- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Geopolitical Events

- USMCA – NAFTA 2.0

- Dairy Industry

- Automobile Industry

News & Analysis

The fourth quarter kicked off with some good news on trade with a last-minute agreement between US-Mexico- Canada just before the deadline. “America first” is the slogan by Trump and he managed to do just that at least when renaming NAFTA to USMCA. The new agreement came with rules for cars and trucks, labour, IP protections and dairy products.

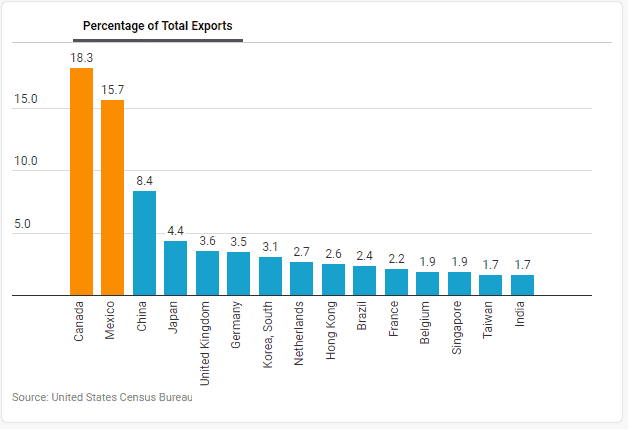

After more than a year of tumultuous negotiations, Trump revamped the nearly 25-year old deal. Markets participants cheered a “Non-Disaster” scenario but continue to be wary of trade tensions. Investors welcomed the trilateral agreement and eliminated the downside risks of a trade war in this part of the hemisphere. Canada and Mexico are the United States’ two biggest export markets. The largest exports are the automobiles and auto parts while the largest import with Canada is crude oil and gas.

*(Data are goods only)While there are a few tweaks, or changes to the new agreement, the dairy and automobile industry emerged as the two main factors that helped all parties to revamp the trilateral agreement.

The dairy industry appears to be the deal maker even though this sector represents a negligible percentage. Canada is not a significant exporter or importer of dairy products, but its supply management system helps them to control their dairy sector and protect their farmers’ income by limiting imports and setting quotas on domestic production.

The US is facing a severe milk glut, and the US farmers are suffering heavy losses. The new deal gives American farmers greater access to the dairy industry in Canada worth 3.6%. The removal of the controversial Class 7 which is a domestic pricing class that governs milk ingredients such as skim milk powder and milk protein is “a win” for the Americans, Australians and New Zealanders. They have insisted that this new pricing class has effectively pushed them out of the Canadian dairy markets and this was even challenged at the World Trade Organisation.

However, some analysts are sceptical of whether this win on Canada opening up its dairy industry will solve the oversupply of milk in the US.

The agreement will reportedly benefit the car-manufacturing workers in all three countries. 75% of the parts that go into a vehicle is required to be made in North America to qualify for tariff-free, and it also requires 40-45% of a car be made by workers earning at least $16 an hour.

The reaction of the markets

The deal brought a relief rally in the markets, but investors are aware that the US-China trade dispute is a much bigger issue. The US has a trade deficit of $71bn with Mexico and $18bn with Canada for goods transactions, and it took more than a year of negotiations for the trilateral agreement to be revised. China has a whopping $375.2bn trade deficit with the US and investors are aware that talks will be challenging.

The Asian markets will probably remain vulnerable to the tit-for-tat trade spat between the US and China. The European markets were able to build up the upbeat momentum on the USMCA as Brexit noises, and Italian risks weighed on markets’ sentiments. Investors are reluctant to put their money in those markets when the US stocks are more attractive given that its fundamentals are stronger.

USDCAD fell sharply to 1.2780 before rebounding and consolidating at the 1.2800 level. A lack of fundamental drivers is restricting the pair to make a firm move in a direction. On the technical side, the RSI remains above the 30 mark which is the oversold conditions which may signal that the pair could drop further down before making any correction.

Is it a “win” for Trump? At first glance, it looks like a victory, but the concessions are mostly similar to the TPP, so it is more good news for Canada. It is argued whether the damage done to the relationship was worth it. Unlike China, Canada was a good ally to the US.

Trade tensions are not over as US-China, US-Japan, US-Europe trade talks are still pending.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

A Rise in U.S Bond Yields

Is rising bond yields bad news for the equity markets? Bond yields are an important indicator to gauge the direction of equities. They have an inverse relationship which explains why the stocks markets were in a sea of red when the US 10 -Yr Treasury yields soared to multi-year highs on Wednesday. The catalysts behind the surge in yields are mai...

October 5, 2018Read More >Previous Article

Top 5 Oil Exporters In The World

There has been quite a lot of talk about oil in the news recently with some analysts suggesting the price could reach $100 per barrel, which would be ...

October 2, 2018Read More >Please share your location to continue.

Check our help guide for more info.