- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Share CFDs

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- Where to for the Aussie dollar in 2016?

News & AnalysisAnother year down, and another year spent under pressure for the Australian dollar. If January’s performance is any indication, 2016 may very well be another year spent on the ropes, with solid losses of over 5 percent in January alone.

While it is not unusual for the AUD/USD pair to post such significant declines, what’s worth noting was that we have not seen a cumulative decline of almost 30% in a span of three years since the AUD was floated in 1983.

Looking at this situation closely, we can see the roots of the cause including:

» Continuing US dollar strength

» Lower commodity prices and

» Emerging markets rout putting a much stronger pressure on the currency pair.Let’s see how each of these factors has affected the AUD in the last year.

Continuing US Dollar StrengthThe year 2015 was certainly another year for the greenback to shine. Looking at the history of the US dollar index, we can see that since 1973, there have been two other distinct U.S. dollar rallies which made headlines in their respective times. The first one was during the Ronald Regan rein when USD rallied by almost 95% (from low to high) in space of five years. The second one was during the Clinton era when the greenback appreciated by approximately 50% from the lows of 1993 to the highs of 2001. The third one is during the Obama presidency which has seen the US dollar rising more than 37% from the 2010 lows to the current levels.

US Dollar Index since 1971 Lower Commodity Prices

Being a commodity driven economy, Australia and the Australian dollar are naturally tied to the developments in the commodity markets. The grey line in the graph is daily prices of AUDUSD and the red, black and blue lines are daily iron ore, coal and commodity index. Note how the commodities change of gear in early 2012, pushed Aussie down almost a year later in 2013.

Emerging Markets Rout

With more than 33% of our trading activities being done with Asian emerging markets, we are very much depending on the financial well- being of these developing nations. The latest figures from the Department of Foreign Affairs showed that China alone accounted for more than 22% of Australia’s international trades in 2015.

Given the economic slowdown in some of these markets, and in particular China, it is not surprising that the Aussie dollar is being affected.

To better understand the relationship between China and the Aussie, let’s have a look at the chart below. The candlesticks show the AUDUSD daily closing prices and the red line is the Shanghai composite index. Notice how the Aussie has followed the Shanghai index almost in every twist and turn since July 2015.

Also, of interest is the increasing correlation between the two represented by the red line in the lower section of this graph. (The correlation coefficient in here is calculated over the net daily changes in a 60 day rolling period)

Aussie in 2016: Will it continue lower?

From a fundamental point of view, let’s consider the same set of factors and how will they impact the Aussie in 2016. First let’s look at the US dollar.

The Almighty Dollar

The US dollar’s phenomenal rally during the latter part of the Obama presidency can be attributed to three factors:

End of Quantitative EasingWith the US Federal Reserve ending its Quantitative Easing (QE) programme in 2014, billions of funds being pumped into the economy were finally unwound. Throughout the QE programs, many maintained bearish views on USD, expecting it to fall deeply against its counterparts. Close to the third round of QE, these traders began adjusting their positions relieving USD from a significant selling pressure.

US Recovering Faster Than The Rest Of The World

2015 marked a significant year for the US economy post the GFC. Unemployment dropped to 5% for the first time since the financial crisis. The shrinking current account deficit and strong corporate earnings growth in early 2015 and late 2014 made many analysts and central bankers think that US economy is ready for its first rake hike since the GFC. On the other hand, other developed countries in Europe and Asia were still struggling with economic weakness. The mismatch between US and the rest of the world and expectation of an imminent US rate hike, made USD more attractive than other major currencies leading it to the top of the board.

Capital Flows

During the commodity boom and in the period between 2009-2013, emerging markets and in particular China, accumulated huge unhedged US dollar nominated debt. It was estimated that half way through 2015, Chinees companies have accumulated more than $1.1 trillion in foreign debt. Cheap interest rates and abundance of dollar (due to QE programmes) and appreciating Chinese Yuan were the main drivers of this massive debt bonanza. But when the US dollar started to get more expensive, many of these companies rushed to pay back their U.S dollar debts which in turn created a very real demand for USD in 2015.

Add to this the prospects of further easing in China (due to slower economic growth ), lower commodity prices , weak economic conditions across emerging markets which all pushed Chinese and emerging market wealthy families and companies to move their capital overseas for better investment opportunities.

Notwithstanding the U.S dollar getting stronger or weaker in 2016, we still think the Aussie will be under pressure from China, commodity and domestic factors.

Turmoil in China

As we all know the Australian economy as whole is very much tied to the Chinese economy. At the time this report is being written, China has had a very shaky start for the year with its equity prices almost falling off the cliff. According to the latest data, China’s 2015 GDP had a growth of 6.9% which is the lowest amount since 1990.

Also, as China is transiting from a 30 year long capital intensive economy to a more service based economy which means it will be less hungry to buy Australian iron ore and other minerals. Based on the latest economic releases, China’s fixed asset investments only increased by 10% during 2015, which is the slowest pace since 2000.

Adding to the fuel is China’s currency fluctuations. The Yuan is now acting as barometer for Chinese economic prospects. The further the authorities have to weaken their currency to stimulate the economy, the more negative reaction and risk off sentiment is created amongst the traders globally. This can result in further pressure on higher risk currencies such as AUD.

Considering all these factors, it would be reasonable to expect the headwinds for our currency as well our local stock market will remain in place in 2016.

The Commodity Rout

Whilst many believe that a cure for lower commodity prices is lower prices, meaning the lower prices will ultimately disrupt the supply chain which in turn results in higher prices. But with the world’s biggest commodity consumer (yes it’s China) steering away from a capital intensive economy, and with no firm sign of production cut by the major commodity producers, there is no positive scenario in sight for the commodities in 2016.

