- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Articles

- Geopolitical Events

- First Quarter: Crisis, Volatility, and Opportunities

- Home

- News & Analysis

- Articles

- Geopolitical Events

- First Quarter: Crisis, Volatility, and Opportunities

- Tensions between US and Iran;

- The extreme weather conditions across the globe as a result of climate change;

- The novel coronavirus; and

- An oil price war between Saudi Arabia, the oil kingdom, and Russia.

- Trading will halt for 15 minutes if the drop occurs before 3:25 p.m.

- At or after 3:25 p.m.—trading shall continue unless there is a Level 3 halt.

- Trading will halt for 15 minutes if the drop occurs before 3:25 p.m.

- At or after 3:25 p.m.—trading shall continue unless there is a Level 3 halt.

- At any time during the trading day—trading shall halt for the remainder of the trading day.

- Central banks issued emergency rate cuts as well as other policy tools like quantitative easing (QE).

- Major countries like Australia and New Zealand were forced to join the QE wagon to support their respective economies.

- Governments issued various massive stimulus packages to relieve consumers and businesses from the coronavirus fallout. The US stands out with a $2 trillion stimulus package, the biggest in history.

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

The first quarter of 2020 was marred by unpredicted events that rattled the financial markets:

A Trio of Crises

Faced by an unprecedented health crisis that caused an abrupt slowdown of activities, forced by governments and an oil crisis derived from a simultaneous demand and supply shock, the world is currently bracing for an economic recession.

The markets tumbled like dominoes hit by various headwinds at once. The freefall in the markets has forced central bankers and governments to implement various stimulus packages, emergency rate cuts and engage in significant bond-buying.

Confidence has taken a massive hit as the world faces unprecedented quarantines measures!

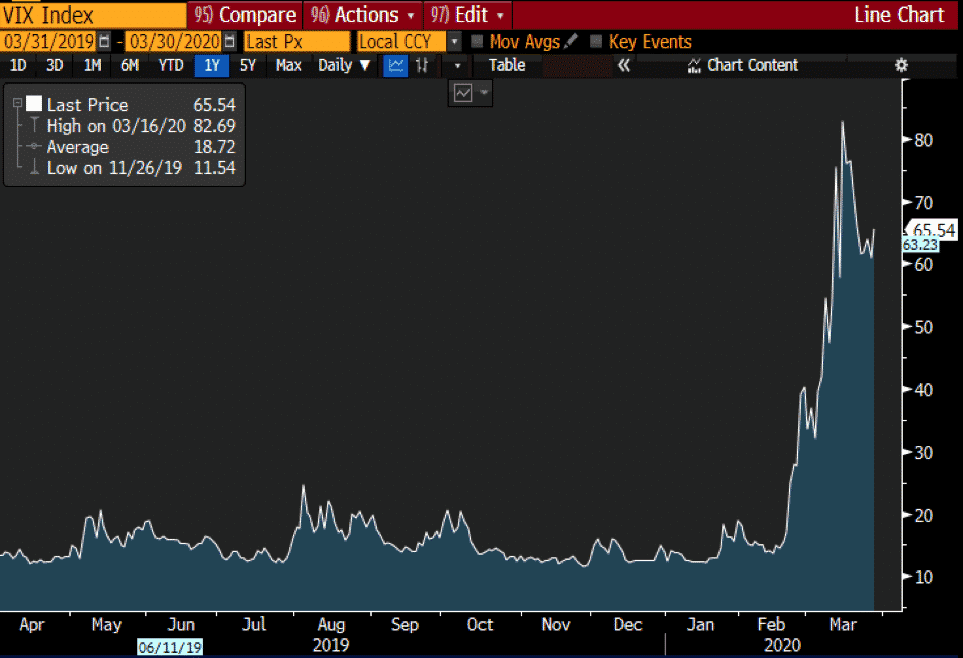

Volatility Index (VIX)

A look at the CBOE Volatility Index shows how investors are reacting to the impact of the coronavirus on markets and the economy. Also known as Wall Street’s fear gauge, the index is a real-time market index that represents the market expectation of 30-day forward-looking volatility.

