- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- What Lies Ahead For Japan

News & AnalysisIn the midst of Wednesday afternoon’s global bond sell-off, we saw government bond yields rise across the board and in one particular 10-year bond we saw a significant level approached and then surpassed.

Japanese Government Bond – 10-year yield

The Japanese government’s 10-year bond yield rose to and then surpassed 0.145 percent, a significant level because the Japanese government has kept pretty tight control over treasury yields. Last time yields approached this level we saw a spur in BoJ (Bank of Japan) bond buying. However, to keep yields lower, we are yet to see such action from the BOJ this time. It could be down to the current perceived weakness in the Yen currency which could be affording central banker’s the breathing room to hold off on further bond purchasing.

However, this may not be just some temporary blip in bond/yield prices, and this may be the beginning of a shift in the BoJ’s approach to monetary policy. Up until this point, Governor Kuroda was seemingly happy with allowing the Yen’s price to slide versus the dollar to help revive Japan’s economy. However, chief economist at Mizuho Bank in Tokyo, Daisuke Karakama, recently said: “Foreign-exchange markets see the excessively one-sided rise in the dollar-yen as hurting bilateral trade negotiations, and that’s spurring speculation that Japan will take some action.”

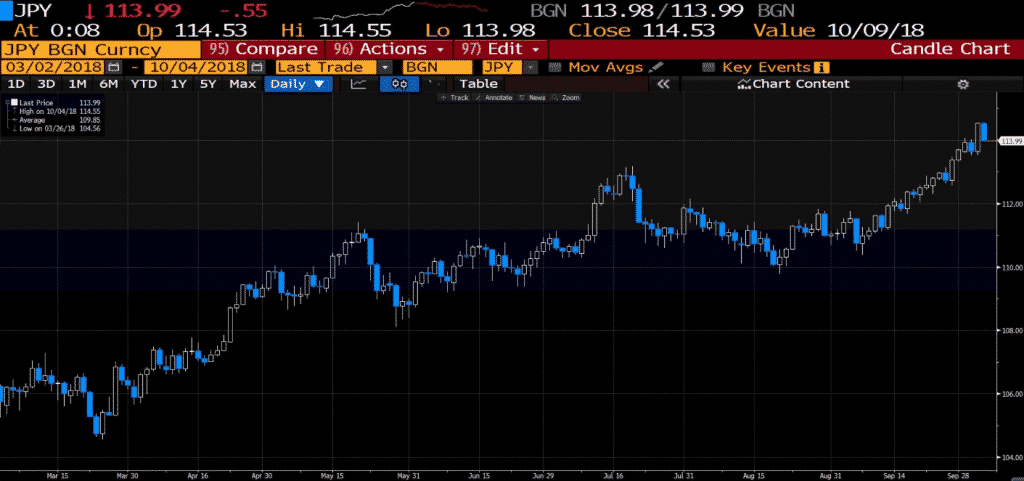

USDJPY – Daily Chart

Donald Trump recently levelled accusations of currency manipulation at both China and Europe, in an effort to avoid having similar accusations laid at their feet the BoJ may have already begun attempting to stem the slide in the yen vs. the dollar so as to allow trade talks to take place more smoothly and gain access to the U.S. markets.

Tatsuhiro Iwashige, Tokyo based GCI Asset Management chief FX strategist, recently commented that the moves to stop the yen’s decline could be “extremely simple” and may potentially come from local bond yields being higher than what they are.

The Yen has seen speculative strengthening before on the back of potential BoJ monetary policy changes, a 3% jump after the bank cut bond purchases.

Could the BoJ’s reluctance to step in where they have previously with the 10-year yield be a sign that we are about to see a strengthening in the Yen? The market has concerns around the 115 level prompting some level of intervention. “Kuroda has that power and markets are wary,” Tatsuhiro Iwashige also commented, “Kuroda must be careful about the timing, thanks to the experience of what happened in 2015, but 120 will prompt him to come to the fore.”

Whether it comes sooner or at the 120 print from USD/JPY, it seems clear that to remain competitive in regards to trade talks with the U.S. it appears that Governor Kuroda and the BoJ will have to make a shift in monetary policy.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: BloombergReady to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Latest US Jobs Report

The Buraeu of Labor Statistics have released the latest jobs report for September. Let’s take a look at the latest numbers. The total non-farm payroll employment increased by 134,000, the U.S. Bureau of Labor Statistics reported today versus the forecast of 185,000. Biggest job gains were in professional and business services, in health care, an...

October 5, 2018Read More >Previous Article

A Rise in U.S Bond Yields

Is rising bond yields bad news for the equity markets? Bond yields are an important indicator to gauge the direction of equities. They have an inve...

October 5, 2018Read More >Please share your location to continue.

Check our help guide for more info.

@

@