- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- What Has Moved The Markets So Far This Week?

- The equity markets were flashing green again, and major equity benchmarks managed to climb sharply to the upside.

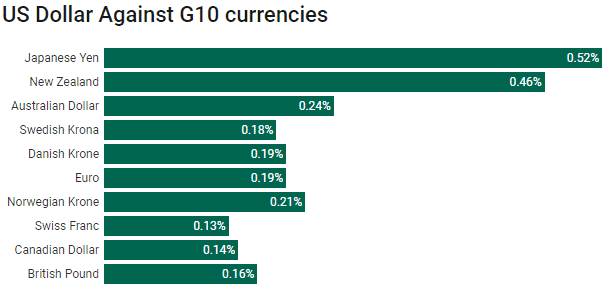

- In the FX markets, all G10 currencies appreciated against the greenback. The Japanese Yen and the Antipodeans emerged as the best performers. The British Pound struggled to keep the pace with the other G10 currencies, due to the Brexit uncertainties.

- Investors dramatically dropped riskier assets. Wall Street bled the most: The Dow Jones Average Industrial dropped 799 points (3.10%), the S&P500 fell by 90 points (3.24%), and Nasdaq Composite erased 3.8%.

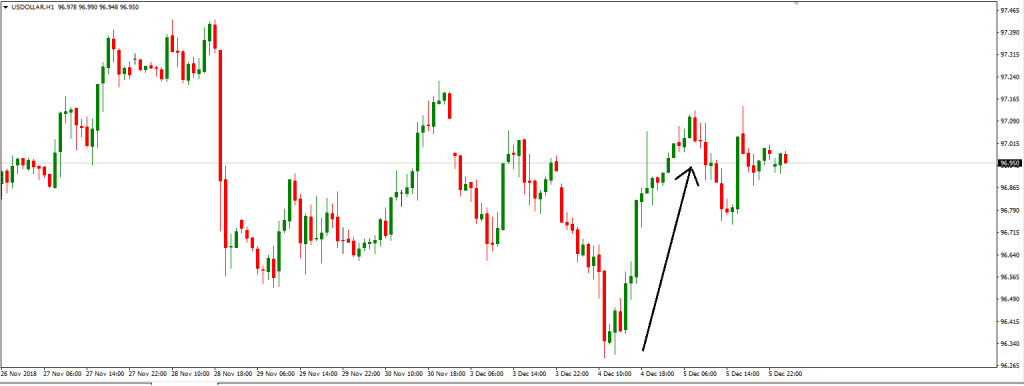

- The greenback retrieved its safe-haven status and bolstered against rival peers. The US dollar Index spiked above the 97 level before losing some bullish momentum.

- Legal advice which states that Brexit deal can be reversed using Article 50

- A motion to disclose the legal advice supported by the House of Commons

- Three Brexit defeats in the Commons

- Scottish political parties are joining forces to show their opposition.

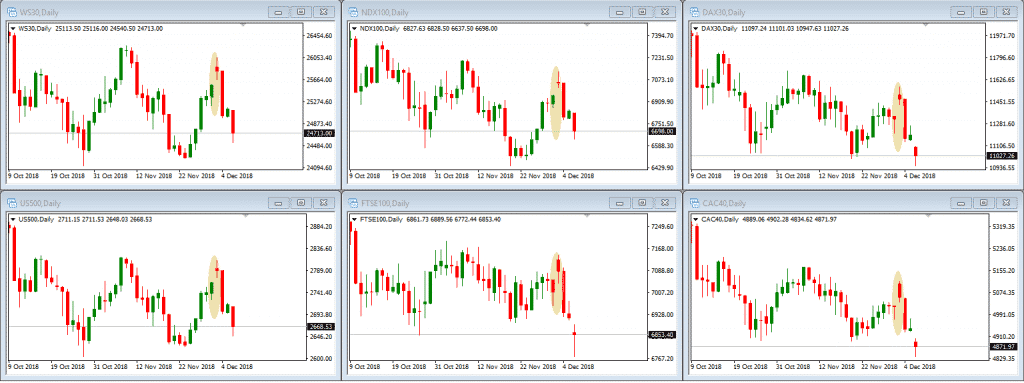

News & AnalysisDecember started on a positive note, though it was short-lived. During the G20 meeting, there was more optimism in the financial markets than the market participants had anticipated. Investors were therefore hopeful that December would be promising.

Post G20 Reactions – Bullish Gaps

Monday started on a buoyant note with a few bullish gaps, and risk sentiment was revived. The dynamic in the financial markets had changed, and investors entered the last month of the year with more confidence.

