- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Oil dips to the bottom of its range as recession fears hit the market.

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Oil dips to the bottom of its range as recession fears hit the market.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisOil dips to the bottom of its range as recession fears hit the market.

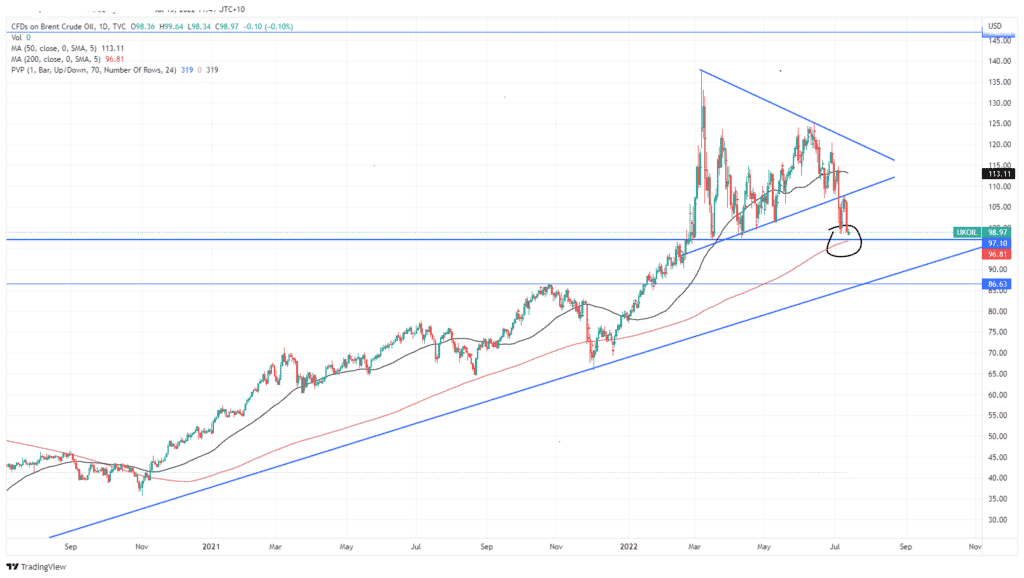

13 July 2022 By GO MarketsOil has seen its first real slip up in price since March. The commodity had been running on the back of high inflation and supply issues stemming from the Russian and Ukraine crisis. During the run Oil peaked at $137 a barrel before entering a period of consolidation.

The recent catalyst for the drop was OPEC announcing that 2023 would likely result in lower demand for Oil. In addition, the threat of Chinese lockdowns is once again rearing its ugly head, adding to the woes. Furthermore, there have been discussion in recent days and week with the President of the USA, Joe Biden pushing for an increase in production. The price has now fallen out of the wedge and is testing the support level.

A strong USD

Oil historically moves inversely to the USD. This is because oil is priced in US dollars. Therefore, when the US dollar is strong fewer US dollars are required to buy a barrel of oil. Conversely, when the USD is weak, more USD is required, increasing the price of Oil. Consequently, with the USD being as strong as it is currently, the price of oil had to at some point fall.

Slowing Growth

A recession could be a strong driver for a dip in the price of oil as negative growth has reduces the demand for commodities. Growing economies require Oil and other commodities to develop their infrastructure. Therefore, a recession will likely lead to less manufacturing and less infrastructure development due to a reduction in demand.

Technical Analysis

The price of Brent is approaching an important area of support. It can be observed that the price of Brent has broken down from its wedge pattern and following back into the longer-term trend. The price is sitting on its short-term support level of $97. This level is also of extra importance because it also doubles as the 200-day average. It can therefore be expected that there will be a great deal of volume traded near this zone and that to break through it will require a great deal of selling pressure.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

ANZ set to acquire Suncorp in mega acquisition

Big 4 bank ANZ is set to takeover Suncorp in a massive buyout. The agreement stipulates that the buyout is only for the banking side of the business with the insurance arm not being apart of the deal. Details of the deal ANZ is set to pay Suncorp 4.9 Billion dollars 1.3 time the current Net Tangible Asset value of Suncorp. The compl...

July 18, 2022Read More >Previous Article

Twiggy’s Beefy Winner

Andrew ‘Twiggy’ Forrest has bet on a winner in Australian Agricultural Company (AAC). The company is Australia’s largest integrated cattle and b...

July 6, 2022Read More >Please share your location to continue.

Check our help guide for more info.