- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Top 5 Oil Exporters In The World

- Capital: Riyadh

- Official language: Arabic

- Population: 33,000,000

- Gross Domestic Product: $683 billion

- Currency: Saudi riyal (SAR)

- Capital: Moscow

- Official language: Russian

- Population: 144,526,636

- Gross Domestic Product: $1,5 trillion

- Currency: Russian ruble (RUB)

- Capital: Baghdad

- Official language: Arabic and Kurdish

- Population: 37,202,671

- Gross Domestic Product: $202 billion

- Currency: Iraqi dinar (IQD)

- Capital: Ottawa

- Official language: English and French

- Population: 37,067,011

- Gross Domestic Product: $1,6 trillion

- Currency: Canadian dollar (CAD)

- Capital: Abu Dhabi

- Official language: Arabic

- Population: 9,575,729

- Gross Domestic Product: $382 billion

- Currency: UAE dirham (AED)

News & Analysis There has been quite a lot of talk about oil in the news recently with some analysts suggesting the price could reach $100 per barrel, which would be the highest since 2014. Whether that will happen, that is another story. In this article, we take a look at world’s largest crude oil exporters.

There has been quite a lot of talk about oil in the news recently with some analysts suggesting the price could reach $100 per barrel, which would be the highest since 2014. Whether that will happen, that is another story. In this article, we take a look at world’s largest crude oil exporters.Saudi Arabia

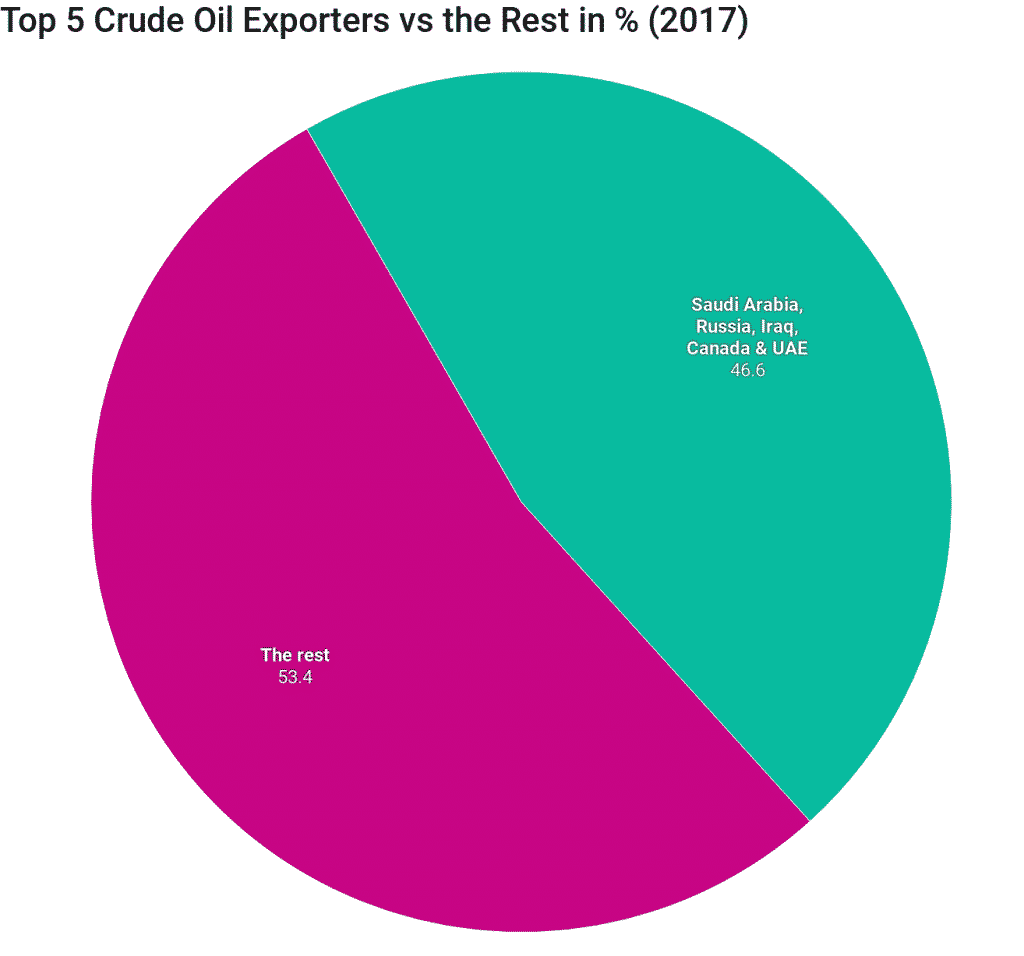

Saudi Arabia is the world’s largest crude oil exporter with $133,6 billion worth of oil exports in 2017 which was around 15,9% of the total crude oil exports in the world. The middle eastern country is highly reliant on its oil exports and it has the 2nd largest proven oil reserves in the world. In recent years, we have seen the Kingdom announce ”Saudi Vision 2030” which outlines plans to diversify its economy to reduce its dependence on oil. One of the most notable plans is the new city called Neom, you can find out more about the ambitious city plan by clicking here.Russia

Russia is world’s second largest crude oil exporter at with $93,3 billion (11,1% of the total) worth of oil exports last year. Russia is the biggest country in the world and has the 11th largest economy in the world at $1,5 trillion, according to the World Bank. It’s biggest export partners are the European Union, China and neighbour Belarus. Russia is 8th on the list of world’s largest proven oil reserves.Iraq

Iraq is third on the list with $61,5 billion worth of oil exports in 2017, 7,3% of the total. Iraq was one of the founding member Organization of the Petroleum Exporting Countries (OPEC) with Iran, Kuwait, Saudi Arabia, and Venezuela when it was established back in 1960. Iraq’s economy is highly depended on oil with oil production accounting for 2/3 of the country’s GDP.Canada

The North American country is the fourth largest crude oil exporter in 2017 with $54 billion worth of crude oil exports (6,4% of the total). Canada has the 3rd largest proven oil reserves with 95% of these reserves are in the oil sands deposits in the western province of Alberta.United Arab Emirates

The United Arab Emirates, the third largest economy in the Middle East is the 5th largest crude oil exporter with $49,3 billion worth of oil exports in 2017 (5.9% of the total). Even though United Arab Emirates has the most diversified economy in the Gulf Cooperation Council (GCC), a regional intergovernmental political and economic union which is made up of all Arab countries of the Persian Gulf, it is still highly dependent on oil.This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk. Click here for more information on trading oil commodities.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

USMCA – NAFTA 2.0

The fourth quarter kicked off with some good news on trade with a last-minute agreement between US-Mexico- Canada just before the deadline. "America first" is the slogan by Trump and he managed to do just that at least when renaming NAFTA to USMCA. The new agreement came with rules for cars and trucks, labour, IP protections and dairy products....

October 3, 2018Read More >Previous Article

The Most Traded Currencies In The World

The Forex market is the largest in the world with around $5 trillion average daily trade volume. It dwarfs the daily trade volume of the New York (N...

September 28, 2018Read More >Please share your location to continue.

Check our help guide for more info.