- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Australian Gold companies slump to yearly lows

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Australian Gold companies slump to yearly lows

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisSome of Australia’s largest gold miners have slumped to their 52-week price lows as rising costs and labour shortages have pushed their share prices down. St Barbara, (SBM), Ramelius Resources, (RMS) and now Evolution Mining, (EVN) have all reported disappointing updates to the market. The collective weakness has reverberated across the sector with gold mining giants Newcrest Mining (NCM) and Northern Star (NST) also seeing strong sell offs as well.

Inflation Problem

High volatility and inflation usually increases the market’s interest into Gold, as investors and the like look towards some stability and assurance. However, inflation has caused widespread problems for much of the economy and the mining sector has been hit quite hard. With rising operations costs, labour and supply chain issues, profitability and future forecasts have seen a decrease. Covid has and continues to cause distress and disruption as staff absenteeism is on the rise and extreme weather has limited the ability for these companies to operate, especially within Australia.

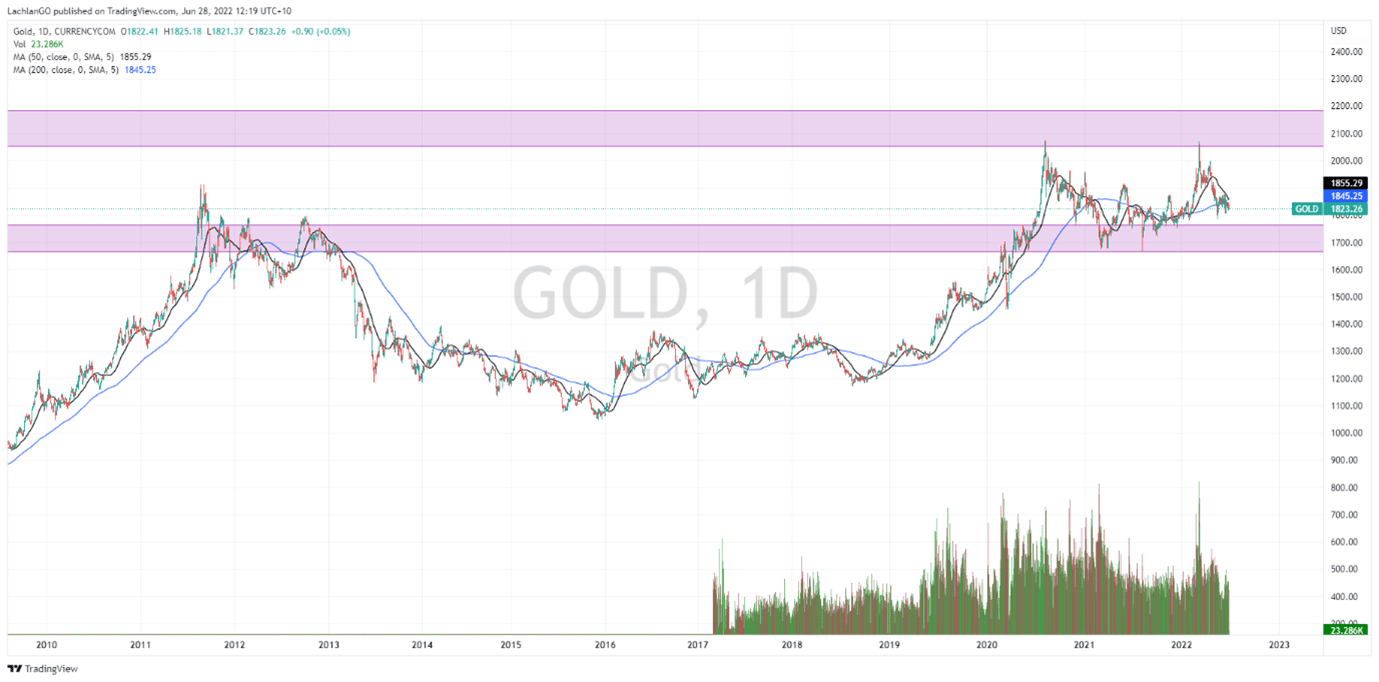

The Price of Gold

The price of gold has seen a strong push in the last two years. However, it has been unable to break through the $2080 USD per ounce resistance level. It has come down since the height of the Russian/Ukraine conflict and the initial inflation panic. It is now ranging around with quite choppy price action. On a longer time, frame, it can be observed that the chart is still holding the long-term support zone. Until the price breaks through either of the zones a significant move in either direction will be unlikely to occur.