The Index, on average, has been around the 20 levels but increased to decades high at 82.69 on the 16th of March 2020. The sharp rise is the reflection of fears and anxieties prevailing in the financial markets.

Source: BloombergStock Market Busts and Circuit Breakers

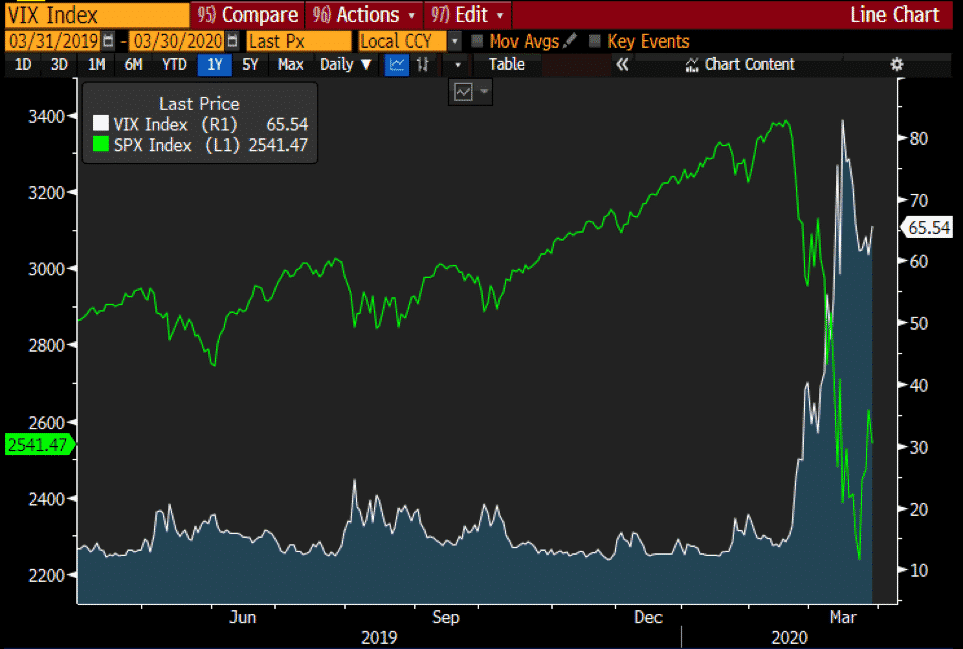

Circuit breakers were first introduced in the 1980s to curb panic selling. For the US exchanges, the S&P500 is used as the pricing reference to measure a market decline and there are currently three levels to the circuit breakers:

Level 1 (7%)

Level 2 (13%)

Level 3 (20%)

There were four circuit breakers in one month which is a record number ever since circuit breakers were first introduced!

The novel coronavirus has created such uncertainty around the globe, which has caused plunges in global equities. Despite the VIX easing to 65.54, further wild swings seem certain in the next couple of weeks.

Source: Bloomberg

Source: BloombergRescue Packages

In such plunging markets, the focus has been on the rescue packages. Some world leaders were complacent at the beginning, however, we are now seeing highly coordinated intervention measures flooding the markets in an attempt to cushion the effect of the COVID-19 on the global economy.

The rescue packages have not necessarily addressed the full extent of the economic pain which yet to be seen in the coming months, but have provided some relief to wounded economies.