(Daily Charts: WS30, NDX100, DAX30, US5OO, FTSE100, and CAC40)

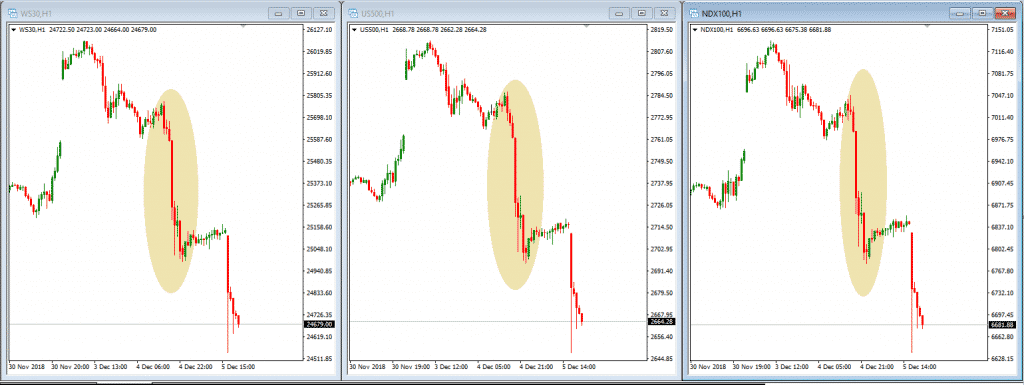

Inverted Yield Curve and Trade Ambiguity

An inverted yield curve and lack of details around the trade truce deal have halted the upbeat tone in the financial markets. The yield spread between the 3-yr and 5-yr Treasuries dropped to -0.1 on Monday, triggering a massive sell-off due to rising fears of a recession. At the same time, investors were worried that a muted China regarding the ceasefire was bad news.

(Hourly Charts: WS30, NDX100 and DAX30)

(Hourly Chart: US dollar Index)Brexit

Aside from trade headlines and the fears around the inverted yield curve, Brexit news dominated the markets. A meaningful Parliament vote is scheduled on the 11th of December, and there was much new information for market participants to digest.

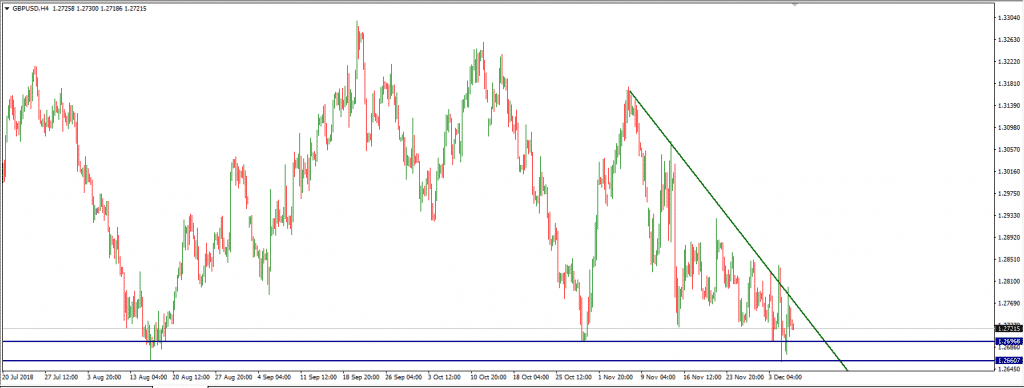

The GBPUSD pair swung up and down, depending on the headlines. Any gains appeared to have been capped by the downtrend line. The pair has also broken key support levels and dropped to August lows. It briefly attempted a break outside the descending line.

(H4: GBPUSD)Fundamentals are weak, and investors reactions seemed to be more pronounced. Sparks in the markets are either bringing relief or igniting the fears.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. For more information on trading Forex, check out our regular free Forex webinars.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Preview: The European Central Bank Rate Decision

With the Brexit negations dominating the news flow over the last few weeks, you may forget there are other events taking place. On Thursday, the European Central Bank will announce its decision whether to increase, decrease or maintain the interest rates. The decision is scheduled to be announced at 12:45 PM UK time. Why Is The Announcement Impo...

December 12, 2018Read More >Previous Article

Canada – Taking A Look At The Loonie Economy

Canada News Flying Under The Radar Canada has been a predominant feature in financial news in the recent few months, with many discussions centered a...

December 2, 2018Read More >Please share your location to continue.

Check our help guide for more info.