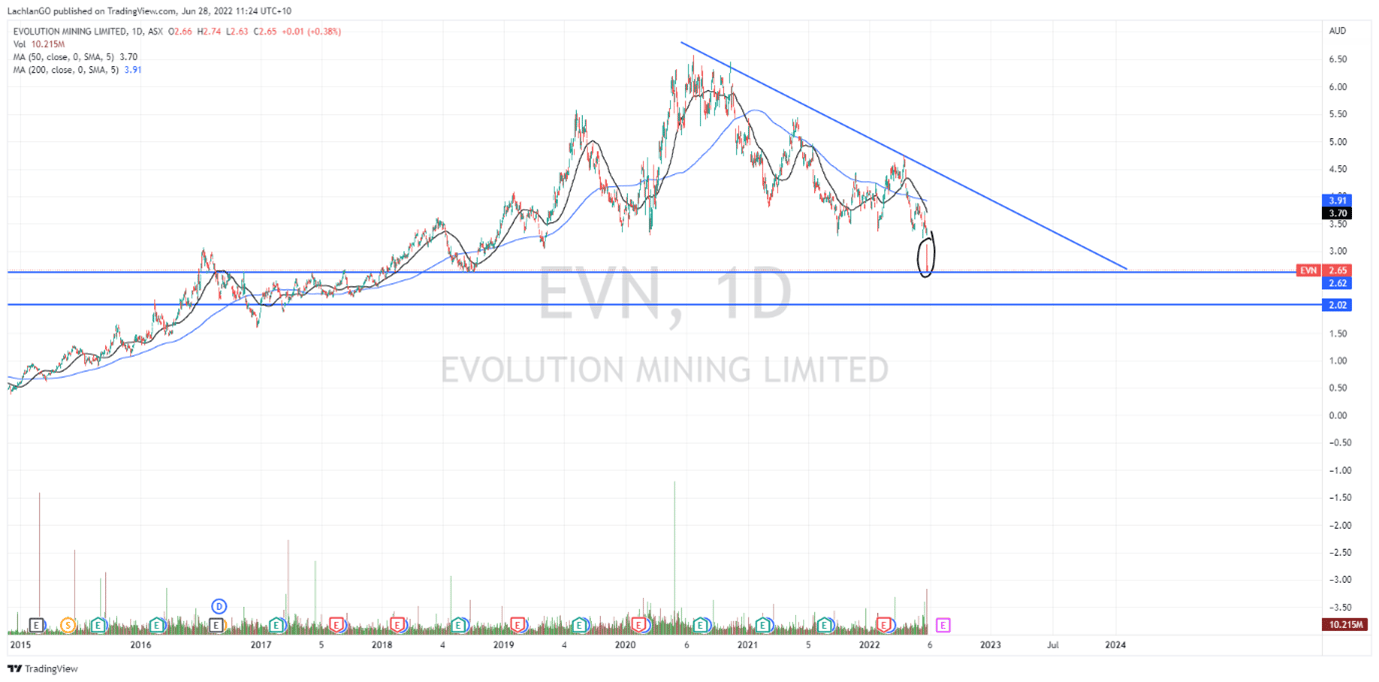

Evolution Mining, (EVN)

Evolution Mining (EVN) specifically not only cut its forecast for the 2022 FY but also its 2023 and 2024 forward guidance causing significant damage to its share price. As can be seen below, the price had already been trending down from its peak of $6.59 in July 2020. The price is currently sitting on a relatively strong long term support zone between $2.00-2.60. Selling may continue through this zone, however, it will require significant volume to break through.