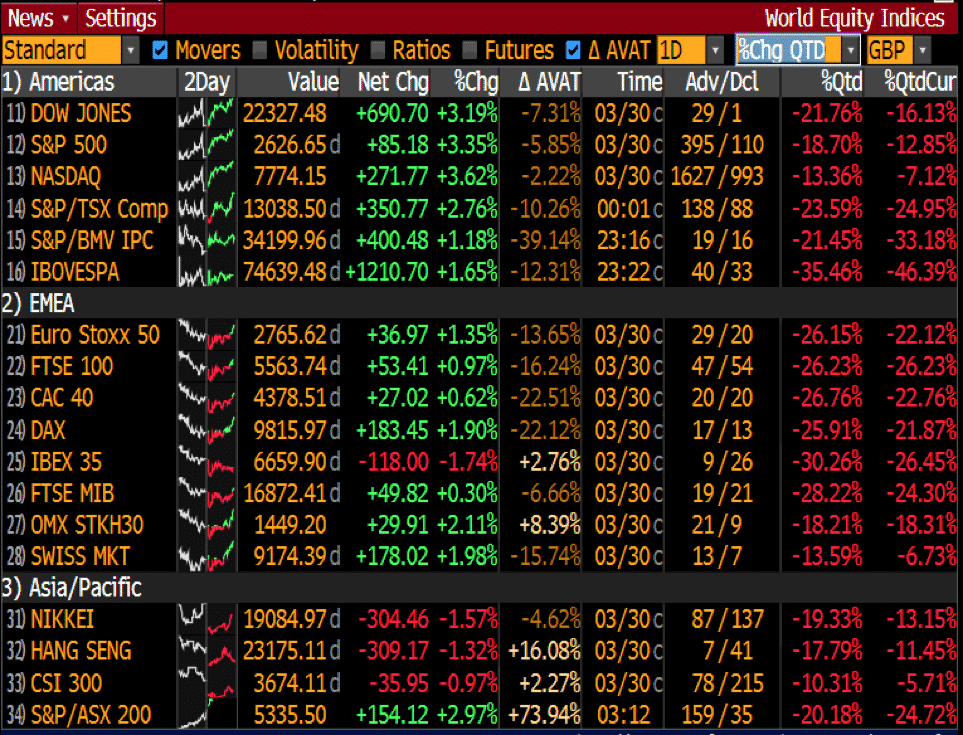

Stock Market – A Degree of Calm

In the first quarter of 2020, it is evident that the 11-year bull run in the stock markets was over. Major equity indices dropped in bear market territory in what was the worst week since the global financial crisis.

Source: Bloomberg

Source: BloombergThe stock market went on a roller coaster ride as investors pulled out of riskier assets. The degree of calm is driven by various interventions in the financial markets. But, the worst of the virus is not yet over and it may not yet be a lasting rebound.

It could well be a dead cat bounce. Notwithstanding, there are not enough signs to predict whether the stock market has found a floor or is yet to find a bottom. There are too many uncertainties to start pricing-in a recovery.

