- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- The Week Ahead – US and UK inflation, RBA minutes, BoJ meeting

- Home

- News & Analysis

- Forex

- The Week Ahead – US and UK inflation, RBA minutes, BoJ meeting

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Week Ahead – US and UK inflation, RBA minutes, BoJ meeting

18 December 2023 By Lachlan MeakinEquity markets enter the second last week of 2023 on a roll, with US equities rallying for seven straight weeks and seeing all time highs in the Dow.

The risk on rally was turbo charged last week after a dovish pivot from the US Fed in the December meeting saw yields and the Dollar tank and everything else bid heavily with rallies in Gold, Oil, equities, and other currencies.

Looking ahead to this week, we do have a quieter calendar but there a are couple of key figures due for traders to keep an eye on, including the Feds favoured inflation gauge released on Friday.

Charts To Watch

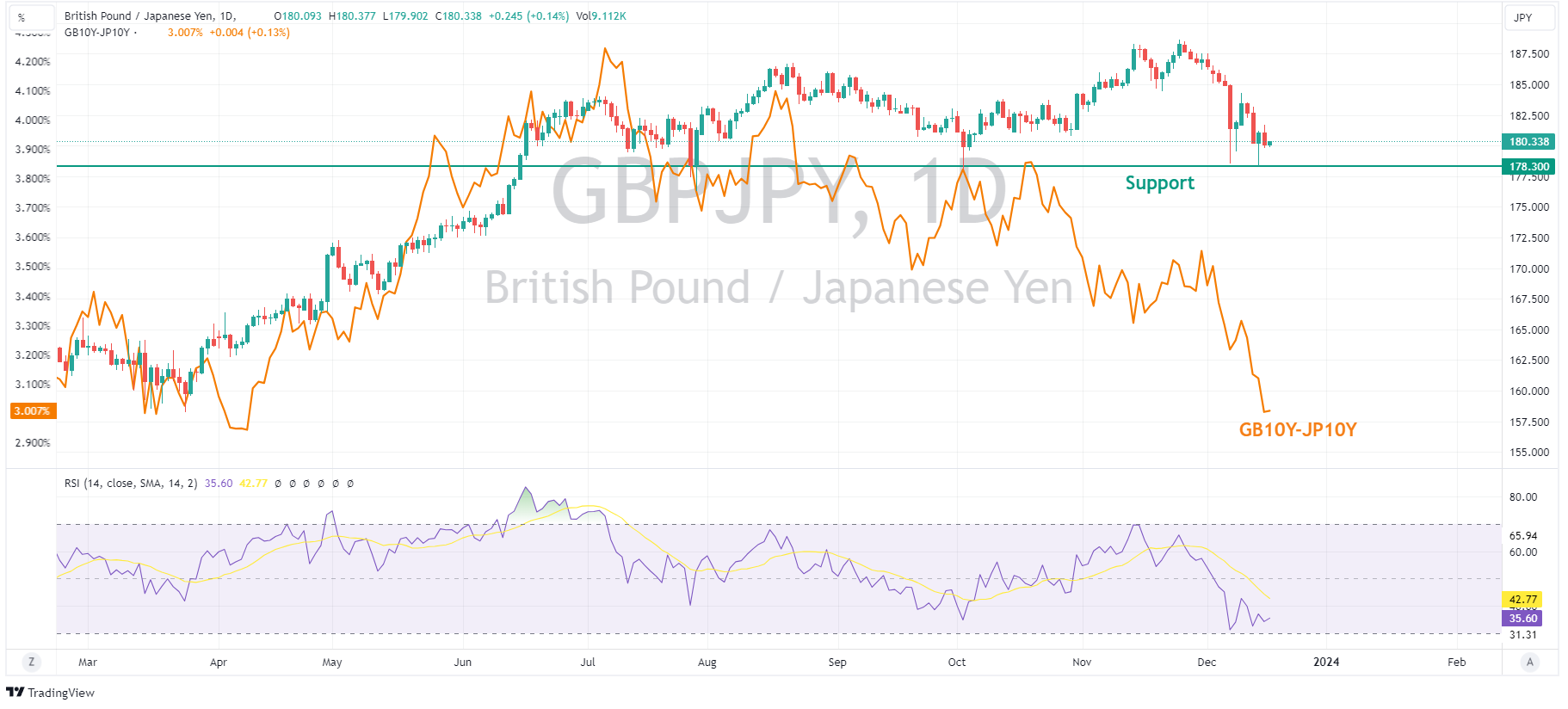

GBPJPY

With the Bank of Japan set to release their latest monetary policy on Tuesday and UK CPI released Wednesday sets the scene for some volatility in this pair this week.

The BoJ is expected to stand pat this time and seek gradual steps towards policy normalization. Traders will be watching for any hints of a BoJ pivot, and we could see a decent move in the Yen if they are forthcoming. UK CPI will also be of note, after the Bank of England (unlike the Fed) pushed back somewhat against dovish rate expectations in their meeting last week, a figure outside range, especially to the downside should see a move in GBP as rates markets re-price.

A widening gap in UK and JP 10 year yield differentials also putting pressure on the pair to the downside.

AUDUSD

AUDUSD rallied strongly last week on a weak USD and improved risk sentiment propping up the pair. The 200 Day SMA which AUDUSD had been revolving around was broken decisively to the upside and saw AUDUSD hit 4-month highs before finding some resistance around 0.6728.

Tuesday the RBA will be releasing their minutes from the December rate meeting where they could push back at the market’s view that rates have definitely peaked which would lend the AUD another tailwind. Friday see the US core PCE inflation figure released, where it is expected to hold steady at 0.2% for the month on month figure, though a beat to the upside could certainly test the market’s expectations of a dovish Fed going forward.

The weeks full calendar at the link below:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

NIO gets a boost from the Middle East

It was positive start to a new week for the Chinese electric vehicle company, NIO Inc. (NYSE: NIO), after it announced a $2.2 billion strategic investment from an Abu Dhabi based investment firm CYVN Holdings on Monday. The deal is expected to be completed in the last week of December and it will make CYVN a major shareholder in the company with...

December 19, 2023Read More >Previous Article

Costco posts solid results

American wholesale chain, Costco Wholesale Corporation (NASDAQ: COST), announced financial results for the first quarter of fiscal year 2024 after the...

December 15, 2023Read More >Please share your location to continue.

Check our help guide for more info.