Many analysts believe that in the second half of 2016, oil and energy commodities may stabilize or even bounce back. This can be quite good for oil linked currencies such as Canadian dollar or Norwegian Krone, but will have less significant effect for the Australian dollar as we are not a major oil producer.

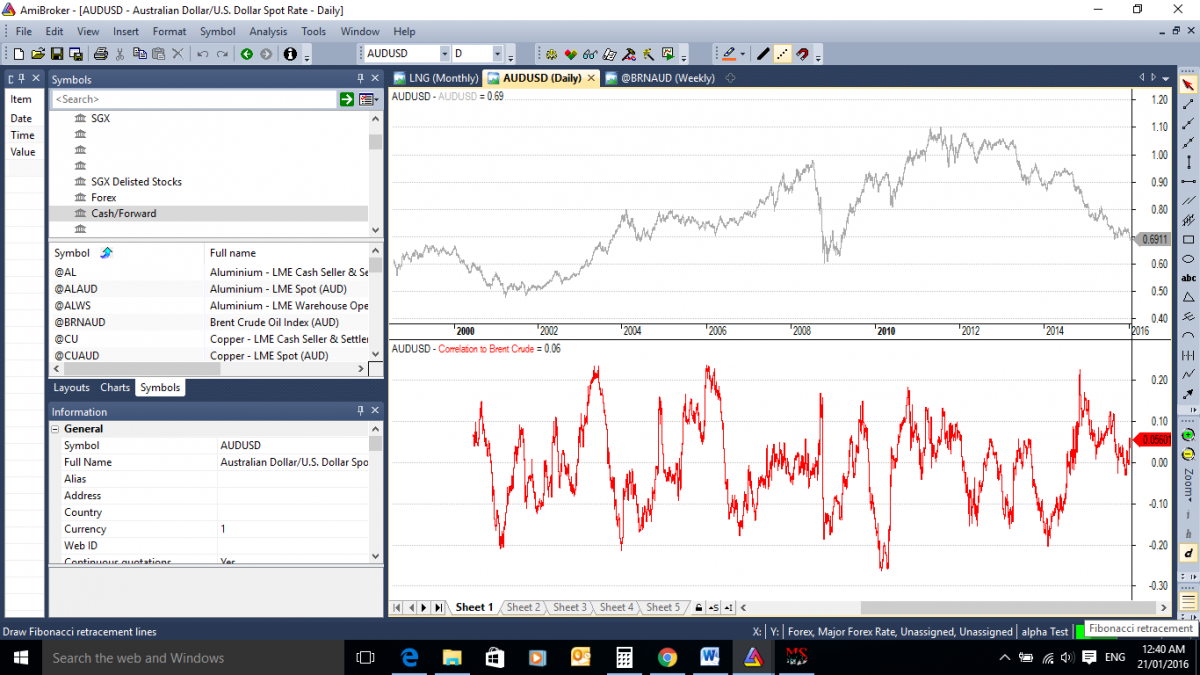

The low impact of oil on the Australian economy is shown in the chart below .The grey line is Australian dollar and the red line in the lower section is the 6 month correlation of Aussie with Brent crude oil. As you can see the correlation coefficient between the two has never been greater than 20% since the year 2000.

A Note on Aussie and Commodities Correlation

In studying the correlation between AUD and commodities, it should be noted that these correlations can change over time. In fact looking back at earlier analysis we conducted it was a negative correlation with Iron ore late last year.

This is illustrated in the chart below where the red line in the lower section of the chart. Notice how it changed from a positive reading of 50% in November 2015 to a deeply negative territory in mid-December.

So a possible rebound in commodities may or may not have a positive impact on the Aussie dollar depending on the correlations at that point in time.

The Domestic Factors: Interest Rates and the Reserve Bank

For the time being it appears that Governor Glenn Stevens and the Reserve Bank of Australia are not in any hurry to make deeper cuts to the cash rate for as long as the local unit is responding how it should and continues on a moderate downward path. Therefore there won’t be further pressure to push Aussie lower from the central bank.

However, if the currency is judged to be materially overvalued at some point during 2016, RBA may start thinking to cut the rates again. At the time of writing, money market pricing would suggest that interest rates will be cut twice this year.

Aussie Technical

From a technical point of view, we see the Aussie in a nice and strong down trend. It looks like the Aussie’s next targets will be around 65 and 60 cents. On the upside though, the major resistance we see are around 79 and 85 cents. These levels are extracted from a combination of Fibonacci, trend and standard support and standard resistance analysis.

Chris Gore | Market Commentator Christopher has 12 years’ experience across a range of financial instruments, specialising in CFDs and Margin FX. Currently, Chris’ role at GO Markets focuses on matters of regulatory compliance, trading and liquidity management, media and organisational culture.

Chris joined GO Markets after four years as a Trader and Market Analyst in one of the world’s largest CFD and FX brokers. Chris has appeared on Sky News Business as a market analyst and commentator and has contributed to Money Magazine and the Australian Financial Review.

Connect with Chris: Twitter | Email | Chris’ posts

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Be prepared and trade smart with the MT4 Genesis Session Map

Forex is one of the heaviest news driven markets in the world. Major news announcements play such a critical role to the intraday volatility, which in turn create trading opportunities. Most of the time, particularly for the active traders, market volatility can present more trading opportunities. So it stands to reason, all Forex traders should b...

February 24, 2016Read More >Previous Article

MT4 Genesis: Useful and practical trading tools

MT4 Genesis - Our Top MT4 Trading Tools Like any other successful person in their chosen field, you also need the proper trading tools if you are to...

January 28, 2016Read More >Please share your location to continue.

Check our help guide for more info.