- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- OPEC and G20 Meetings Not Guaranteed

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- OPEC and G20 Meetings Not Guaranteed

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

On 8 March 2020, Saudi Arabia initiated an oil price war with Russia, triggering a rout in the oil market at a time where the world is facing a pandemic and many countries forced to shut down their activities and borders. Crude oil prices have lost nearly half of their prices, battled by a simultaneous demand and supply shock.

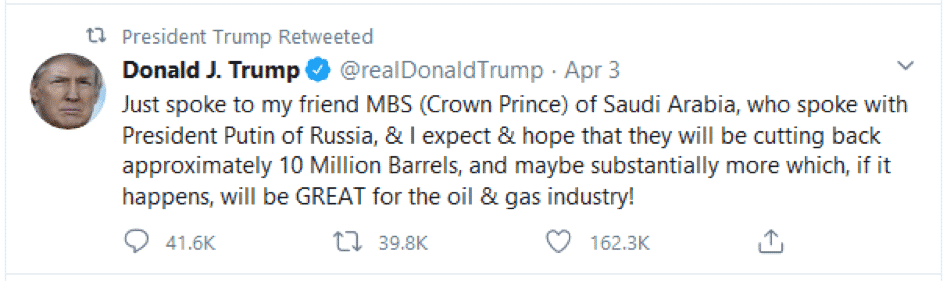

Last Thursday, President Trump tweeted about expectations of substantial production cuts, which has lifted hopes that OPEC and its allies will intervene to bring some stability in the oil and gas industry.

The Blame Game Delayed the OPEC meeting

President Trump’s actions resulted in an emergency OPEC meeting which was initially scheduled to take place on Monday. Over the weekend, the rift seemed to have widened as Russia dragged Saudi Arabia into the hostilities against the US Shale oil industry. The blame game has caused the meeting to be postponed which is “likely” going to take place on Thursday.

Multilateral Support Needed

Unprecedented measures are needed to tackle an unprecedented crisis. Are we going to see an alliance of oil producers other than OPEC+?

A supply glut and weak demand have sent prices into a freefall, which is prompting growing calls of a multilateral commitment of oil producers to regularise the oil market. Among all the noises currently in the oil industry, traders need to pay particular attention to key factors:

Russia and Saudi Arabia

Market participants will need to monitor whether Russia and Saudi Arabia are willing to look passed the blame game and go back to the negotiable table. The first calming factor will be that both oil producers are able to resolve their differences and start a dialogue to cut oil production.

The US to Join Efforts

It is clear that for the interest of all producers, the efforts should not only come from OPEC+ members. Ever since the US President tweeted about the hopes of a truce between Saudi Arabia and Russia, the US has been under increased pressure to join global forces in cutting production amid crashing oil prices.

EIA Reports

The US Energy Information Administration slashed its expectations for US crude oil production by more than 1 million barrels – a day ahead of the much-awaited meeting. Despite the projected cuts by the EIA, the US is still expected to formally commit to production cuts. It appears to be the decisive factor that will restore peace in the industry.

G20 Meeting

It is reported that the G20 group of leading world economies will meet on Friday to host an emergency meeting with energy ministers. The aim of the meeting will focus on bringing nations together in an effort to stablilise the world energy markets.

Dual Meeting

The OPEC meeting followed by the G20 meeting could be a turning point for the oil and gas industry. Global efforts by OPEC+ members along with other key members, including the US, Canada and Brazil, among others, are key in bringing back confidence at a time where the oil market is facing the brunt of a pandemic.

Saudi Arabia has delayed setting May delivery prices of oil in anticipation that the meeting will end in a net positive. As of writing, we note that President Trump stated that he was not asked to participate in cutting production but “may” consider such a scenario if it would help to resolve the international disputes.

As the week comes to an end, attention will remain fixated on the upcoming meetings and any developments that will help investors to gauge the thinking of oil producers.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

5-point checklist for using chart patterns within your trading plan

Chart patterns (e.g. head and shoulders, triangles, double bottoms/tops), are commonly used to assist in trading decision making. If using these as part of your entry approach, their use should be viewed as a specific strategy, amongst others you may use, and so merit a dedicated section within your plan. This article outlines some of ...

April 11, 2020Read More >Previous Article

Inner Circle Video: Treating your trading as a business…the next level

In this weeks session we explored the concept of trading as a business. We differentiated between this and the way in which many traders operate i.e....

April 2, 2020Read More >Please share your location to continue.

Check our help guide for more info.