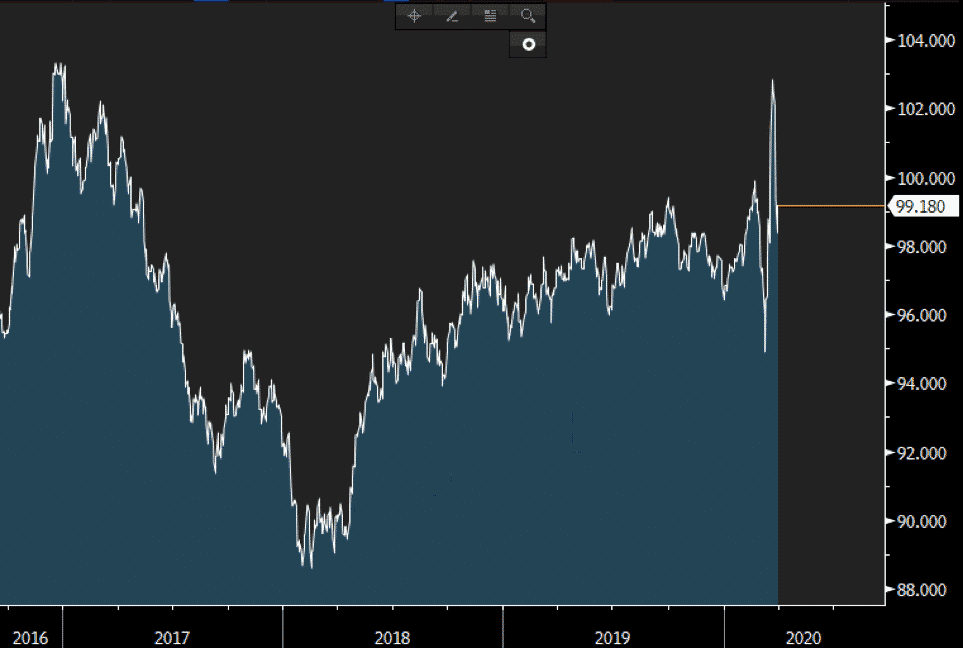

FX – The King Dollar?

The currency market is on the same wild run as other markets. The immediate attention falls on the King dollar. In the early stage of the outbreak, the US seemed relatively unfaed by the virus and the greenback gathered strength as a safe-haven compared to the rest of the world.

As panic gripped markets, dollar funding pressures drove the US dollar index to a 3-year high above the 102 level.

Source: Bloomberg

Source: BloombergEven though the greenback has somewhat retreated as policymakers stepped in to enhance flows, the US dollar index remains in elevated levels just below 100. A significantly bigger stimulus package compared to its peers are fuelling hopes that the US economy would probably recover faster than other major economies.

