 14:30 pm Sydney/Melb time.

RBNZ Rate Decision – Thursday 07:00 am Sydney/Melb time.

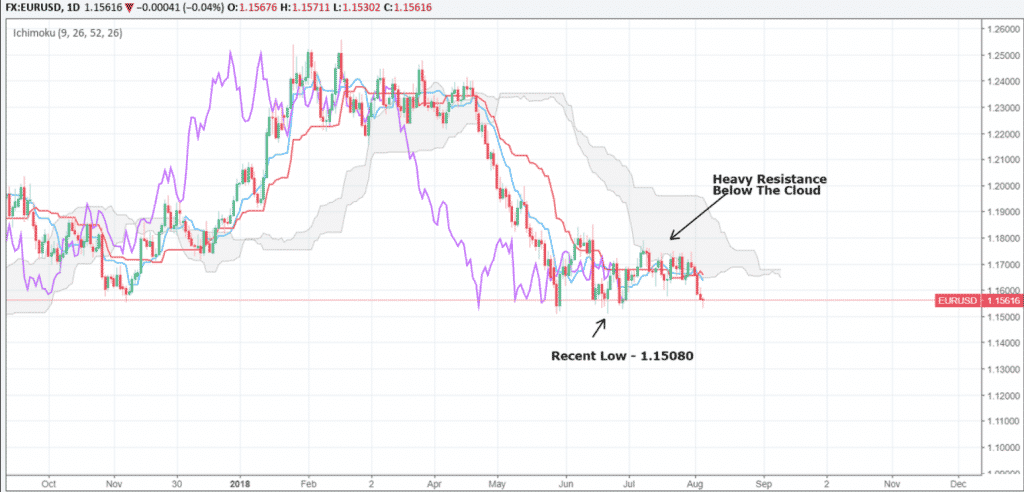

EURUSD – Daily Ichimoku

EURUSD – We took a look at this pair last week on the daily Ichimoku chart, and price action has mostly followed my expectations in this case. To refresh your memory, I’ll leave a link below. Remember, we discussed the potential resistance within the cloud, and as you can see, the price failed to breach this area and is now looking like it may re-test that low of 1.15080. Longer-term, I am still bullish on the pair, but still waiting to see a close above the weekly 200 day moving average. Finally, the thinning of the cloud just below the 1.17 region presents an opportunity for the bulls if there becomes less resistance. We’ll have to wait and see on this one.

Last weeks EURUSD analysis – here

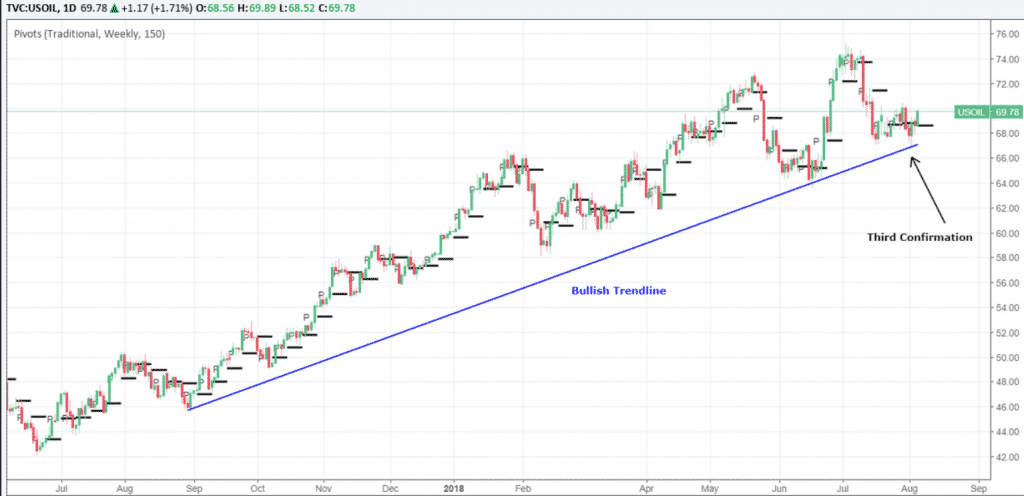

USOOIL – Daily Chart

USOIL – Similar to EURUSD, I wanted to do a quick recap of last weeks snapshot analysis as we have seen significant development. I mentioned the longer-term bullish trendline forming and waiting for the third touch. Over the past few days, we have witnessed this price action confirming the uptrend as the price re-tested the trendline in blue and resumed course. At this stage, I am still eyeing the 72.00 and 74.00 levels which coincide with the weekly pivot points as potential targets for oil.

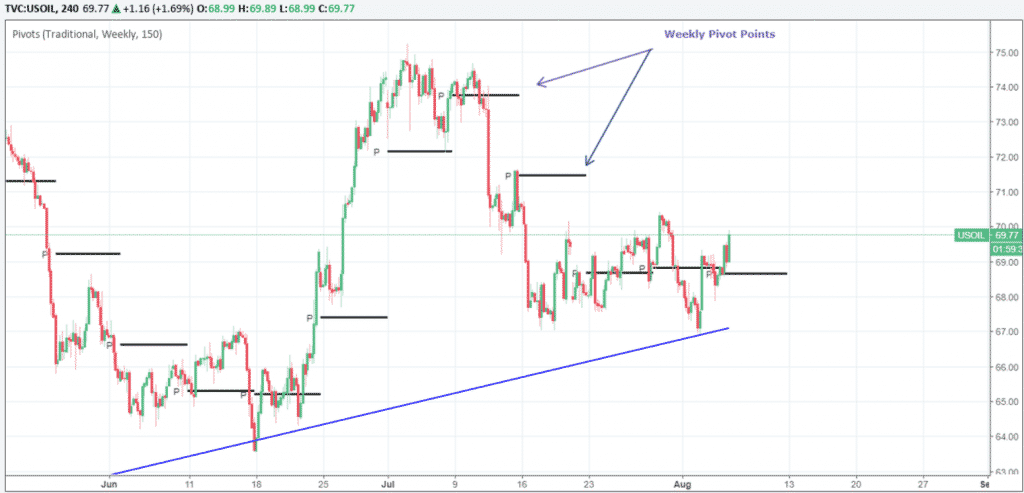

Below is the same chart viewed on a four-hour time frame to provide a clearer picture of these weekly pivot points.

You can also compare last week’s oil chart here to see how price action unfolded.

By Adam Taylor CFTe

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more on trading Forex check out our Forex Trading Education Centre, MetaTrader 4 Tutorials, or open a free MetaTrader 4 demo account.

Sources: MT4 Metatrader, TradingviewReady to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Are the bond markets overwhelming or intimidating?

By Deepta Bolaky The intermarket relationships between commodities, currency, equity and bond markets are key in understanding the way the markets interact and move. Some markets will move with each other while others will move against each other. There are different types of bonds but for the purpose of this article, we will use the U.S Treas...

August 7, 2018Read More >Previous Article

Bullish Technical Reversal Trend

By Deepta Bolaky “Buy the Dips” and “Sell the Rallies” are widely followed strategies by new or experienced traders. Buy-the-dip strat...

July 31, 2018Read More >Please share your location to continue.

Check our help guide for more info.