- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Oil Companies Record Profits in question

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Oil Companies Record Profits in question

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

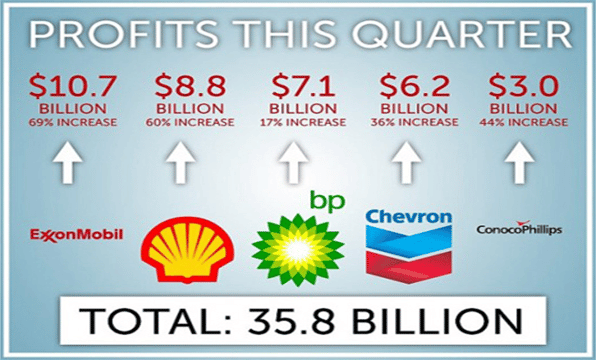

In a time when you consumers could potentially be feeling domestic budgets tighten up, by the result of surging high inflation and rise in prices of commodities, you would be forgiven to be receiving the news that some of the biggest oil companies in the world, have acquired record profits with some skepticism, you would even question if these companies are acting in the best interests of its consumers instead of their shareholders?

That’s the question that the Energy and Commerce Committee Chairman Frank Pallone, Jr. (D-NJ) made, when he wrote to four major oil companies today demanding answers for how they are using their record high profits, and what – if anything – each company is doing to alleviate peoples’ pain at the pump.

The letters come as drivers continue to bear the burden of higher-than-average fuel costs at the same time as the four major oil companies announced quarterly earnings of nearly $50 billion combined. Exxon alone reported a profit of $17.9 billion – the highest quarterly profit reported by any oil company in history – while Chevron reported $11.6 billion, Shell reported $11.47 billion, and BP reported $8.45 billion (USD).

The heat seems to be coming from all angles at the minute with various diplomats chipping in, back in June, president Joe Biden singled out Exxon for criticism, saying: Why don’t you tell them what Exxon’s profits were this year? This quarter? Exxon made more money than God this year.

Energy analysts at SP Angel says: The five remaining Majors (Exxon, Chevron, Shell, BP & Total) have announced c.$59bn in 2Q22 profits, up almost 100% y/y, and returned c.45% of this to shareholders during the quarter. Based on their aggregate $1.1 trillion market cap, this quarter would represent an implied annualised profit margin in excess of 20%.

Some however have a more pragmatic approach and advise that the sector has been haemorrhaging money the last few years, a clampdown on pollution, a focus on a greener future and investment in renewable energy have curtailed some of the industries profits.

Consider that in the past 10 years, major oil and gas companies suffered tremendous losses in 2014, 2015, and 2020. In fact, in 2020 the five integrated supermajors (i.e., “Big Oil”) – ExxonMobil, BP, Shell, Chevron, and Total – lost $76 billion. Oil prices plunged into negative territory in 2020. Were the oil companies feeling especially generous then?

ExxonMobil for example doesn’t set oil prices. They are set in the market by how much people are willing to pay, just like with Apple stock. U.S. oil companies are price takers, not price makers. Yes, speculators have an influence, just as they do with Apple stock. Even OPEC and Russia don’t control oil prices, although they do have tremendous influence relative to ExxonMobil. If ExxonMobil decided to produce less oil to drive the price up, it just hurts ExxonMobil because OPEC and Russia can easily make that up. But if OPEC and Russia decide to produce less oil, there isn’t much the rest of the world can do to make that up.

This is a particularly unique asset class and one which investors could access in different ways, you could trade the spot price of US and UK oil also known as WTI and BRENT oil respectfully, you could directly buy or sell shares in these companies or invest in ETFs which have exposure to energy companies.

If you would want to be a position to take advantage of these companies’ profits and the price action movement which follows it? Visit us here at GO Markets where you have a choice between trading the spot price as an CFD or acquiring shares through our share portfolio service.

Sources: Forbes, The Guardian, mirror.co.uk, https://energycommerce.house.gov/

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Bitcoin showing signs of a reversal.

Bitcoin has seen a large tumble in its price since it reached its peak of $70,000, however there are signs that the price may be ready to break out of its downtrend. Background With rising inflation and a tense geopolitical climate, growth equities and risk assets have felt the pinch and Bitcoin has been right in the...

August 9, 2022Read More >Previous Article

Barrick Gold beats Q2 estimates – sends the stock price higher

Barrick Gold Corporation (GOLD) reported its latest financial results before the market open in the US on Monday. One of the world’s largest gold...

August 9, 2022Read More >Please share your location to continue.

Check our help guide for more info.