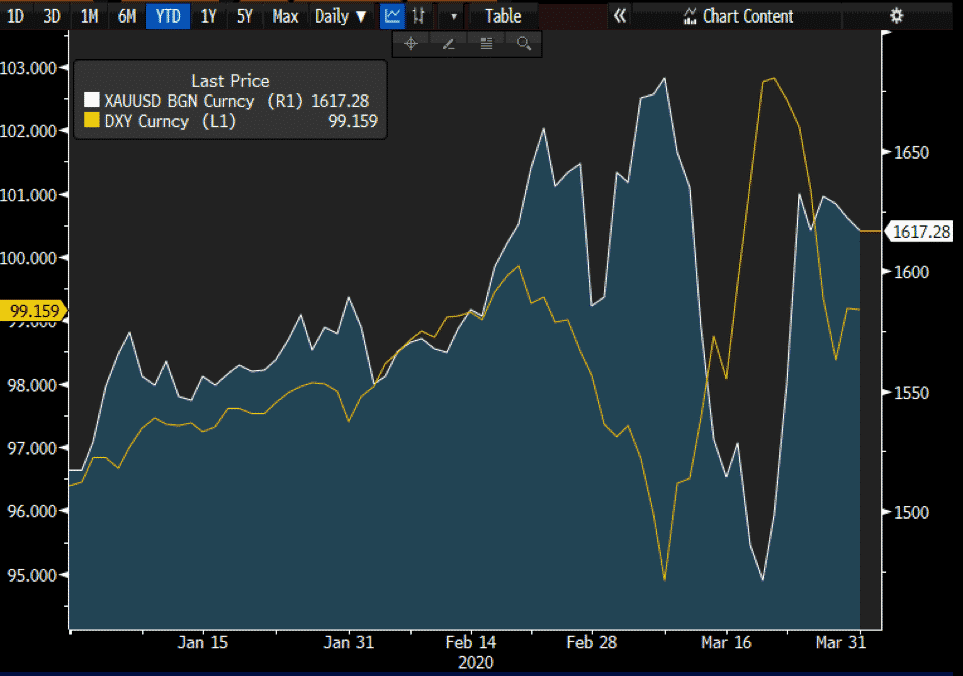

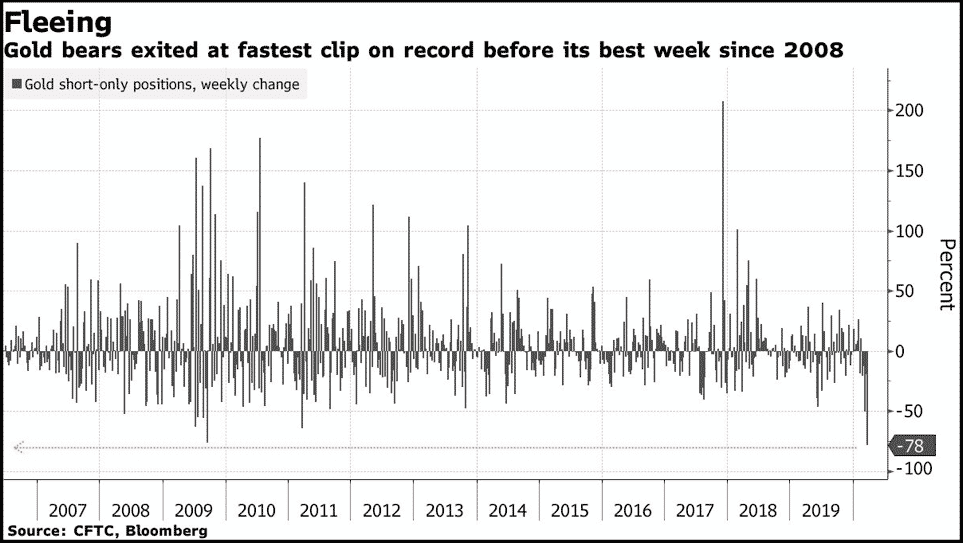

Gold – The Safe Haven

The price movement of the precious metal also depicts the turmoil in the markets. At the start of the year, the US dollar and Gold were moving in tandem due to the prevailing uncertainties. QE, low-interest rates, trade frictions, geopolitical tensions, global debt and growth uncertainties, gold hoarding by central banks have driven the gold price to a high of $1,680.47.

Gold was liquidated due to the wider and rapid spread of the coronavirus across the globe. The precious metal is viewed as a highly liquid asset and investors were in a need of cash due to margin calls and other liquidity requirements. The greenback and the US dollar have therefore started to diverge from each other. COVID-19-induced liquidity issues caused the yellow metal to plunge to a low of $1,471.24.

Source: Bloomberg

Source: BloombergOnce investors were reassured that central bankers are injecting money into the financial system, investors resumed the buying of gold as a safe-haven. At the same time, gold is facing disruptions in the physical markets due to the shutdown of gold refineries leading to a shortage of gold. A combination of positive fundamentals, weaker US dollar and rescue packages lifted the XAUUSD pair back above the psychological level of $1,600.

Source: Bloomberg

Source: BloombergThe economic backdrop is creating a bullish environment for the precious metal. Amid high volatility, Gold traders are likely going to keep monitoring any updates on the virus, liquidity in the financial markets, and the strength of the US dollar for fresh trading impetus.

Volatility Means Opportunities

Human lives and the global economy are at risk. The coronavirus has heavily impacted the way the world operates. Even though the worst of the health crisis is not over yet, and many countries are bracing for another brutal quarter ahead, the health crisis will ease and end at some point.

It is not all gloomy in the investment space despite the sharpest falls in history. The panic-driven volatility might present investment opportunities. Investors will likely be in search of bargains by buying at rock-bottom prices once the number of coronavirus cases starts to slow down.

An oil storage problem, higher storage costs, faltering demand and a significant rise in production are creating a perfect storm for the oil market.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Control your trading time (with FREE audit tool download)

Trading requires a commitment of time. For each of us the amount of time we must dedicate to trading activities is limited and justifiably so by other life activities (for of course, we want trading to contribute rather than take away from lifestyle). Despite the importance of checking in on how you are using your trading time, comm...

April 2, 2020Read More >Previous Article

Quick trading Tip…Be Calm and Develop Trading Patience

When we first start to trade, or subsequently (as a more experienced trader) when we trade a new symbol or system we are often “excited”...

March 30, 2020Read More >Please share your location to continue.

Check our help guide for more info.