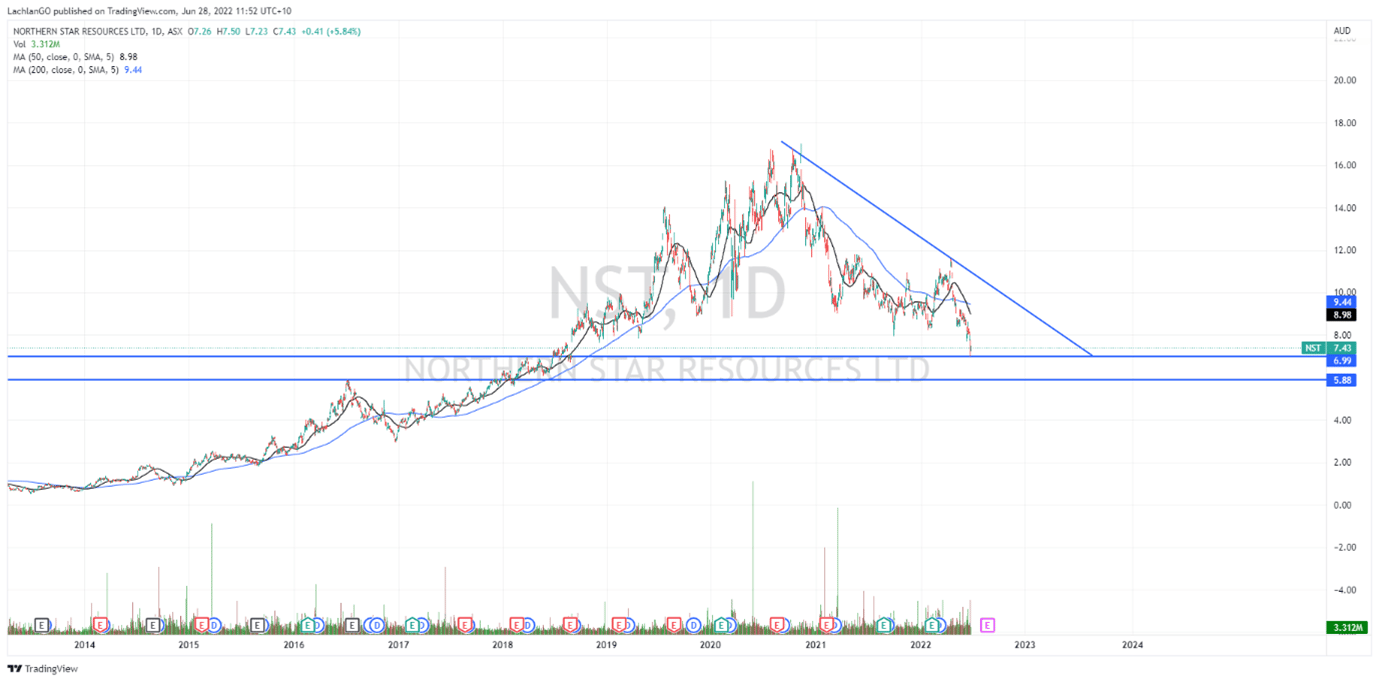

EVN’s share price also dragged down other gold miners and large cap gold mining company Northern Star, (NST). The companies’ price action is almost identical. This means when one of their share prices is declining it is likely the other will follow. Similarly, to Evolution Mining is approaching a support zone between $5.90 – $7.00.

Looking ahead

The future for the share price of these companies is obviously at the whim of what the gold price decides to do and their own ability to get gold out of the ground. As discussed above, EVN specifically has outlined that it the short to medium term it will struggle to produce significant amounts of gold. The price of gold is still an unknown, however Geopolitical volatility or Covid events may see a shift in the price.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Liontown Resources, (LTR) secures offtake agreement with Ford

Australian lithium company, Liontown Resources, has secured another offtake agreement for its Kathleen Lithium project. The agreement with global car manufacturer Ford, means that it will now be the third offtake partner as part of the foundational financing for the development of the Project. Lithium is key for the batteries in electric vehicles i...

June 29, 2022Read More >Previous Article

Nike tops Wall Street estimates

Nike Inc. (NKE) reported its latest financial results for its fiscal 2022 fourth quarter after the closing bell in the US on Monday. World’s largest...

June 28, 2022Read More >Please share your location to continue.

Check our help guide for more info.