- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- MetaTrader 4

- MetaTrader 5

- Mobile trading platforms

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets.

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Western Countries consider new sanctions against Russia, limiting their access to gold.

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Western Countries consider new sanctions against Russia, limiting their access to gold.

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisWestern Countries consider new sanctions against Russia, limiting their access to gold.

25 March 2022 By GO MarketsThe USA and other Western nations have intimated that they are planning to block Russia’s access to its international stockpile of gold. Russia has so far been able to use gold to support the Rubel as a tool to reduce the impact of sanctions. Russia has been able to trade gold assets for more liquid foreign exchange that have not been subject to current sanctions.

Tech stocks continued their momentum overnight as the Nasdaq closed at its highest level since February 9, up 1.93%. Intel was a top performer overnight as it rose 6.94% on reports that it may assist NVIDIA corporation in chip manufacturing. Uber also had a stellar night increasing by 4.96% after it reached an agreement to list NYC taxis on its app. The Dow Jones closed 1.02% higher as material stocks performed well. The S&P 500 reflected the positive momentum as it closed the day up 1.43%.

In Europe, the FTSE had a relatively flat day. The material sector performed strongly, supporting the index as it closed up 0.09%. The DAX also had a relatively flat day finishing down 0.069%.

Commodities

Brent Crude oil failed to carry on its rise as it dropped back 2.69% to $118.14. Although the price is still holding above the $115 level. The gold price saw a mini spike out of its consolidation as it jumped by 0.69% to USD 1957.41. The move can be somewhat attributed to the potential for new sanctions on Russia. Natural Gas had another bumper day as it rose by 5.81%. The price extended break out as it closed at its three-month highs of $5.464. The USA may be forced to increase its exports to Europe to offset any disruption in supply from Russia.

Cryptocurrency

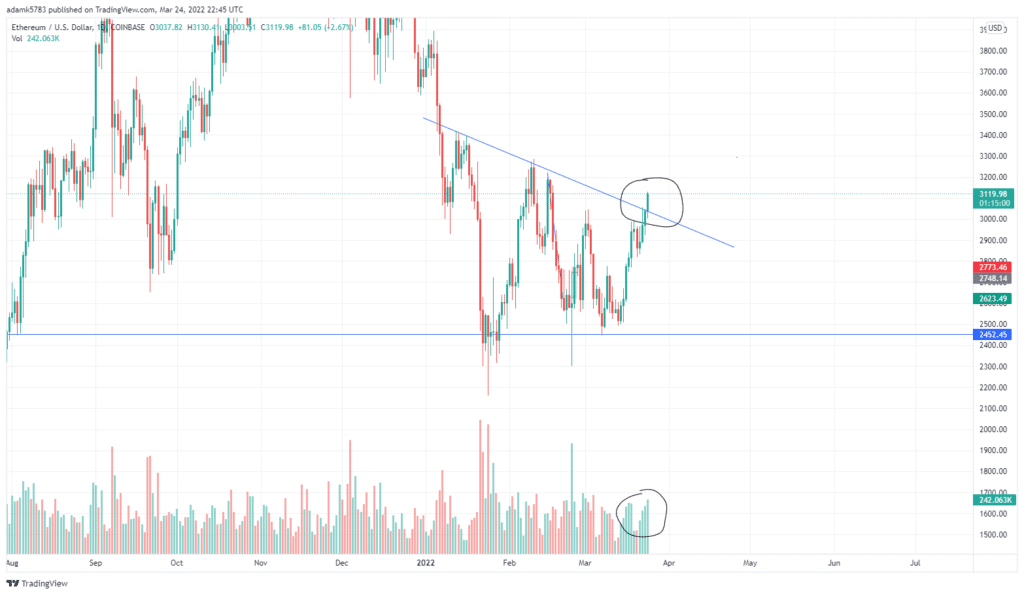

Bitcoin performed solidly overnight. It is currently testing the highs of its recent range and as the BTC/USD approaches the $46,000 resistance level. The pair closed at $44,091, a 2.56% increase, at 22.36 GMT. Ethereum has kept its strong week going with another 2.59% rise holding the $3118 at 22.42 GMT. The ETH/USD has seen a recent period of consolidation before overnight breaking above the trend line.

The JPY continues to be smashed against most other currencies. The USD/JPY rose by 0.97% to 122.324. The GBP/JPY also saw a huge move moving 0.88% to close at 161.330. The AUD/USD had a mixed day. Initially, the currency pair sold down, however it recovered later to close at 0.7512. The EUR/USD has seen a settling of its price as Ukraine and Russian conflict has settled. The pair finished trading at 1.0998 USD.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

How to trade the Volatility Contraction Pattern

The Volatility Contraction Pattern, (VCP) is a famous trading pattern identified and dissected by Market Wizard, Mark Minervini. The premise of the pattern is that stocks in long term up trends will pause and consolidate as some holders exit their positions and the stock is accumulated again by buyers in the market. The chart pattern can provide op...

May 11, 2022Read More >Previous Article

Oil spikes again on fears of supply shortages

US indices retraced overnight as the market took a step back to assess the recent rally. The Nasdaq finished down 1.32%, the Dow Jones Index was down ...

March 24, 2022Read More >Please share your location to continue.

Check our help guide for more info.