- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- New Zealand see unexpected contraction after Quarter figures released

- Home

- News & Analysis

- Geopolitical Events

- New Zealand see unexpected contraction after Quarter figures released

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisNew Zealand see unexpected contraction after Quarter figures released

16 June 2022 By GO MarketsThe New Zealand economy took a hit in the first quarter as Covid 19 ran rampant and interest rates rose as the Reserve Bank of New Zealand increased interest rates to combat inflation. The contraction was exaggerated as imports were reduced.

Growth across the country was slowed. Production based output or the GDP fell by 0.2% which was below the analyst’s expectation of a 0.6% increase. The figure was also a substantial level below the 3.0% rise seen in the December quarter. Primary industries drove the decrease. Lower output in the food, beverage, and tobacco manufacturing industry as well as the agriculture, forestry and fishing industries were key reason for the reduction in growth. Housing prices dropped as the rising interest rates began to hit mortgage holders in the hip pocket. Prices dropped 5.6% in the three months to May. The Reserve Bank of New Zealand also tempered its expectations predicting a modest 0.7% increase for the March quarter.

New Zealand spent much of the quarter fighting the Omicron spread of Covid-19. It was the real time the small island country had to deal with a significant covid outbreak. Despite this, domestic travel data remained strong. The country also in a bid to help the travel industry, opened it borders to international visitors.

The Reserve Bank has already raised interest rates five times since October in a bid to stem inflation from getting worse. The Bank also made it clear that slowing down inflation would take priority over protecting the economy against a recession.

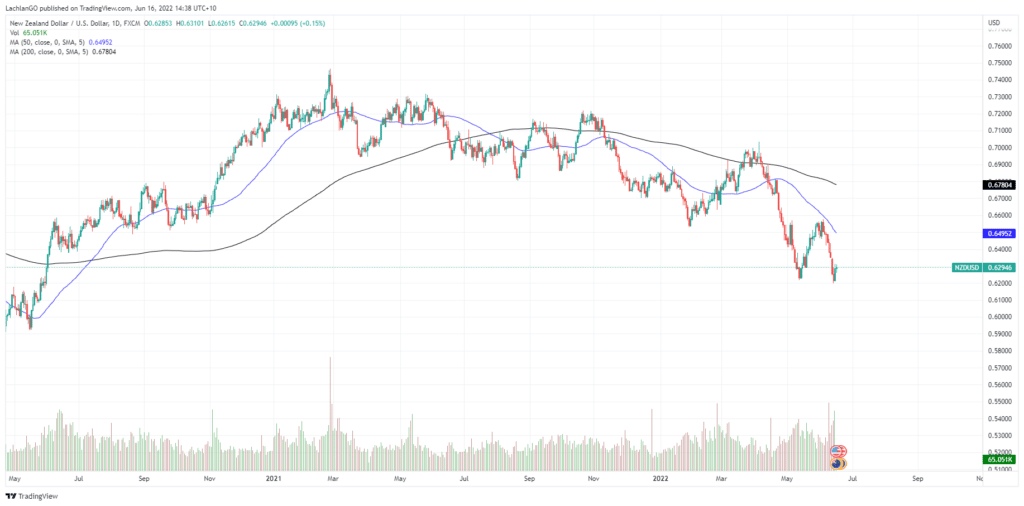

The New Zealand dollar dropped on the news before rallying and is currently buying 0.63 USD. The NZD recovered after the drop before settling. The NZD.USD pair has been in a downward trend since March 2021. It has seen a recent test of the 2-year lows.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Crypto’s week of horror ends in a new 18 month low

As the week comes to an end, many cryptocurrency investors grow increasingly nervous. This emotional sentiment has resulted in bitcoin’s new 18 month’s low price, since December 2020. It has also caused a well known crypto company, Celsius, to suspend client’s withdrawals. Bitcoin started the week at $27,000 USD which was a 10% decreas...

June 17, 2022Read More >Previous Article

Are ETFs really Passive?

What is an ETF Most people have heard of ETFs but not everyone knows what they are. An ETF is an Exchange Traded Fund and they are extremely popula...

June 15, 2022Read More >Please share your location to continue.

Check our help guide for more info.