- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- US equities whipsaw on CPI, S&P downgrade – Oil and BTC at critical levels

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- US equities whipsaw on CPI, S&P downgrade – Oil and BTC at critical levels

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities whipsaw on CPI, S&P downgrade – Oil and BTC at critical levels

15 March 2023 By Lachlan MeakinWe had roller coaster of a ride on US markets in Tuesdays session, US markets initially moved higher on a CPI figure that came in line with expectations taking a little bit of pressure off the fed and no more news of banks going bust.

The punchbowl was taken away later in the session though as news of a US drone and Russian jet colliding paired with S&P downgrading First Republic Bank to negative credit watch saw the markets reverse, then a late day rally saw a strong finish in all the major indexes with the Nasdaq again outperforming finishing up over 2% and the Dow up over 1% or 336 points.

Some big US banks were the winners from the SVB implosion, with the likes of JPM and Wells F seeing record deposits incoming as depositors fled smaller banks, Wells finishing up almost 5%

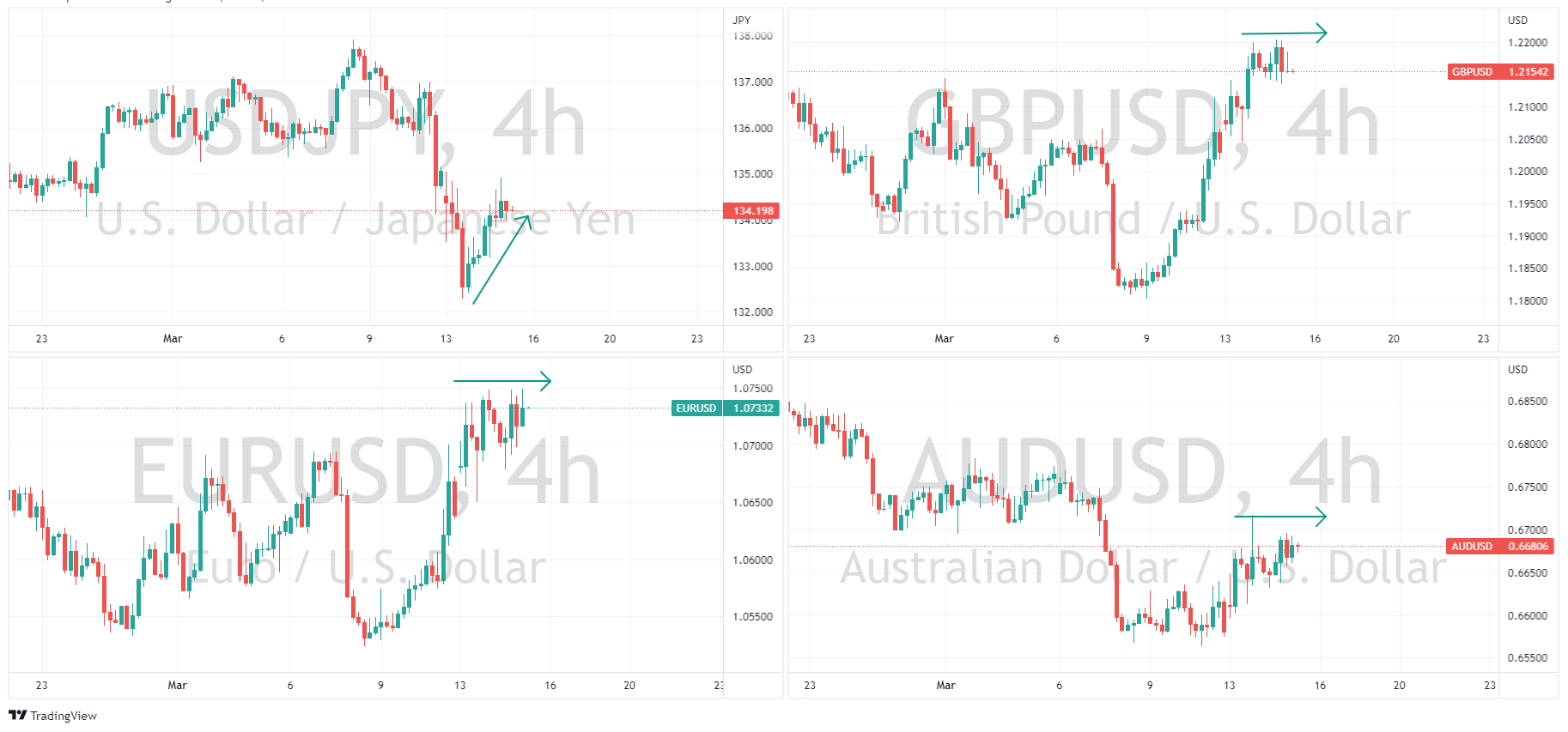

In FX , a choppy session with the USD finishing mostly unchanged against major peers, though the USD did rally strongly against the JPY, recouping some of the last 3 days losses against the Yen. Rate odds for the Feds March meeting did increase to 75% for a 25bp hike from 60% yesterday which also lent the greenback some support.

Oil prices plunged as lingering recession fears saw WTI hit 3 month lows with a 71 handle and testing the support levels set back in December last year, this also brings it in to the price range where the US administration is looking to refill their SPR so we could see some interesting price action going forward.

Bitcoin burst higher again, breaking through the major resistance at 25k before pulling back, this is a big level to watch as it has been the upper band of the range BTC has been in since July last year.

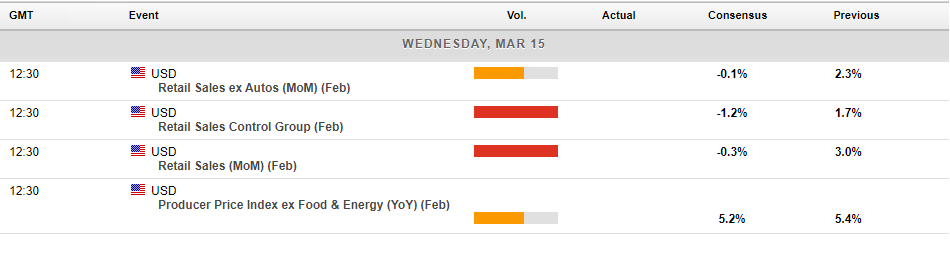

In economic announcements we have retail sales and PPI figures out of the US later today which will add another piece to the Fed puzzle as to the health of the US economy and further indicators on inflation.

Video recap:

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

XAUUSD, GBPUSD, EURUSD Analysis 13-17 March 2023

XAUUSD Analysis 13-17 March 2023 The gold price outlook remains positive in the short and medium term. As the price of gold rested above the 1800 support level before making a strong rally and breaking above the 1880 level as a result of the increased demand for gold as a safe haven over the weekend. come After the collapse of Silicon Valley...

March 15, 2023Read More >Previous Article

How to trade the US Dollar Index

The US Dollar Index (DXY) is a popular tool used by forex traders to assess the value of the US dollar relative to a basket of other major currencies....

March 14, 2023Read More >Please share your location to continue.

Check our help guide for more info.